This is a great thread! When I have to spend over a half hour lurking over a discussion like this, that's worth the price of admission and what FF should ideally be about.

Great stuff folks!

Agreed

Great work everyone

Posted 01 August 2009 - 02:55 PM

This is a great thread! When I have to spend over a half hour lurking over a discussion like this, that's worth the price of admission and what FF should ideally be about.

Great stuff folks!

Posted 01 August 2009 - 02:55 PM

that's worth the price of admission

"The power of accurate observation is commonly called cynicism by those who have not got it."

--George Bernard Shaw

"None are so hopelessly enslaved as those who falsely believe they are free."

--Johann Wolfgang von Goethe

Posted 01 August 2009 - 06:52 PM

I didn't even think of the irony of that statement until you posted the above, because I did know what you meant, Mily.that's worth the price of admission

Uhhh...errr....that kinda came out wrong..err...ahh...well, you know what I mean.

Edited by IYB, 01 August 2009 - 06:55 PM.

Posted 01 August 2009 - 09:18 PM

Aloha

Aloha

Posted 01 August 2009 - 09:26 PM

Posted 01 August 2009 - 10:39 PM

Posted 01 August 2009 - 11:20 PM

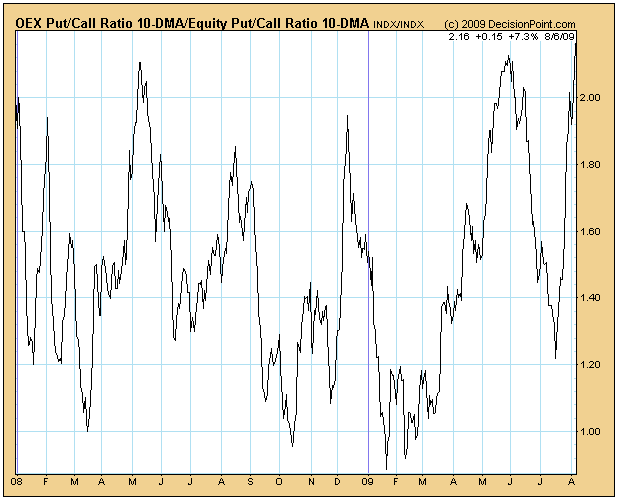

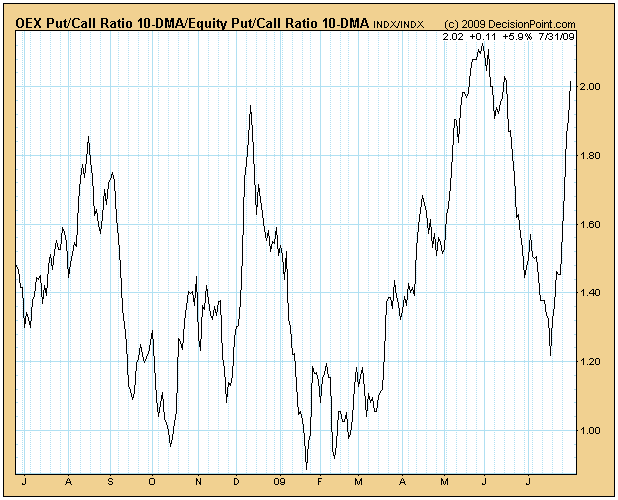

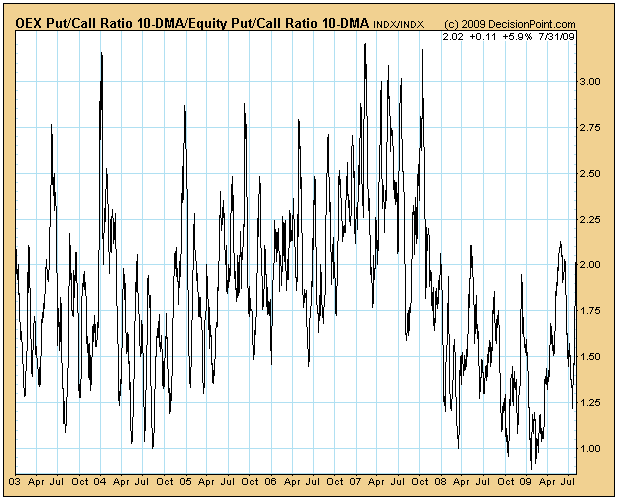

weekly OCC index putcall premium ratio ended at .78 after 2 weeks in the mid .80s area. for reference, 6/12 weekly came in at .75, .70 the week before. that.

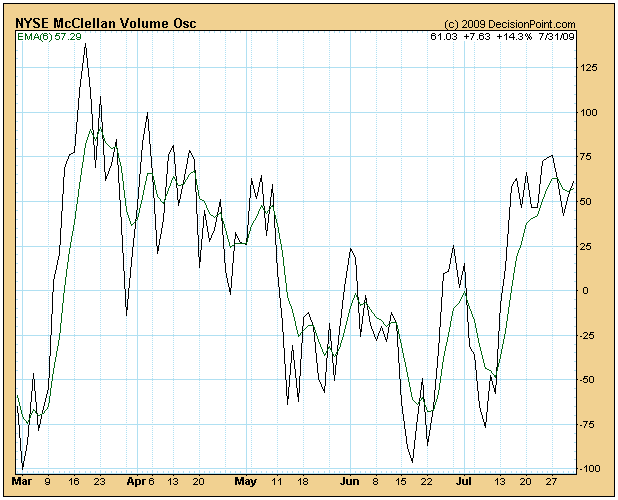

reaching bearish territory, but the primary mkt trend may remain in meltup mode until the ~81TD cycle sputters out (not due until late August)....

fwiw, my software is giving the following cycle projections:

instrument, base cycle wavelength, projected #of bars to peak

DIA, 83, 21

(IWM, MDY), 81, 21

QQQQ, 41, 5

SPY, 81, 19

Posted 01 August 2009 - 11:28 PM

Posted 03 August 2009 - 04:27 PM

Put another way, the strategy is taking a contrarian position against the put/call ratio. A high put/call ratio would indicate that a large number of investors are betting on (or hedging against) the market falling. This strategy is buying into that bearishness except when the market is very overbought and due a pullback.

This all of course goes very much against conventional wisdom, but like most things in the stock market, conventional wisdom is usually not all that wise.

Posted 06 August 2009 - 04:59 PM