Starting to build a short at 3020, might continue up to fill that overnight gap so I'll just add.

Wild West Market: RobinHooders 0 vs Wall St. pros 1

#41

Posted 15 June 2020 - 11:21 AM

#42

Posted 15 June 2020 - 11:45 AM

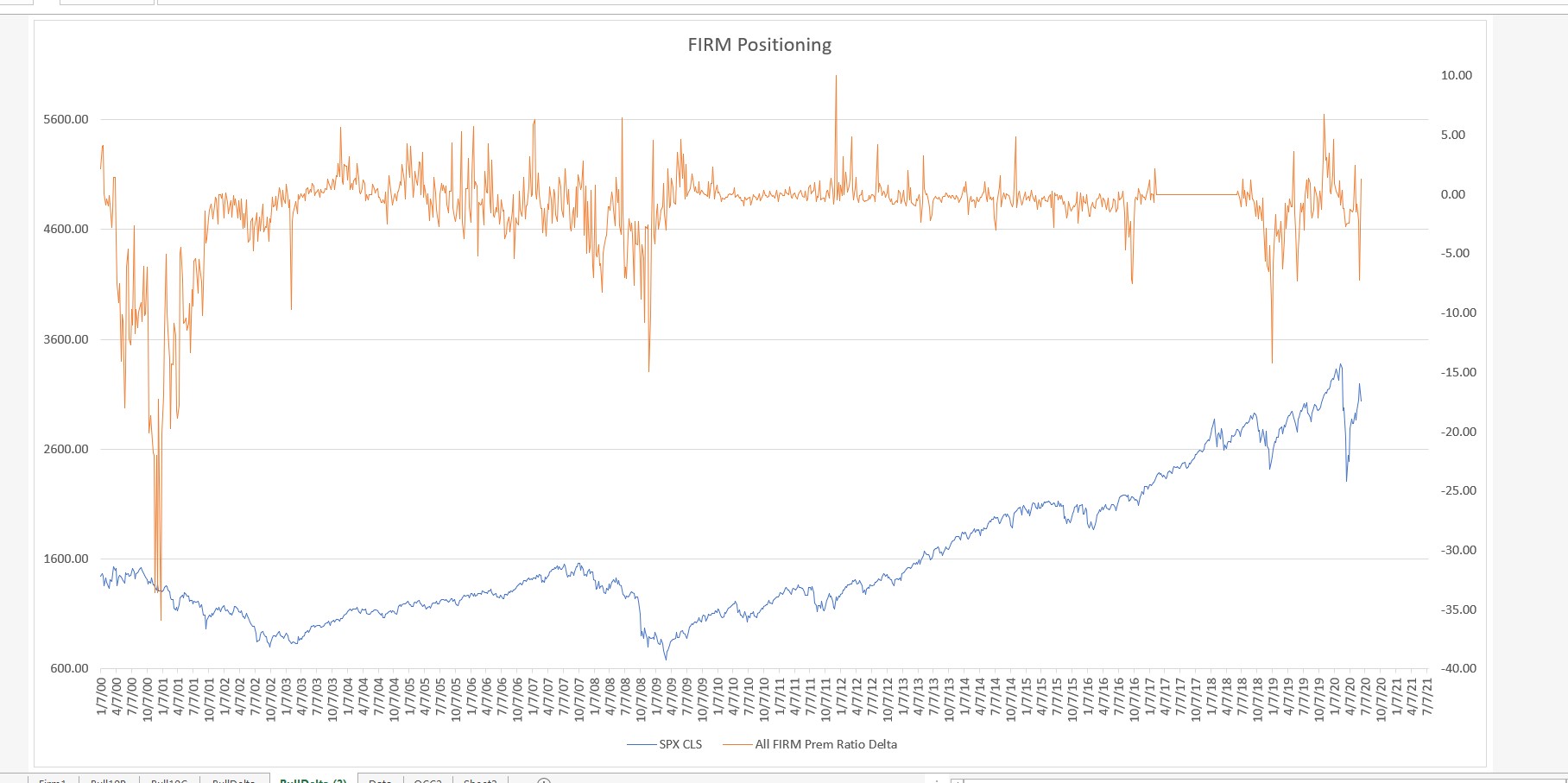

I think it is a better idea to look for extremes by dividing premium by contracts and making inferences within the various categories. The FIRMs positioning is what seems to raise the red flag more often than not, but as the data shows, they can be early or off a bit on the extent of down moves. A lot of the extreme spike downs are near good price bottoms.

#43

Posted 15 June 2020 - 11:48 AM

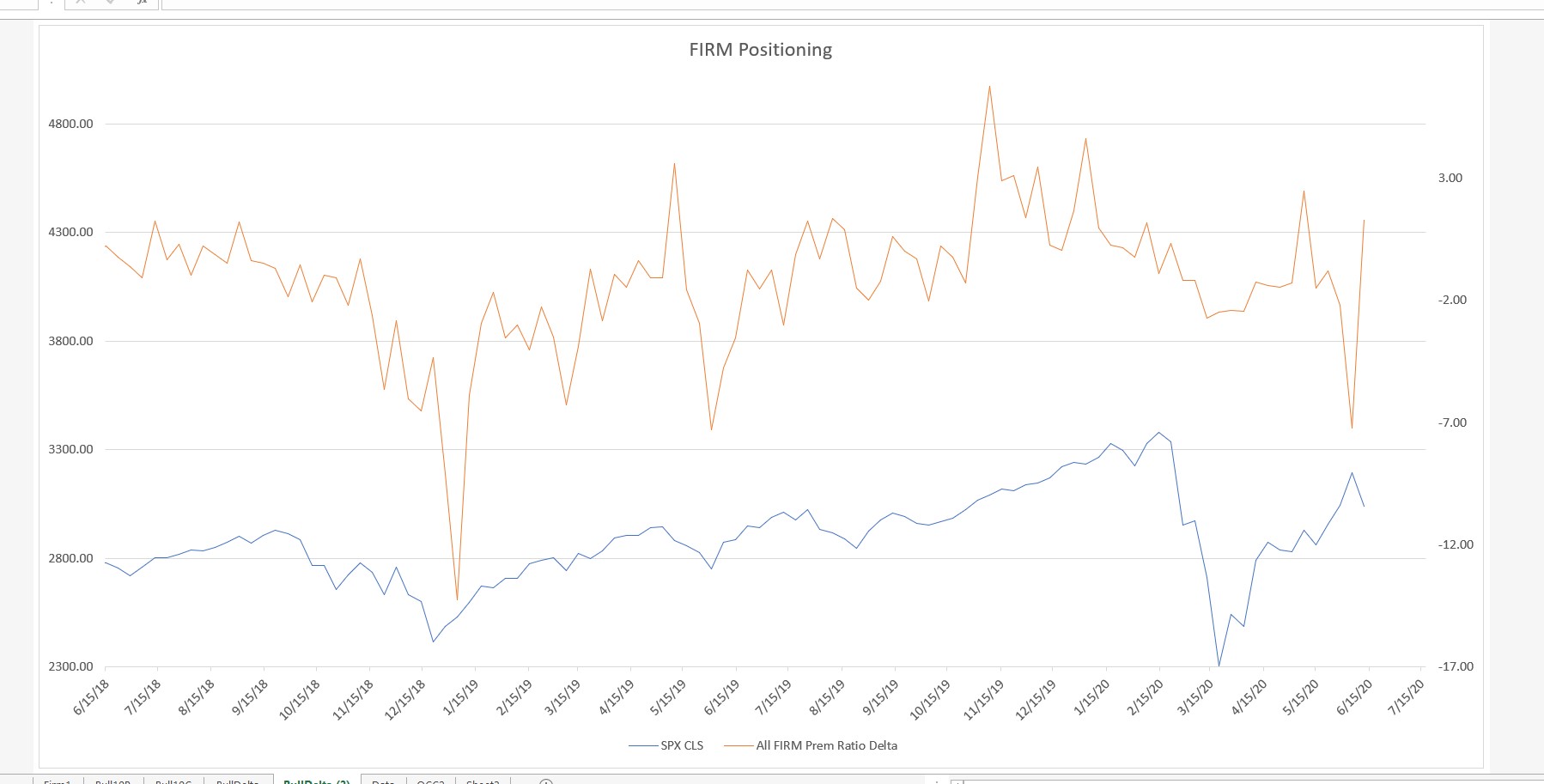

Here is a close up of the last two years. It might be fair to say that they are having to be more active in the more recent environment.

#44

Posted 15 June 2020 - 11:53 AM

es long 3001

Closed 22.50

21.5 profit

Will reopen lowet

#45

Posted 15 June 2020 - 11:54 AM

es long 3001

Closed 22.50

21.5 profit

Will reopen lowet

#46

Posted 15 June 2020 - 01:30 PM

and 33 SPY PUTS

just closed a NQ LONG, had to interrupt the post above to get out of this NQ

It is possible the markets WILL RECOVER to finish UP today in OPEC WEEK

We may have seen the daily LOW already but if that overnight low is broken then .... below 2900 SPX yo test the SPX 2070/80 zone

And so it has been! Not adding new SPY PUTS as yet ... but riding this astonishing NQ rally. How couuld you not go LONG? Those green hourly candles since 9:30am are as clearly bullish as you want! 10 lots..... big size position...

#47

Posted 15 June 2020 - 08:12 PM

great day, that NQ hourly chart tells the story of a market that reversed sharply and then never looked back.

for me, NQ hourly is LT and I try to daytrade with a bias based on the hourly. like a supertanker, when NQ hourly turns it does continue in that direction for at least one or two hours - that's LT in my daytrading world.

Had profitable ES trades, not as many as was possible but I focused on NQ

Reduced SPY PUT positions

Will add more near SPX 3080 if traded.

#48

Posted 15 June 2020 - 10:11 PM

Calling it a night.

#49

Posted 16 June 2020 - 06:32 AM

Do not fight the FED!

Just hold your nose and go with the flow of the market but be ready to reverse hard and fast

A late start this morning after trading last night as NQ just kept going up and up and away

only 3 NQ trades so far today since 6:45 this morning

I am looking for a ST top today but do not see the market going back down to test yesterday's low during the rest of this week.

Maybe on Friday evening, but the market is being propelled by the FED and no matter how out of sync it is with the real world the

lesson learned from decades of trading is: trade the market not the real world! Ultimately, the market adjusts to the realities of global economies and geopolitical events but do not wait on that.

The only immediate event today that could send the market down again is the madness of N Korea.... or a POWELL slip in Congress testimony... or an unexpected event... but go with the market and be ready to exit & reverse ASAP

My remaining SEP PUTS are back in the red but I am happy I closed 39 PUTS with profits during that decline that ended yesterday and I am sure the markets will be down again and the rest of the SEP SPY PUTS will be profitable. Yes, I made profits hedging but I prefer to treat these as separate trades and I want to be profitable in each. I will start adding new SPY PUTS above SPX 3100, maybe OCT PUTS.

ES flat

Crude flat

28 SEP SPY PUTS

#50

Posted 16 June 2020 - 06:53 AM

Did not know this:

"With markets plunging again at the open, and with Jerome Powell's personal fortune on the line at Blackrock..."

https://seekingalpha...square-off-line