Crafting the rhythms series II, November 25, 2011

Title:

Connecting flight to 2012

By Fibo-Nacy [Stanley is working in the Far East, He asked me to continue his work]

Brief review

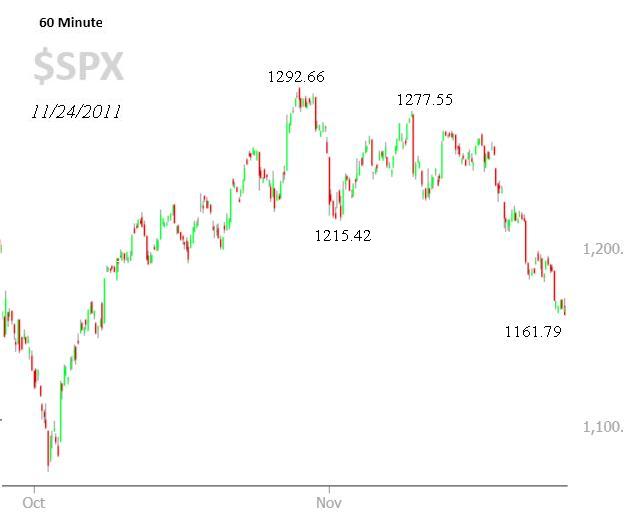

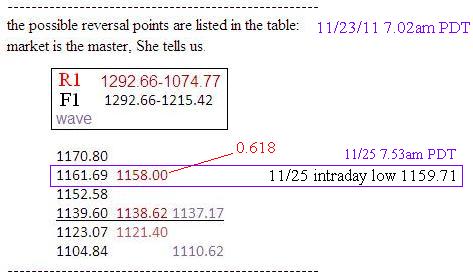

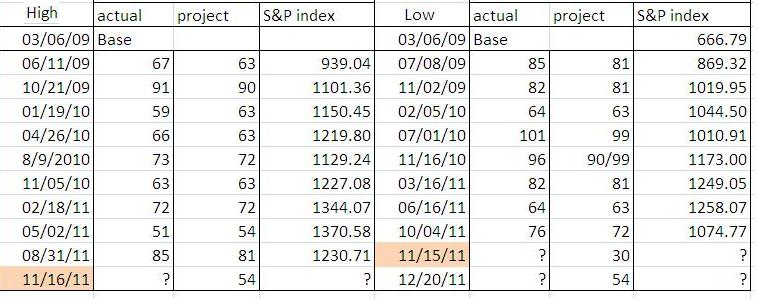

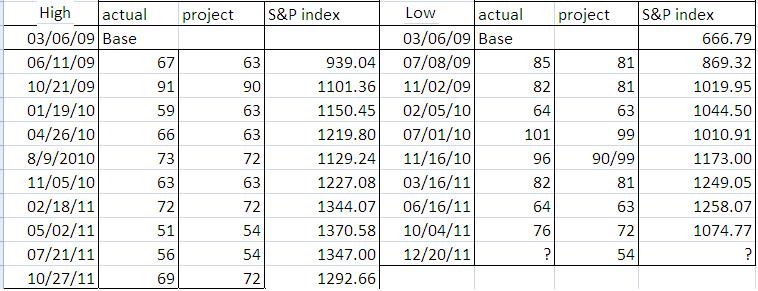

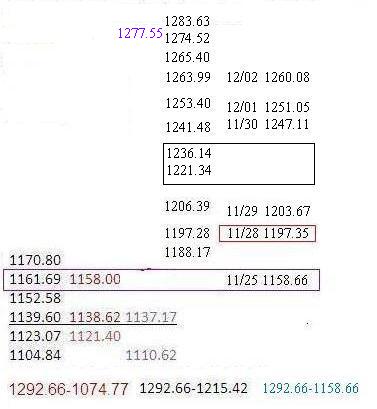

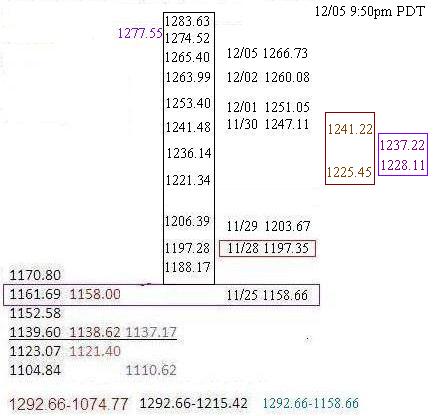

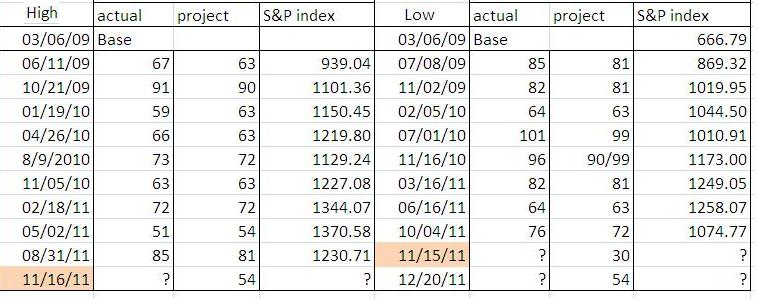

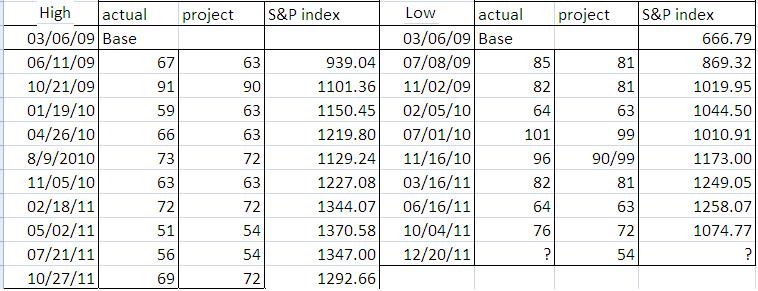

The conflicts on high/low closely synchronized with the breakdown of triangle on 11/16. The low date based on King Wen’s sequence is still ahead, 12/20 (and 01/04, 01/18, 01/31, not shown in the table, see [1] Time pivots )

Oct 28 2011, 02:01 PM

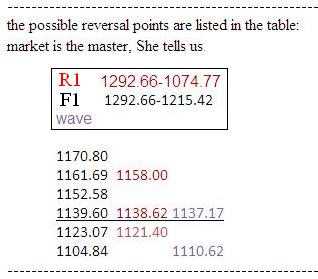

The significance of 1292.66 on 10/27 is not only it is a high ratio Fibonacci point (1292.4 @0.809 1440 vs. 667), after you read

this chart you will know why. ((Fibo-Nacy Posted on 31 July 2011 - 12:01 AM)

“

Sometimes, the 'textbook' example can serve only as a guide, If you are a large swing trader, where is the Exit point? 1286, 1294 or 1234??, thus the beauty of the market, she teases the speculators to the maximum extent” (Stanley posted on Jun 6 2011, 01:04 AM)

Nov 16 2011, 02:00 PM

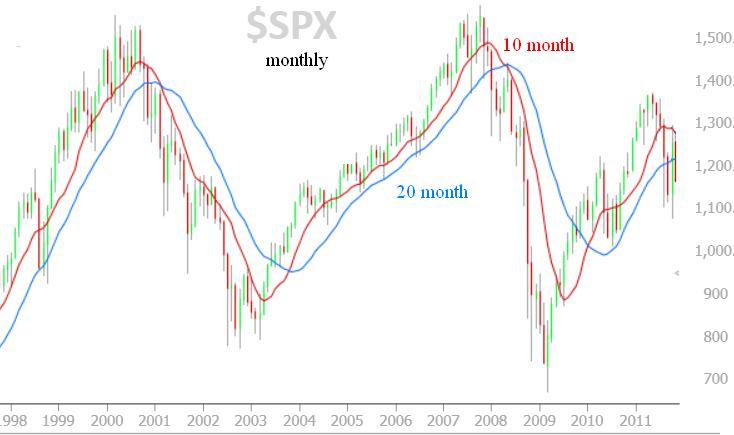

Time flies, when Stanley posted his ‘long’ term target number 950 that was on April, 2011. So, now, I shall call it the middle term target; As time approaches (March/12 – June/12), we can do the fine tuning the number. The key level to watch is 1054 which is the 50% retracement out of 1440 vs. 667. This level was a hot spot when the October’s plunge cratered at 1074. Based on the already deployed trajectories, somewhere in between 1054 & 1086 will be tested again. The lowest number for the near term target is 955.13 (refer to [2] Index level). so I have maintained the consistency in between the near, middle and long time frames. Important reference numbers are 1294, 1176, 1054 and 944, these number give us the rough hints how the zigzags will traverse among those Fibonacci points.

[1] Time pivots

(a.) Ken Wen’s sequence see conflicts again

12/20, 01/04,

01/18, 01/31 [Low]

01/17, 01/30, 02/10 [high]

(b.) Bradley Turn dates

11/22-23, 12/28, 1/11, 1/28, 2/16, 2/22,

3/16, ....

full year chart

(c.) 108 trading day cycle

03/12/2012

Something big is going to happen in the stock market next year, I don’t want say too much, I can feel it is out there. imho, How to balance amongst the date 12/20, 03/12-16, and 05/26-06/12 is the key.

[2] Index level

[a.] near term

chart

break down table

[b.] middle term 950

Stanley April 24 2011, 02:49 PM

“

I have a tentative estimate for S&P 500 index low target. It is around 950 (940-972). ......The magnitude and dates should be considered as a guideline and is subjected to change when newer data arrives"

881.38 = [0.236|666.79:1576.09]

1014.14=[0.382|666.79:1576.09]

mean of (881.38 + 1014.14) = 947.76 == 948, round into 950

May 10 2009

[c.] Long term, the-Bottom 462

chart

original text by Stanley Sep 5 2011, 12:57 AM

[3] Events

2011 Arbic Spring, the squeezed middle

'Squeezed middle' is word of the year –

link

“Arab Spring” -

link

Zodiac 2011 Year of the rabbit

3 February 2011 – 22 January 2012: Metal Hare

Hi, Dear Dragon, it's gonna be your turn

Zodiac 2012 Year of the Dragon

Hi, Dear Dragon, it's gonna be your turn

Zodiac 2012 Year of the Dragon

23 January 2012 – 9 February 2013: Water Dragon,

“The Year of the Dragon is again just around the corner and fear and trepidation are once more an issue.”

Image/Text source

2012 The year we make real change

An important chapter will be written into the history book.