OH, OK, Now I see: BERKS had a bad Quarter, explains it all.

---

Not a fan of TOM LEE who seems to be perpetually bullish but I partially agree with him now

Market Review & Update

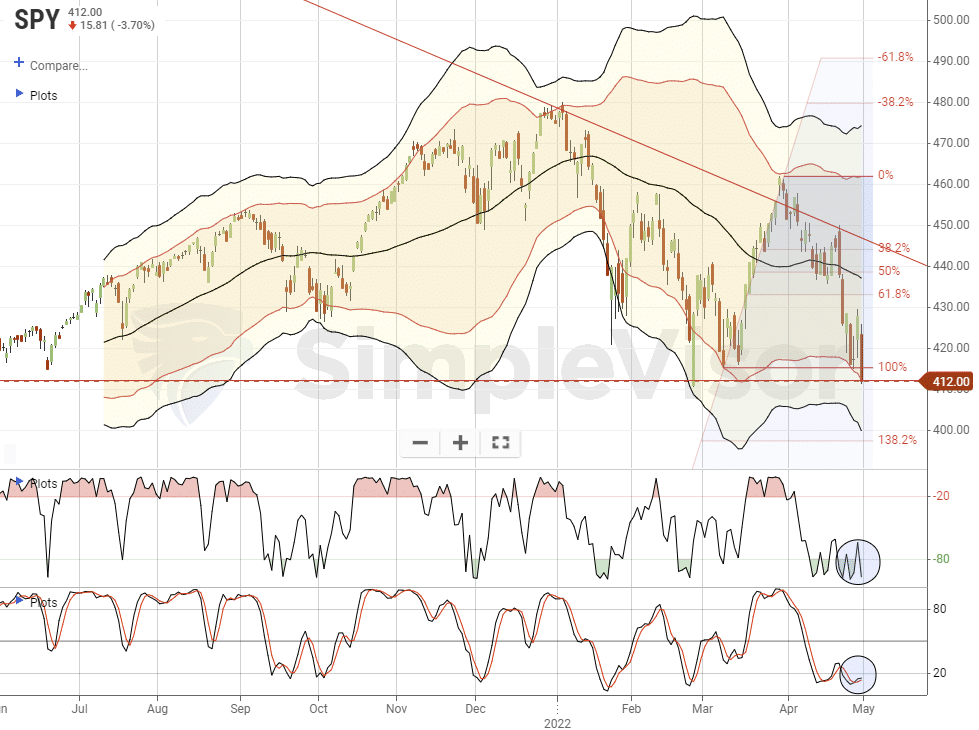

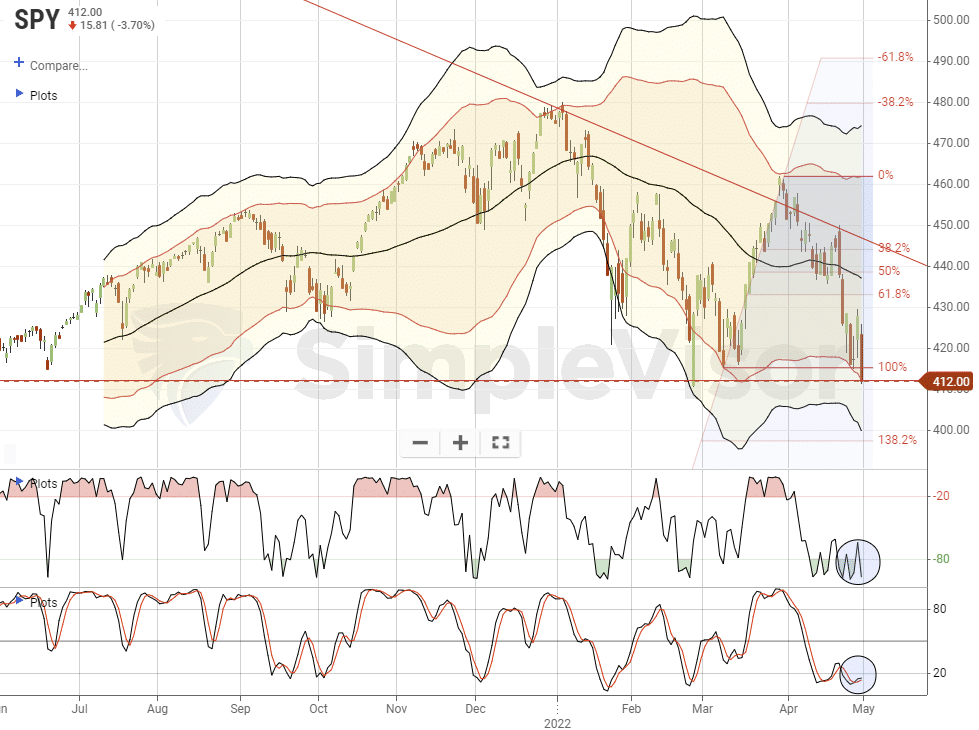

Another tough week, and month, for the market. Ongoing concerns about inflation, earnings, and economic growth, continue to pressure stocks. As noted last week, there is a tremendous amount of damage in the market below the surface of the index. Nonetheless, indexes certainly got beat up last week.

As I noted last week,

“While the market is very oversold short-term, the break of the 50-dma suggests we could see a retest of the March lows next week. Such would be around 4150 on the S&P index.”

Such was indeed the case as markets tested lows on Tuesday. That sell-off led to a sharp rally on Thursday, only to retrace to lows on Friday. For the week, the market made little progress in either direction.

It is also essential to keep some perspective at this juncture. Yes, the S&P is down roughly 12% year-to-date and is one of the roughest yearly starts since 1970. However, don’t forget the 26% gain in 2021.

As we have noted previously, the good news, if you want to call it that, is that investors are so bearish it’s bullish. The percentage of bullish investors is currently 16% and close to a record low, leaving the bull/bear spread at -43%, a level surpassed only twice in the past 35 years. Tom Lee of Fundstrat shows that the returns following such sentiment lows tend to be good.

https://realinvestme...-negative-in-q1