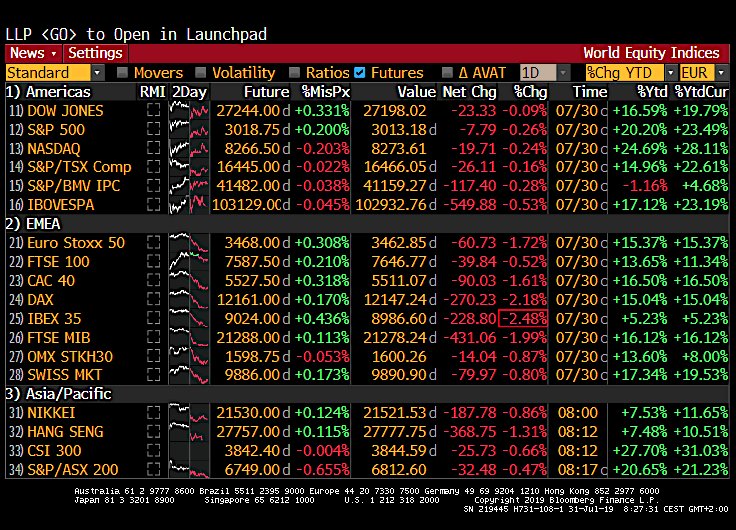

Basically, I am looking for a 25bps with more dovish talk as FED assures market, and politicians, it will continue to cut, and maybe even get back into

QE. Markets may rally 3 to 5 %, SPX 3120/30 MAX, then decline for a few weeks.

Markets would prefer 50bps and a FED wait & see but FED does not want to panic the market and prefers to do it gradually. I think there is a 40% probability FED will cut 50bps.

But, soon, market will realize there is only so much FED can do and thus FED will be pushing on a string.

I still think I can get QQQ > 200 and VIX below 18 for the SHORT TRADES of the year...LT portfolio is almost bare but already up 13% for 2019 so I will wait, patiently, for better entries.

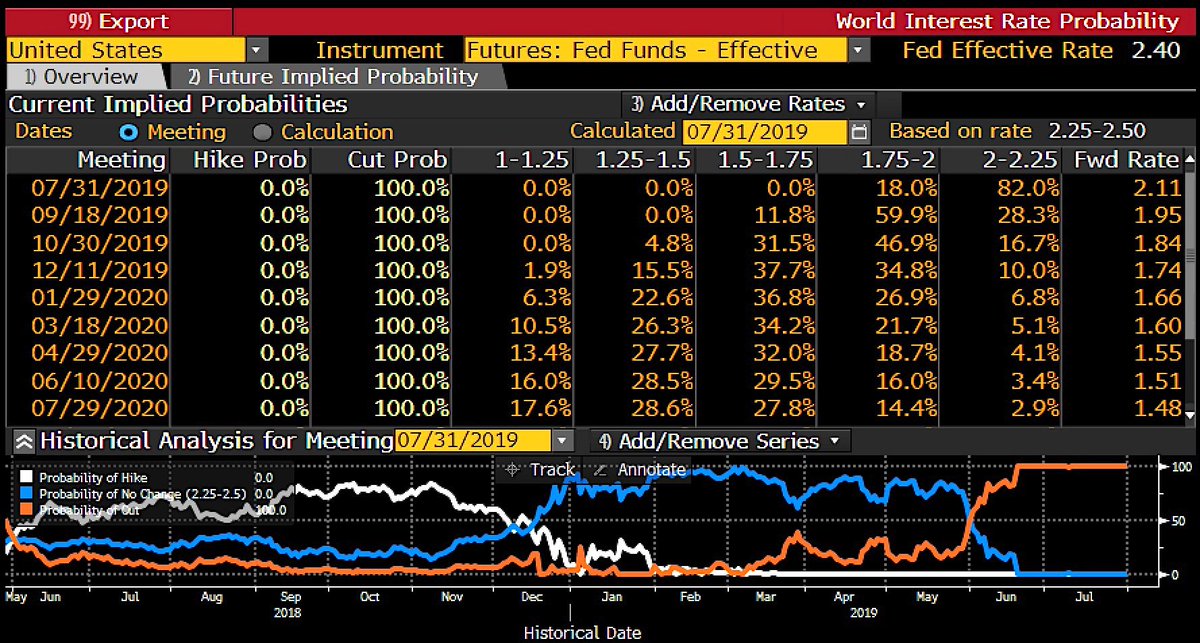

Today is the long awaited #Fed-decision day. Market fully (100%) prices a 25bp cut & implies an 18% chance of a larger 50bp cut. BUT it’s worth noting that the last time Fed began a series of rate cuts, in Sep2007 or Jan2001, their opening move was a 50bp cut, DB’s Reid says.