Atlanta Fed Slashes GDP Growth Forecast to 1.8%

US Housing Market TOPPED IN APRIL and now...

#11

Posted 28 July 2016 - 10:09 AM

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#12

Posted 28 July 2016 - 06:35 PM

Interestingly, the bid here in my berg is firm. Very firm. Most houses in my specific area sell within 48 hours. Though I'm told that the story is different in the burbs. Real estate can be very elephant-like to the blind man.

M

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#13

Posted 29 July 2016 - 08:00 AM

US GDP 1.2%

We have some pretty good chart readers around here, just mentally plug in1.2 into this chart and give me your projection for a downside target. I see at the very least a test of the 2014 low... (looks like around -1.0)...

Oops, they updated this as I was posting...

Edited by SemiBizz, 29 July 2016 - 08:01 AM.

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#14

Posted 29 July 2016 - 08:13 AM

"Another negative in the report is a reversal in residential investment, which had been running in the double-digit zone but which fell at an annualized 6.1 percent to pull down GDP in the second quarter."

Have central banks failed in their easy money policy?

Speculation that the BOJ has hit a wall in its fight to increase inflation is this morning’s main talking point.

Is the perception that the central banks have failed in their easy money policy and Japan’s move is a precursor to the ECB and the Fed to finally bite the bullet? If the central banks slow down on the monetary expansion, the fiscal side will need to pickup the slack, or a global recession will be inevitable.

http://www.kitco.com...-Surprises.html

Major miss in the US GDP headline numbers

U.S. Department of Commerce said that the U.S. economy grew 1.2% in the second quarter, economists were expecting to see the U.S. expand 2.6%

A central concern remains nonresidential fixed investment.

Weakness here points to weakness in business confidence and trouble ahead for productivity growth.

“Today's US data were a big disappointment for those of us looking for a spark back to life after a weak first quarter,” said Avery Shenfeld, senior economist at CIBC World Markets.

GDP

8:30 AM ET

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#15

Posted 29 July 2016 - 08:23 AM

See they are pretty clever down there at the Bureau of Economic "Truth" (BEA)... they lowered the first quarter to .8%, so this quarter at 1.5% is almost 100% INCREASE - Nice paint job for the computers... which won't register the adjustment in the same way we do, the algorithm captures the new number without prejudice and the system sees the output...

UP ALMOST 100%

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#16

Posted 29 July 2016 - 08:30 AM

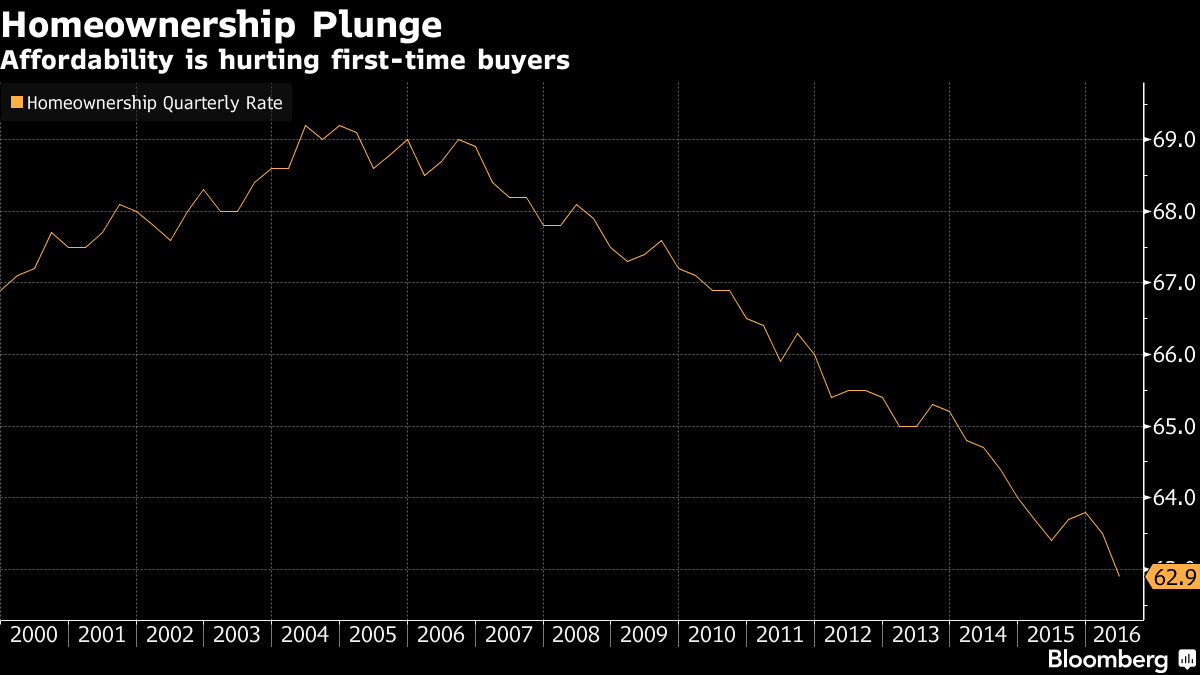

Living at Grandma's, $30K in debt. Working 20 Hours at Mcdonalds.

.Homeownership Lowest Since 1965...

Edited by Rogerdodger, 29 July 2016 - 08:32 AM.

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#17

Posted 29 July 2016 - 09:32 AM

Roger,

Something we see here is younger folks simply not wanting to have a mortgage. They'll pay 2x a mortgage, insurnace + taxes for rent because they don't want the perceived risk of mortgage, nor the commitment.

It's fascinating.

M

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#18

Posted 29 July 2016 - 09:36 AM

Roger,

Something we see here is younger folks simply not wanting to have a mortgage. They'll pay 2x a mortgage, insurnace + taxes for rent because they don't want the perceived risk of mortgage, nor the commitment.

It's fascinating.

M

They already have a mortgage. It is called 100k in student loans.

#19

Posted 29 July 2016 - 09:48 AM

Boy this central planning works great doesn't it?

Obummercare premiums are going up 18% avg. in the first quarter in Northern California...

And $100K for what on education? I've noticed on the internet... these kids coming out of school can't spell or make a sentence.

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#20

Posted 01 August 2016 - 12:37 PM

Semi - that stuff aint important - neither is math or programming skills for the android set - just learn some ruby on rails....

I read that millenials prefer to invest in intangibles - like trips and brain food and giving forward rather than a home - be assured it will change in 10 years.

klh

Also tagged with one or more of these keywords: VOLUME OFF THE TOP

TTHQ Directory →

Fearless Forecasters →

NEW HOME SALES HIT NEAR 9 YEAR RECORDStarted by SemiBizz , 23 Aug 2016 |

|

|