Well out for 5 points, not sure what I'll do from here, was able to sell some weekly puts with the dip earlier so now have both the upside and downside done for this week now. Hmmmm what to do....

CHINA reopening, SPX breaks above 200MA - GRIND UP continues into Q1 2003 TOP

#21

Posted 05 December 2022 - 11:09 AM

#22

Posted 05 December 2022 - 04:25 PM

Likely a range bound market where dips will be bought and bounces will be sold till CPI out on the Nov 13th ...........................

Sorry for the typo, I meant till CPI out on the Dec. 13th.

Dip buyers swarming in five minutes before the close.........................

#23

Posted 05 December 2022 - 06:53 PM

Surprising DOWN day that was much stronger than I expected.

Traded NQ.

#25

Posted 05 December 2022 - 09:45 PM

Interesting that the market is down with the big rally in chinese stocks overnight but not surprising as we are starting to focus more on upcoming earnings and what happens next year, not just pushing the market up because its the end of the year. Bond yields remain the most important thing right now. This as I've said a million times is a grind market and don't think it will change at all for a long time to come. There is going to be some whopper rallies and whopper sell offs up and down, going nowhere in the end. Think we could see some more upside but if the market is smart it won't rally much to make for a better year next. I was short going into this morning and just flipped to long when my "profit stops" at 4047 were hit.

Personally I think thoughts are changing about china more and more as companies leave there and go other places for manufacturing as the world realizes more and more that we need to take back control and use friendlier countries to deal with. The chinese experiment was that they would move away from communism years back when everyone used them for manufacturing but now that more and more things become realized that they aren't really our friends, more and more companies are leaving. Gonna be interesting next year. That's another thing I think will be interesting as the everything bubble continues to implode next year as people adjust to a more normal lifestyle because interest rates are too high to buy toys now.

I can agree with everything you said above.

#26

Posted 05 December 2022 - 09:49 PM

Surprising DOWN day that was much stronger than I expected.

Traded NQ.

I don't know if you were active trader during inflation years of 1970's and early 80's.

But I vaguely remember there were no serious bull markets in tandem with high inflation.

#27

Posted 06 December 2022 - 08:31 AM

REIT index still looking like 1930...

Below the Nov 29 low now would quite likely usher in The Great Bear Wave

Apple 145 still for all the marbles as well...

A solid breach of Dow 34K first step to ending this bear rally...Hartnett thinks it is now pretty much done as does Hadik

Edited by K Wave, 06 December 2022 - 08:34 AM.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

#28

Posted 06 December 2022 - 08:35 AM

Meanwhile deflation continues to run amok...Gasoline Lumber Wheat fresh post-RussiaScare lows...

YOY numbers come March to May of 23 should something else...

Edited by K Wave, 06 December 2022 - 08:37 AM.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

#29

Posted 06 December 2022 - 08:44 AM

Interesting how the wave seems to have come in and now puts are incredibly overpriced. This has been an interesting year for option prices as they have been rarely moving in lock step. The swings have been incredible with a lot of people losing money whoever bought them lol!!! Have to admit I was probably helping then with that selling them. This is going to be one of my best years in the last 40 lol!! Anyhow this indicates that there will likely be more upside coming as the market grinds away. Especially if bond yields remain stable to down. Should be an interesting day when the cash market opens!! I'm long with an average 4015 now, would love to get a nice round even 4000 level lol!!

#30

Posted 06 December 2022 - 08:44 AM

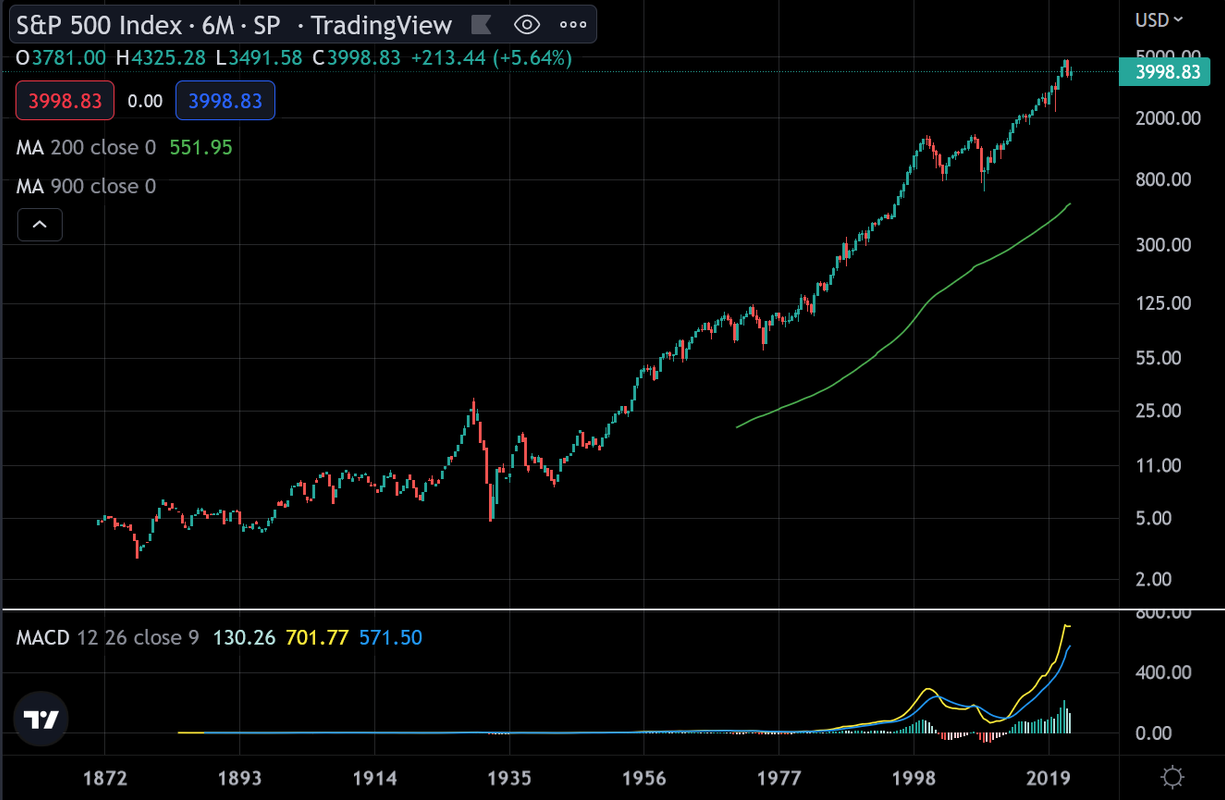

for some longer term perspective...6 month SPX..no bubble here at all folks...(looks a bit like massive 5 wave structure from waaaayyy back nearly done)

Once that momo finally turns over...(3 month already has)

Does not mean it can't blow a bit higher if 900 day holds....but if that 9 hundie gets blown out downside over next few weeks....

Watch the REITs...if the big bear is a comin' they will lead it as the "Shock" period ends, and the "Pain" begins...

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy