12/18/2011 9.00pm PST

By Fibo-Nacy

In summary

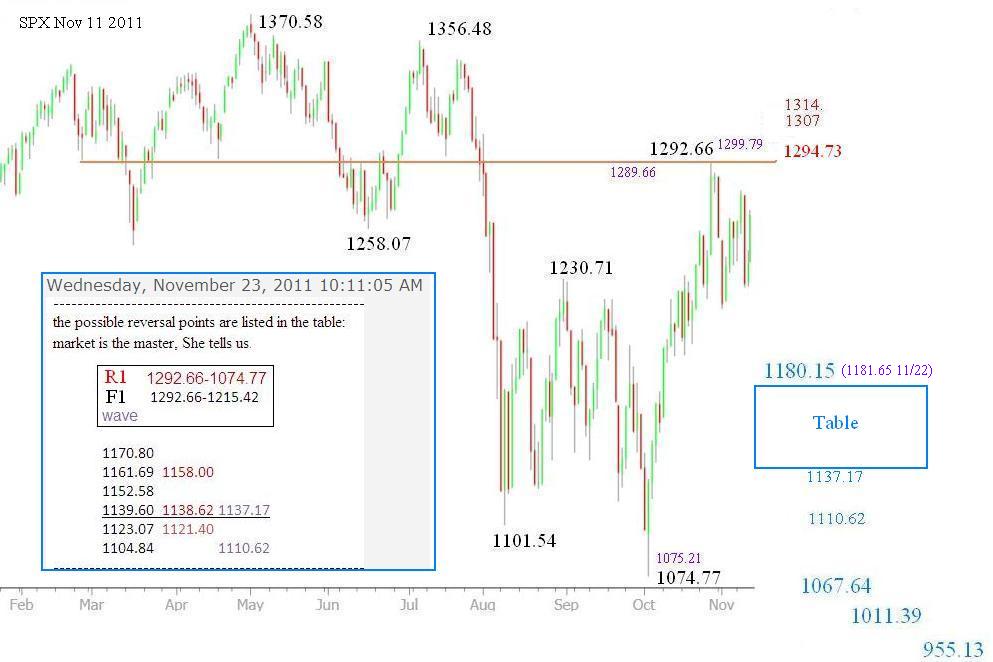

(a.) Regardless of whether the SPX will reach 1320 or not, Index is much closer to the upper rail with a few hundred points down side possibility. A good opportunity is forming for the large swing traders.

(b.) I use the gauge 1277.55 to probe the early stage bullish scenario; In case SPX moves above 1320, all bearish bets are off, at least temporarily. has to wait the index reverse below 1294 again. Right now the index is about 55 points below 1277.55, not a big threat for the bearish scenario.

Time speculation

(a.) Ken Wen’s sequence see conflicts again

12/20, 01/04, 01/18, 01/31 [Low]

01/17, 01/30, 02/10 [high]

(b.) Bradley Turn dates

12/28 [important], 1/11, 1/28, 2/16, 2/22, 3/16 [important]

(c.) 108 trading day cycle 03/12/12 +/-.

Retracements/Wave extensions

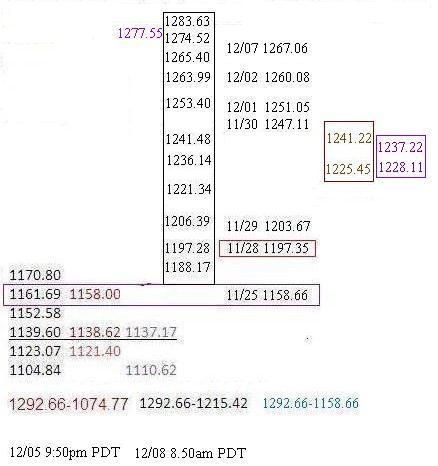

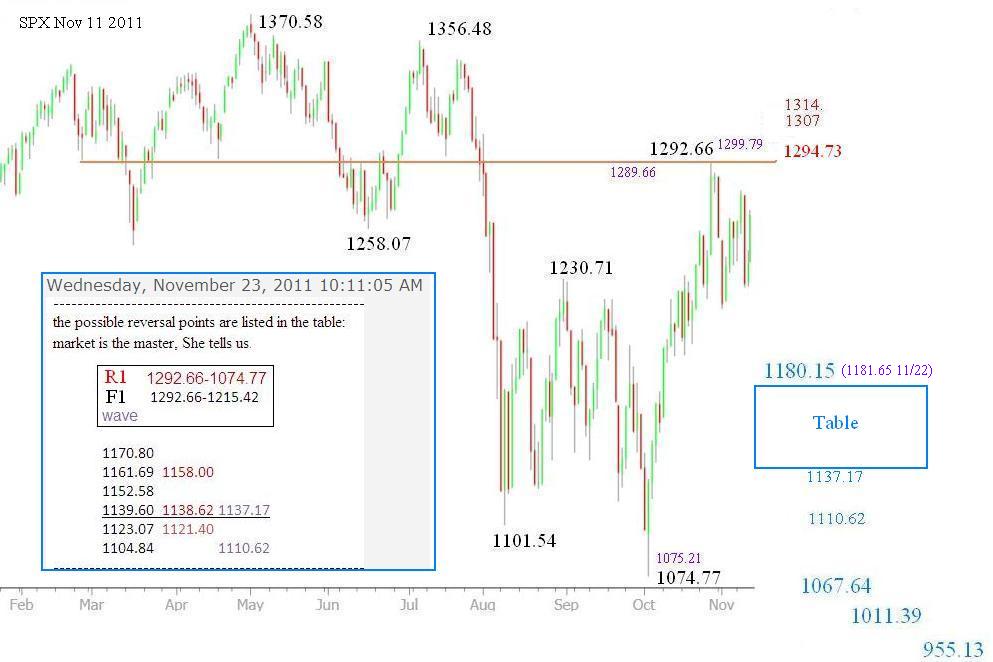

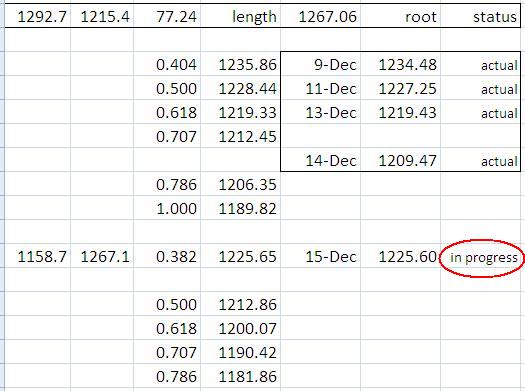

Here is the chart & table that illustrates the index activities.

(1) The outer layer is 1292.66-1074.77. Index marked two important terminal points, 1158.66 and 1209.47. On top of the major Fibonacci point 1293.61 is the resistance 1302, 1307, 1314,and 1320. [not shown in the chart]

(2) The inner layer is from 1258.66 to 1277.55, quite a few good Fibonacci hits in between.

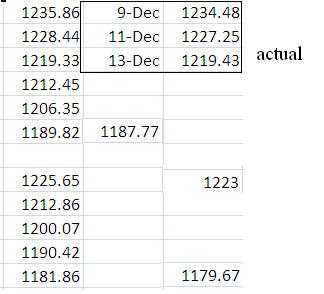

(3) The local layer is from 1209.47 to 1267.06, Last Friday (12/16) intraday has a good hit on 0.382/1231.04 (actual 1231.47).

(4) Due to the complexity, I skip the numbers based on wave extensions. Too much information hinders the thought process.

I nailed the October low 1075 correctly in

this chart 08/10, the calculation is 1356.48 – 2.5 * (1370.58-1258.07) = 1075.21 (actual 1074.77). my 'new' speculation was posted on 11/11. I will put a breakdown table for the numbers in between 1105-1011, let’s go step by step.

Older references

Older references

Stanley Oct 10 2011, 08:59 AM

Zigzags zone has moved from [1228-1310-1381] down to [1011-1176-1228]. it is in the process of testing the upper rail 1228. strong overhead resistance lies in between 1258-1268; it will take time to wash out 1011-1102, once it gets done, the next zone would be 861-944-1011.

Fibo-Nacy Nov 25 2011, 11:38 AM

Crafting the rhythms series II, November 25, 2011

Title:

Connecting flight to 2012

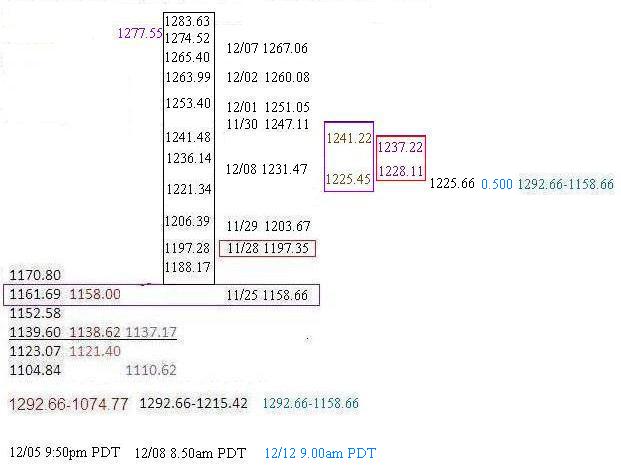

Fibo-Nacy Dec 8 2011, 10:16 AM

This is the bearish case

wave chart

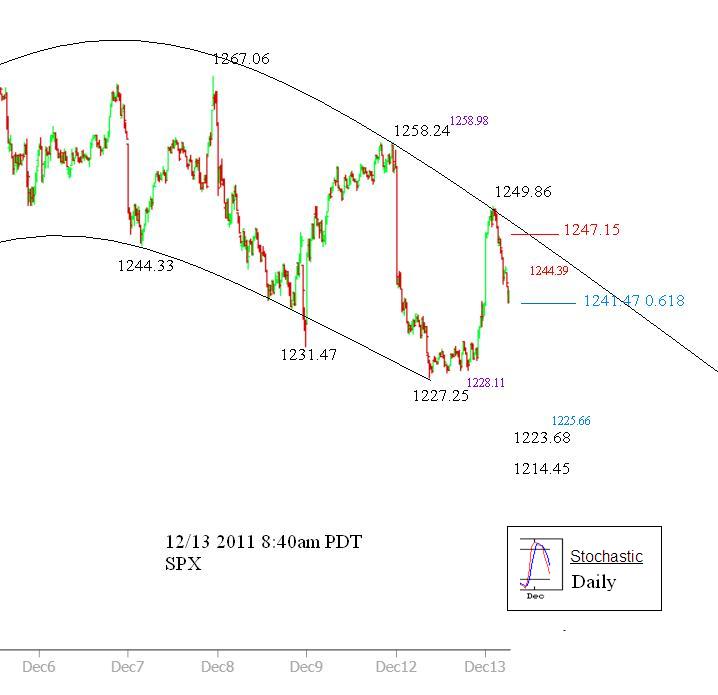

Fibo-Nacy Dec 9 2011, 11:09 AM

range bound chart