Kwave, where can I get more info on your views about Japan? I'm intrigued...

the equinox marks the turn in the pm sector "a new leg higher"

#2291

Posted 14 January 2022 - 10:17 AM

#2292

Posted 14 January 2022 - 11:33 AM

if the metals succumb to a pullback in the stockmarket. they will be the 1st ones out of the chute when the fed rides in , i think this happens much later in the downturn. they are going to lose credibility. slowly confidence in the fed is going to go out the window. how people had confidence in them escapes me. full moon in emotional cancer on the 17th to add to the flowing of emotions here. retail sales, this is for december (Christmas) and consumer sentiment all hit the skids

brady reiterates at least 2300 gold. when this bottoms w/in the next months there will be many good opportunities. stay alert. looking for 20-30% decline in the broad market

dharma

#2293

Posted 14 January 2022 - 12:01 PM

This isnt at all helpful for short term. BUT, think about the macro picture here. We have a Fed planning to tighten, we have indications of economic slowdown, and a bubble stock market. Stagflation imminent.

This was the data this week:

CPI 7%

Retail sales -2%

Fed planning to hike rates sooner than expected

#2294

Posted 14 January 2022 - 03:29 PM

sold some of my xle . i think we are close to completing a wave i up here fwiw

not sure still have most of it but took some profits . i believe xle is in a wave 3

up which started dec 20. this is only wave i of 3 so this thing has a long way to go

hope it pulls back so i can buy back what i sold we will see

#2296

Posted 14 January 2022 - 09:06 PM

#2297

Posted 15 January 2022 - 09:04 AM

Yeah...but the 900 day was not turning up all those other times, eh?

AGAIN.....it is all about knowing where things are LIKELY to happen....

This is a powerful setup we are looking at here.....could it fail??

Perhaps

But this is where it is most likely to launch from based upon decades of looking at these types of charts....

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

#2298

Posted 15 January 2022 - 09:17 AM

Kwave, where can I get more info on your views about Japan? I'm intrigued...

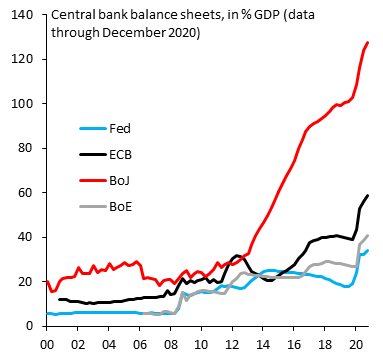

A picture says a thousand words.

Essentially the debt situation in Japan is akin to the Nikkei in the late 80's, and my belief is that once interest rates start to rise, things will fairly quickly (less than decade) get out of hand, with a deadly combination of falling currency and rapidly rising interest rates, both of which "appear" to be just starting now....

Europe should be 2nd in line, with the USA eventually joining in on the disaster....

Once Silver clears $25, the decade of the 2020s endgame likely begins in earnest....

Edited by K Wave, 15 January 2022 - 09:18 AM.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

#2299

Posted 15 January 2022 - 10:05 AM

Kwave, superlative post, thank you.

#2300

Posted 16 January 2022 - 06:03 PM

Kwave, where can I get more info on your views about Japan? I'm intrigued...

A picture says a thousand words.

Essentially the debt situation in Japan is akin to the Nikkei in the late 80's, and my belief is that once interest rates start to rise, things will fairly quickly (less than decade) get out of hand, with a deadly combination of falling currency and rapidly rising interest rates, both of which "appear" to be just starting now....

Europe should be 2nd in line, with the USA eventually joining in on the disaster....

Once Silver clears $25, the decade of the 2020s endgame likely begins in earnest....

yes but, as i said, huge fortunes have been lost predicting the demise of japanese bond market