I agree with most of this:

"The Bull's Case

The bullish case for the market is pretty thin.

- Hopes are high for a full reopening of the economy

- A vaccine

- A rapid return to economic normalcy.

- 2022 earnings will be sufficiently high enough to justify "current" prices. (Let that sink in - that's two years of ZERO price growth.)

- The Fed.

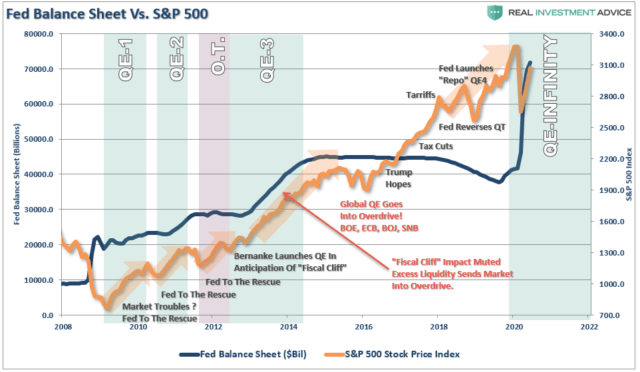

In actuality, the first four points are rationalizations. It is the Fed's liquidity driving the market.

The Bear's Case

The bear's built their case on more solid fundamental views.

- The potential for a second wave of the virus

- A slower than expected economic recovery

- A second wave of the virus erodes consumer confidence slowing employment

- High unemployment weighs on personal consumption

- Debt defaults and bankruptcies rise more sharply than expected.

- All of which translates into the sharply reduced earnings and corporate profitability.

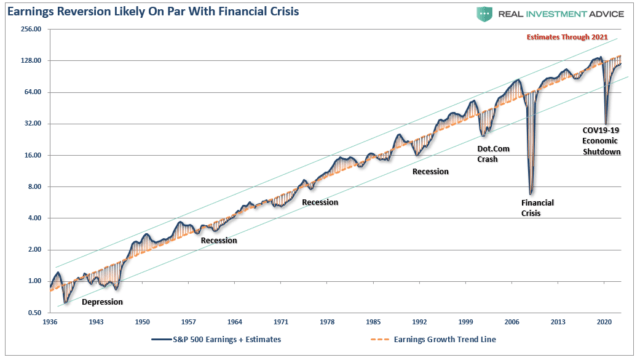

Ultimately, corporate profits and earnings always matter, as discussed previously. (Historically, earnings never catch up with price.)

"Throughout history, earnings are very predictable. Using the analysis above, we can "guesstimate" the decline in earnings, and the potential decline in stock prices to align valuations. The chart below is the long-term log trend of earnings versus its exponential growth trend."

As we noted then, while "don't fight the Fed" seems to be a simple formula for the bullish case, the deviation between "fundamentals" and "fantasy" will eventually matter."

https://seekingalpha...square-off-line

Edited by dTraderB, 16 June 2020 - 06:55 AM.