Dollar index moving up strongly, may keep going into late summer, not good for gold....

Posted 01 May 2018 - 07:01 AM

Dollar index moving up strongly, may keep going into late summer, not good for gold....

Posted 01 May 2018 - 07:18 AM

despite the dollar's strength xau has a trend for a low at the end of this week and gold futures has a low signal for a low next week but is not as strong as the xau signal....

Posted 01 May 2018 - 07:32 AM

Posted 01 May 2018 - 07:49 AM

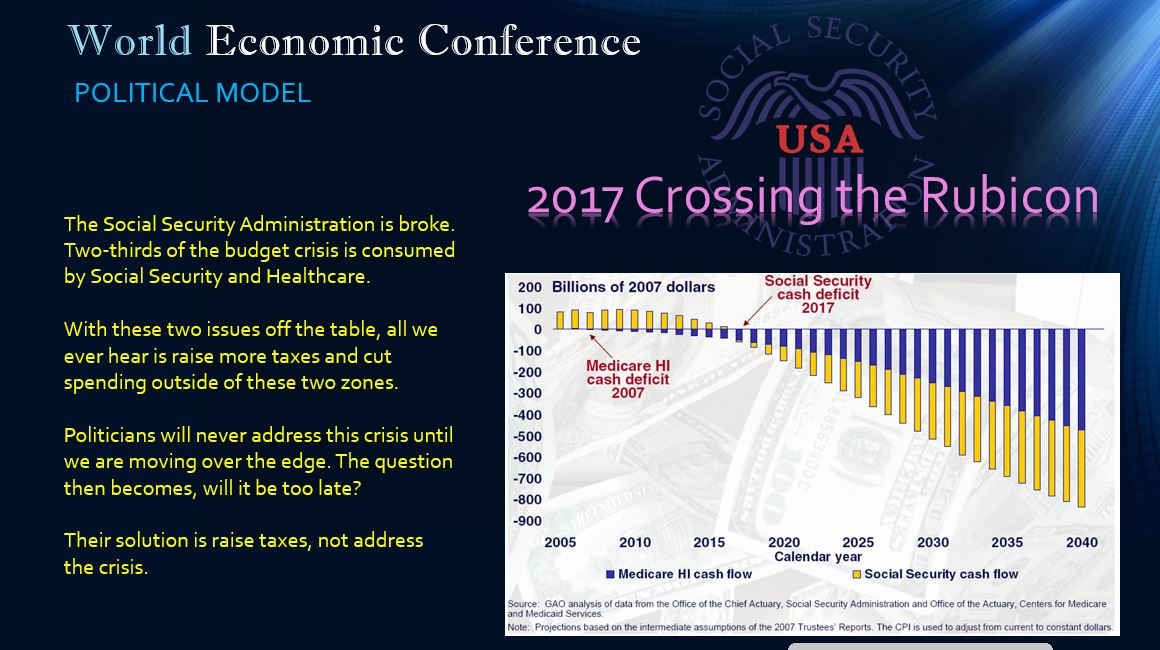

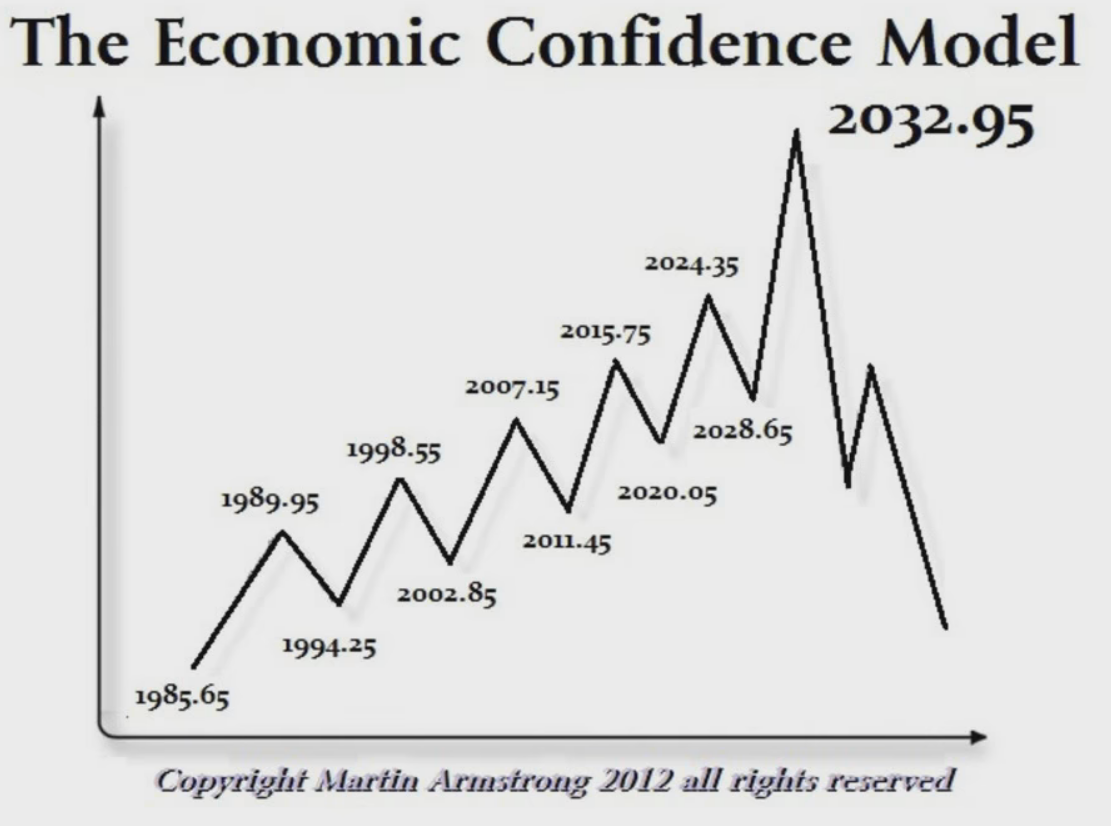

well did everyone get the memo... I guess we have to wait until 2024 for the commodity boom to start...

Armstrong's model, so if correct that commodities start to move after 2024 based on the model that would show them moving up into 2032.95 which based on the 8.6, 51.6 and 309.6 cycles would see the collapse of western civilization after 2032.

Posted 01 May 2018 - 08:19 AM

well if this is a wave C in gold its getting very interesting as the very recent early morning low was 1306.66 (spot), barely below all previous lows in this area except the spike low on Feb 18 at 1302.76, very oversold here and at oversold levels of previous bottoms, buckle up and lets see what happens

Senor

Posted 01 May 2018 - 08:20 AM

well did everyone get the memo... I guess we have to wait until 2024 for the commodity boom to start...

Armstrong's model, so if correct that commodities start to move after 2024 based on the model that would show them moving up into 2032.95 which based on the 8.6, 51.6 and 309.6 cycles would see the collapse of western civilization after 2032.

just another dart thrown by someone who IMO is an average dart thrower![]()

Senor

Posted 01 May 2018 - 08:37 AM

My current best shot is a low for spot gold on Friday, the day of the jobs report. Candidate targets remain spot 1303, 1296 and around 1285.

Edited by Smithy, 01 May 2018 - 08:39 AM.

Posted 01 May 2018 - 09:00 AM

Upon further reflection the low could be tomorrow Weds, FOMC, but I lean towards Friday for cyclic reasons.

Posted 01 May 2018 - 09:17 AM

Edited by Chilidawgz, 01 May 2018 - 09:22 AM.

Posted 01 May 2018 - 09:20 AM

Rising trendline around 122 though.