Flat NQ and Crude

Holding 33 SPY PUTS

one ES LONG

Posted 14 June 2020 - 05:02 PM

Flat NQ and Crude

Holding 33 SPY PUTS

one ES LONG

Posted 14 June 2020 - 05:03 PM

will observe for a few minutes before deciding whether to trade NQ

want to see the ASIAN MARKETS reaction later

Posted 14 June 2020 - 07:25 PM

Directly from the OCC website. Select your parameters and a txt file can be downloaded.

Posted 14 June 2020 - 07:31 PM

By the way, the really new stuff with options are the so called Gamma/GEX calculations, but to my knowledge most of that is paid for subscription if and where available. I think a lot of the new traders that are experts in writing code are just doing it themselves.

Posted 14 June 2020 - 07:37 PM

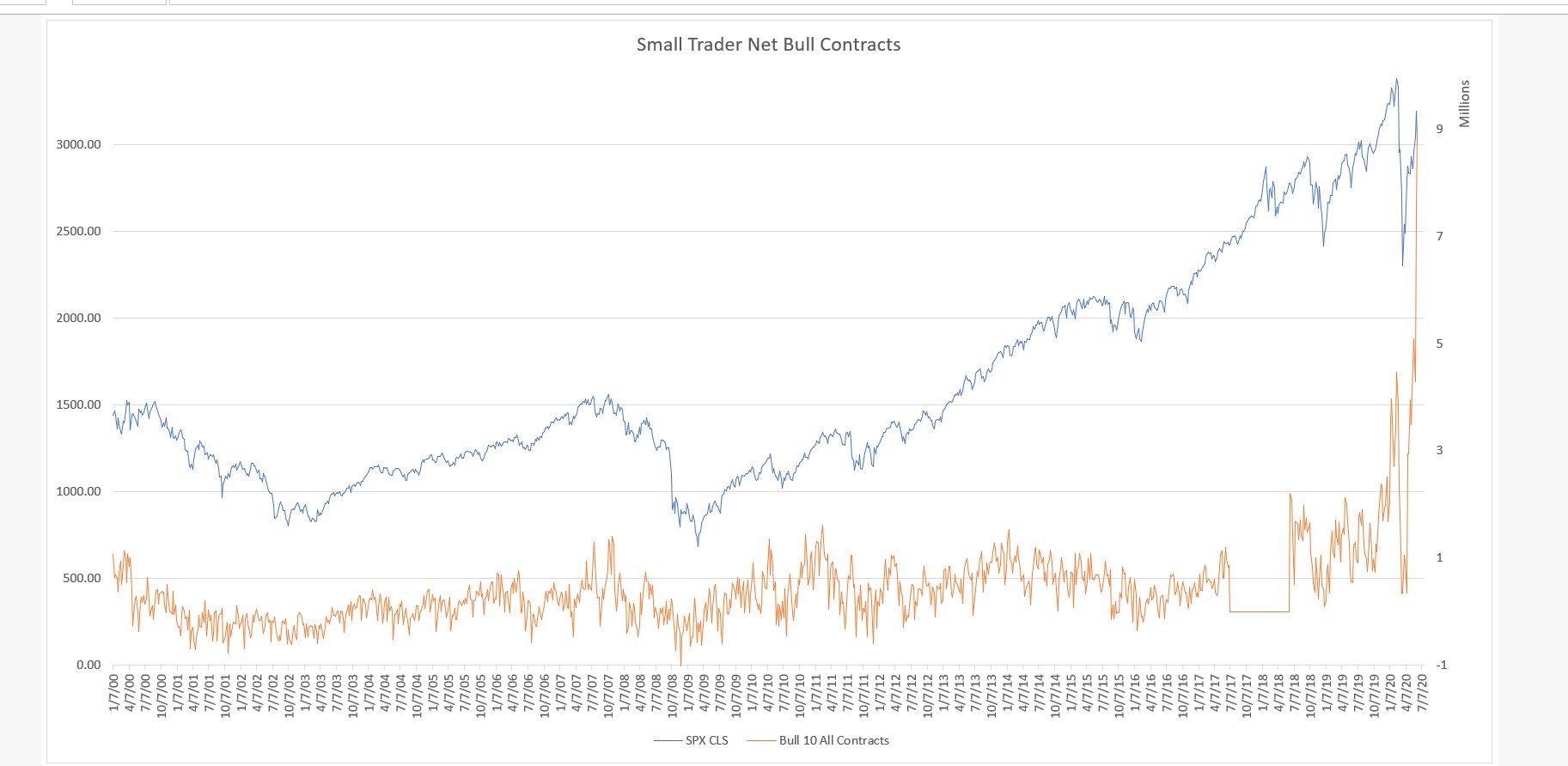

Calls minus Puts purchased is certainly a form of sentiment, and when it goes up by over 20X in a short period of time, it is worth paying attention to, especially IF price action starts to confirm the sentiment extreme.

When it was 20X lower, it certainly nailed the bottom.....

Edited by K Wave, 14 June 2020 - 07:37 PM.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 14 June 2020 - 09:33 PM

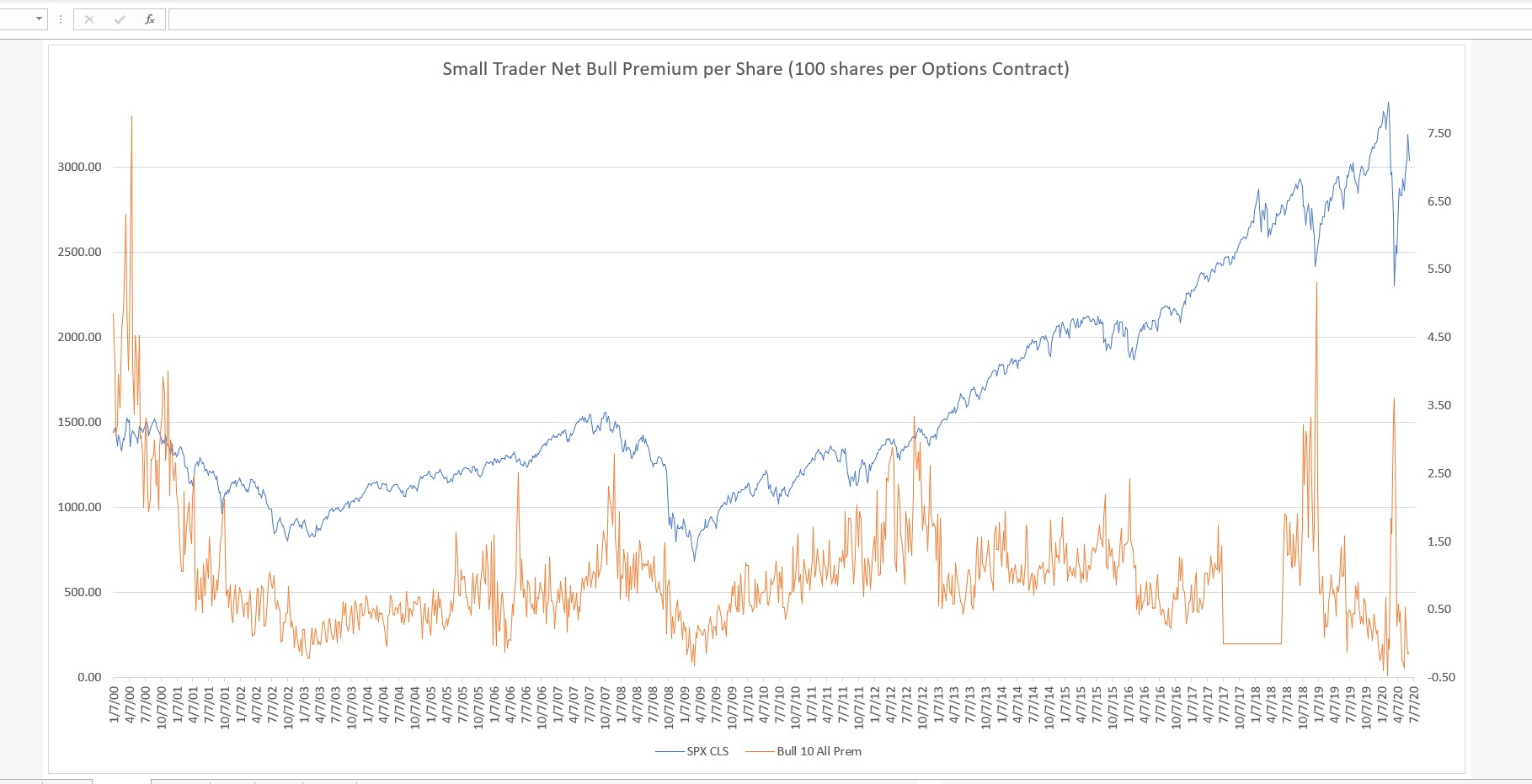

Here is a look at the Small Trader Net Bull Options Strategy based on the overall total cost in premiums paid and received. (BTO Calls plus STO Puts) minus (STO Calls plus BTO Puts). Keep in mind that long term OCC Options data on Equities does not compare apples to apples since in the early years of ETF development any options that were available were included in the equity reports. Even now with a separate ETF report, Long vs Inverse option trades are not separated. I'm not sure of the dates, but the last 7-8 years are probably equity only now. Will show the contract chart next. Note: I'm missing about a year of data in both charts as seen by straight line.

Posted 14 June 2020 - 09:57 PM

This chart based on Net Bull contracts traded will certainly draw in more subscribers and get more folks to watch their Youtube shows. By the way, the COT report was less bullish by 6.6 billion dollars for Commercials, and Non-Commercials added slightly to their net short position by 3000 ES mini contracts for a little over 228K net short which is 7% of the open interest. Non-Commercials are also net long the big SPX contract by the equivalent of 76,500 ES mini contracts, so that category is really on net short a little over 150K ES min contracts if you want to look at it that way. SH has redeemed shares almost every day for a month, and overall Inverse shares have redeemed very little even with Thursday's big drop. A lot of inverse shares have been in single digits for a while now, so the next wave of reverse splits will be announced very soon. QID is down 99.8% from 2008 and only 2x.

Posted 15 June 2020 - 06:33 AM

4 NQ long and 2 NQ short trades since 4:50am

Looking at OIL for a possible LONG OCT CRUDE FUTURES

holding 1 ES LONG and

Posted 15 June 2020 - 06:37 AM

and 33 SPY PUTS

just closed a NQ LONG, had to interrupt the post above to get out of this NQ

It is possible the markets WILL RECOVER to finish UP today in OPEC WEEK

We may have seen the daily LOW already but if that overnight low is broken then .... below 2900 SPX yo test the SPX 2070/80 zone

Posted 15 June 2020 - 06:39 AM

Will close some of those once-hopeless PUTS that are GREEN, or hovering near the zero line, later if SPX trades below 2950