WSJ has the same numbers.

https://www.wsj.com/...ks/marketsdiary

TRIN only 1.39....but MASSIVE volume overall.

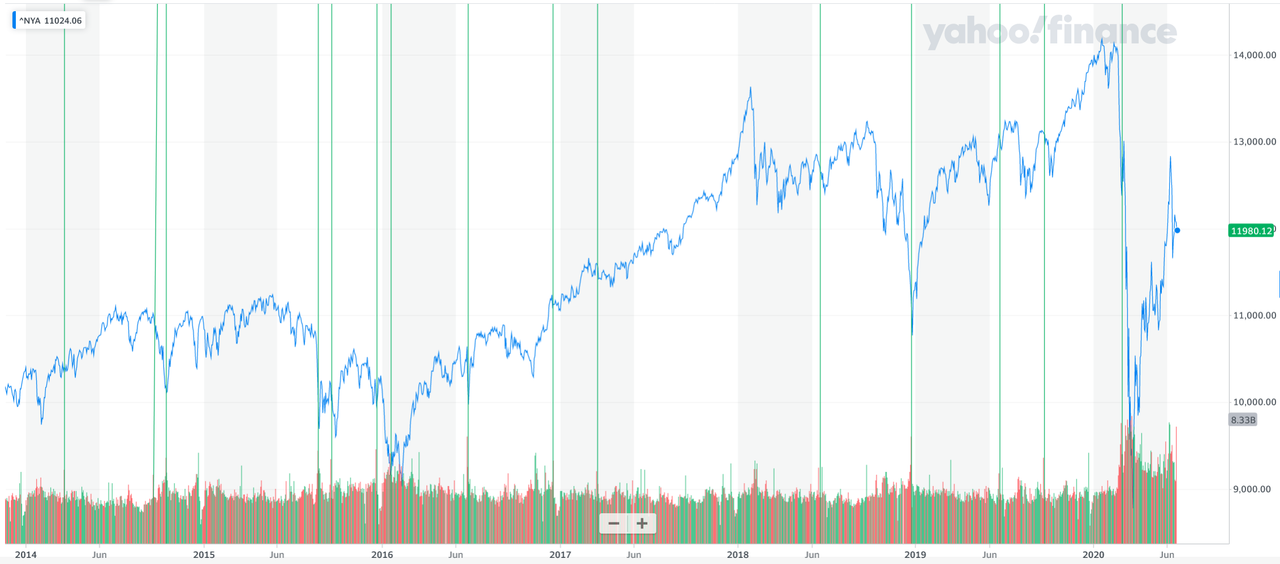

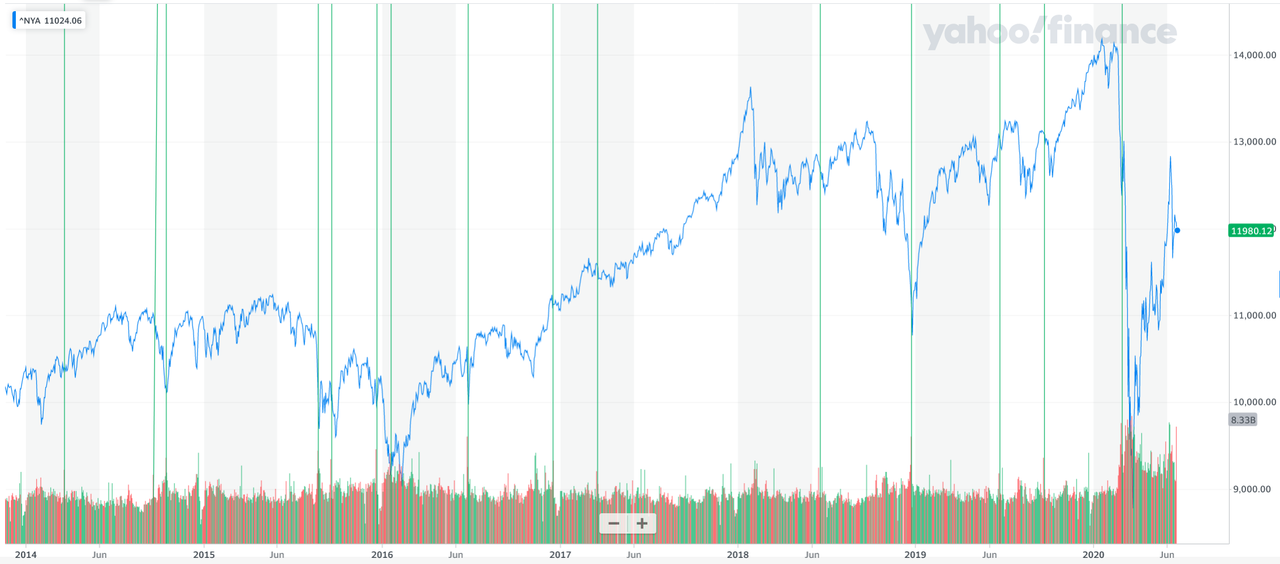

Not quite record volume, but big down volume spikes "usually" indicative of at least a short term low, and some times a major low. I have highlighted some of the bigger Down Vol spikes over the past few years.

But sometimes....it is volume off a top, after a rally attempt after a top has just failed, and down vol spikes have led to nasty declines.

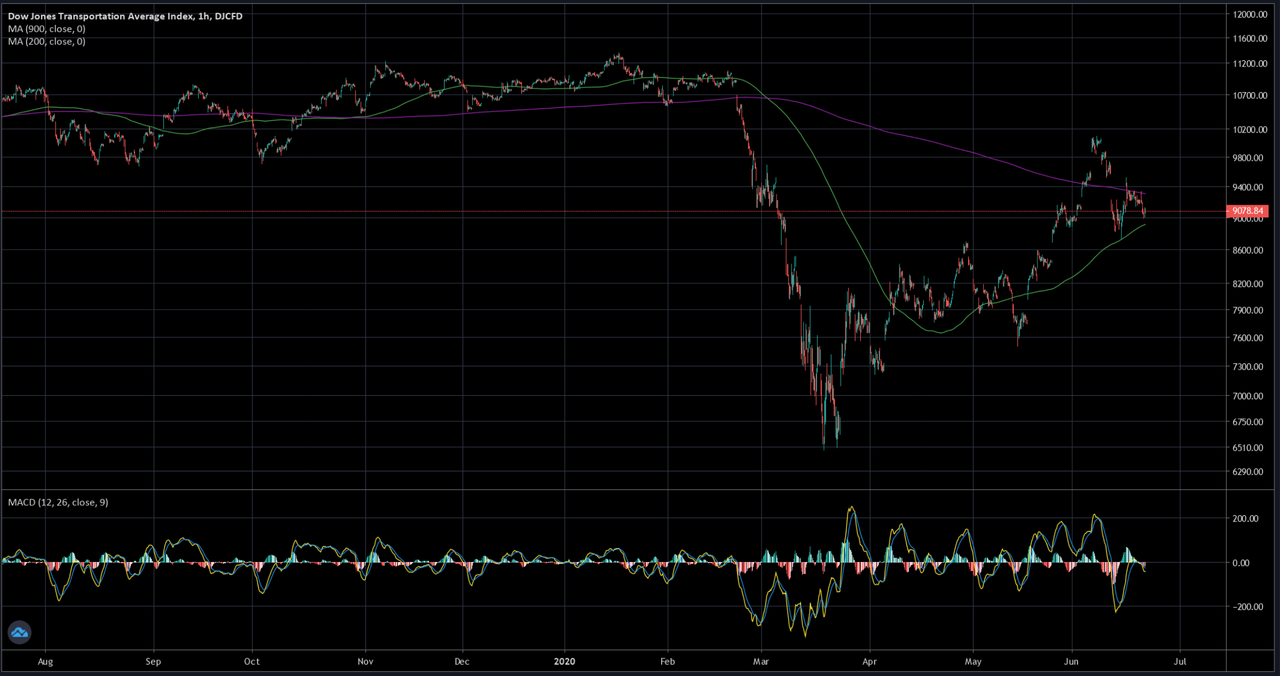

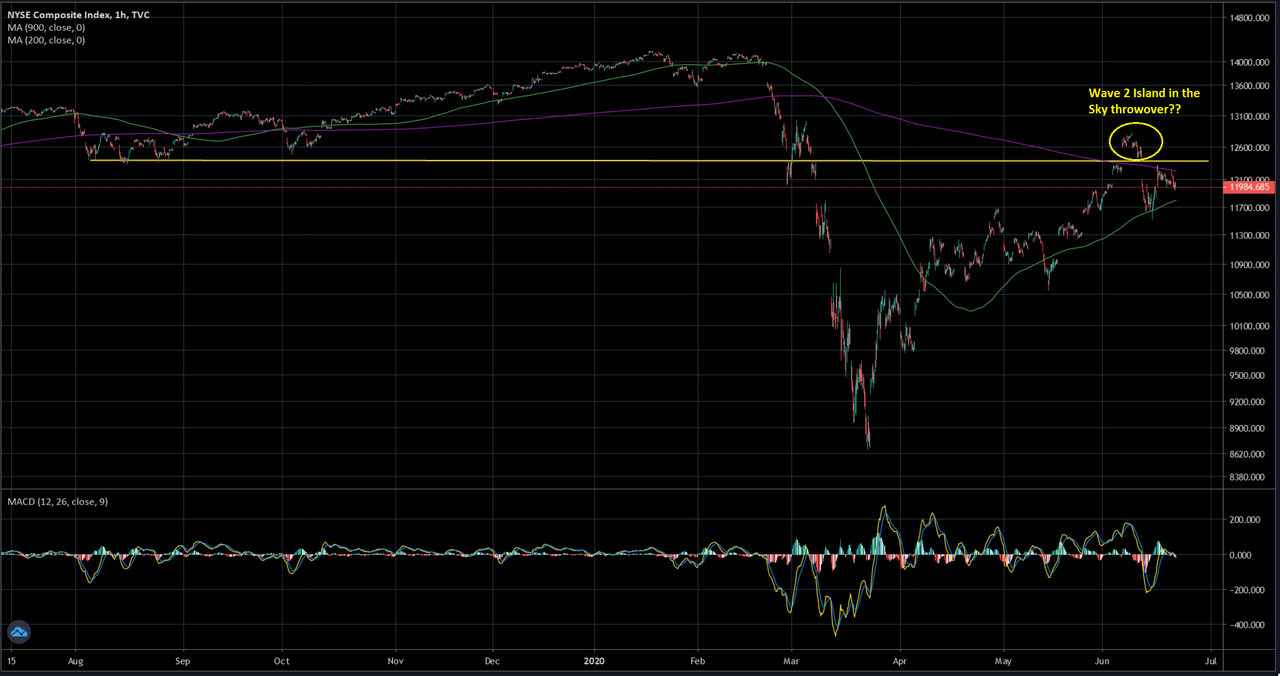

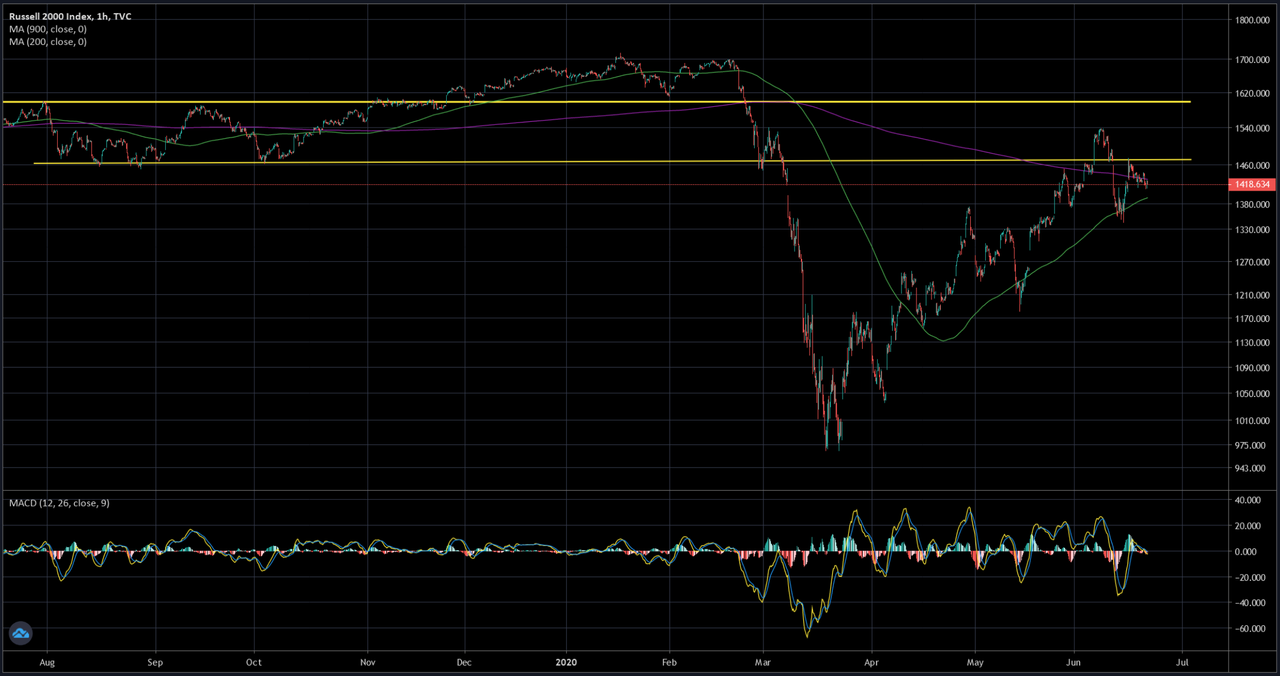

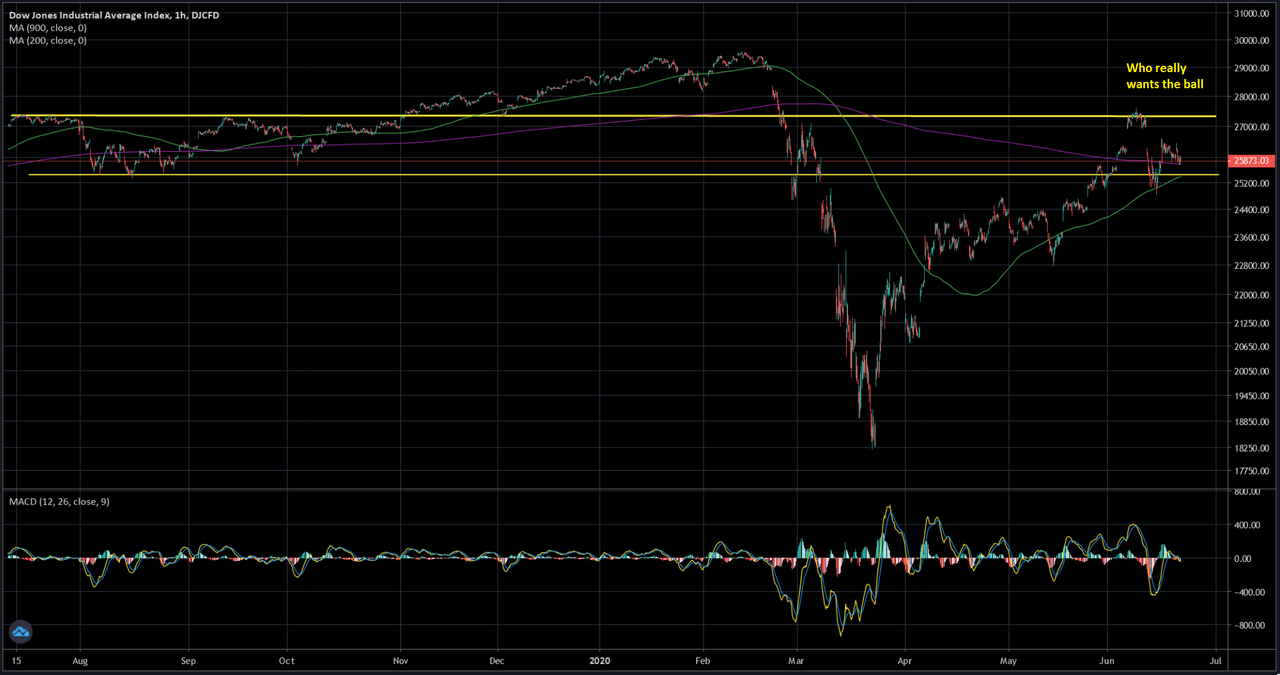

I am using the hourly 900s on RUT Trannies, Dow, and NYA as my guide post as to which this may be.....3 of the 4 closed below the hourly 900 on Friday, but Dow managed to hold just above.

Trannies and NYA had particularly nasty looking rejections right at the 900. Until those rejections are overcome by bulls, bears are still controlling the post Davey Daytrader Tri-Star action as of Friday Close.

IF Dow and RUT join in heartily with big red action back below the hourly 900, then bearish case will get stronger. And if SPX were to take out its 900 at 3K, even stronger yet.

But if we break hard to the upside on Monday after this big Down Vol spike, bears are likely toast for some time to come, as at that point, all the majors indexes will have broken back above the hourly 900.

VERY pivotal action likely over next few days...

So whichever way we break on Monday may tell us whether perhaps a major low....or volume off a top after the rebound rally (after all those Tri-Stars we saw recently) has just failed, and Wave 3 down is on the way...

Sep 2014 was one that led to pretty nasty decline after the Down Vol spike