Futures up on Geithner plan

#1

Posted 22 March 2009 - 07:56 PM

#2

Posted 22 March 2009 - 08:11 PM

#3

Posted 22 March 2009 - 08:28 PM

#4

Posted 22 March 2009 - 08:36 PM

#5

Posted 22 March 2009 - 09:11 PM

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#6

Posted 22 March 2009 - 09:17 PM

#7

Posted 22 March 2009 - 09:24 PM

#8

Posted 22 March 2009 - 09:25 PM

Thursday, March 05, 2009

A lot of the crash markers appear to be there.. execept one

Government intervention..

Pretty much before every crash I've seen, there is the usual government intervention that causes a flurry of short covering. Perhaps they can see it too and try to prevent it.

#9

Posted 22 March 2009 - 09:50 PM

Thursday, March 05, 2009

A lot of the crash markers appear to be there.. execept one

Government intervention..

Pretty much before every crash I've seen, there is the usual government intervention that causes a flurry of short covering. Perhaps they can see it too and try to prevent it.

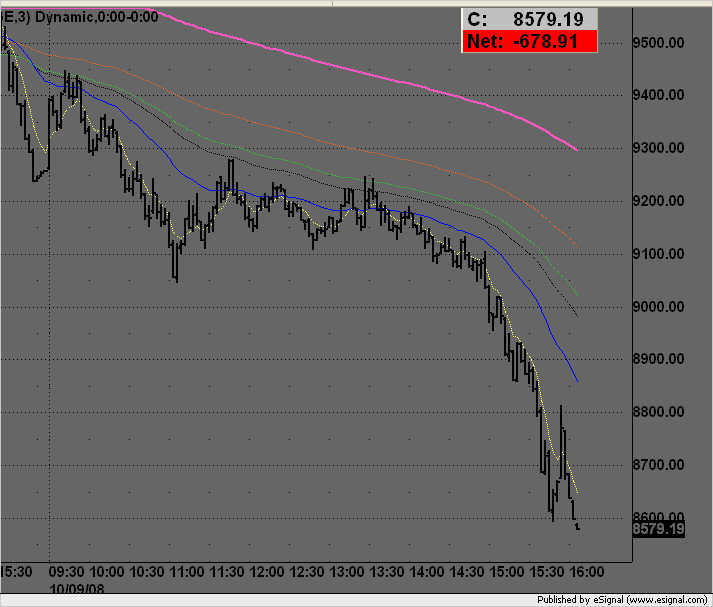

coordinated world-wide rate cut 07:00EST 10-8-08

10-9-08

#10

Posted 22 March 2009 - 11:00 PM