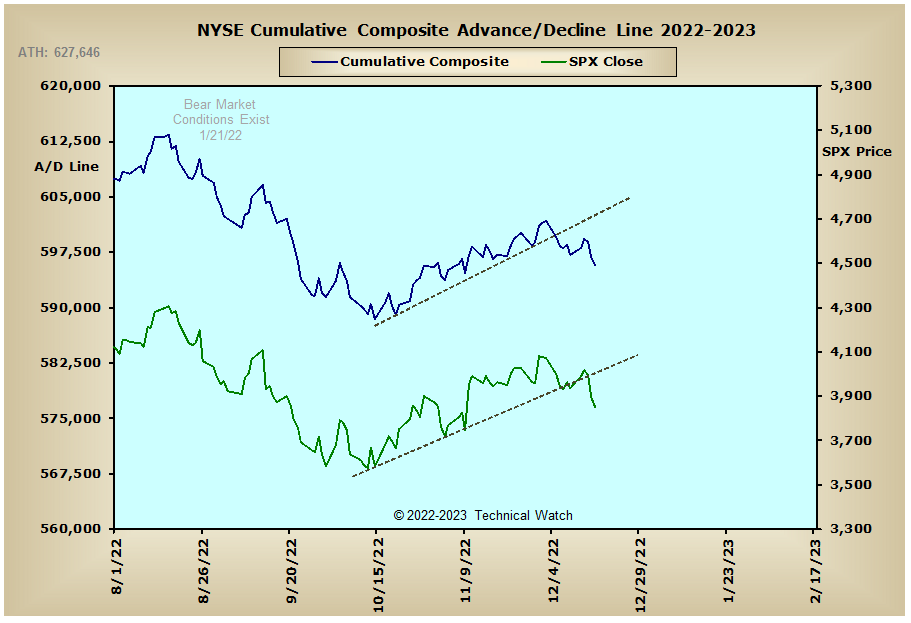

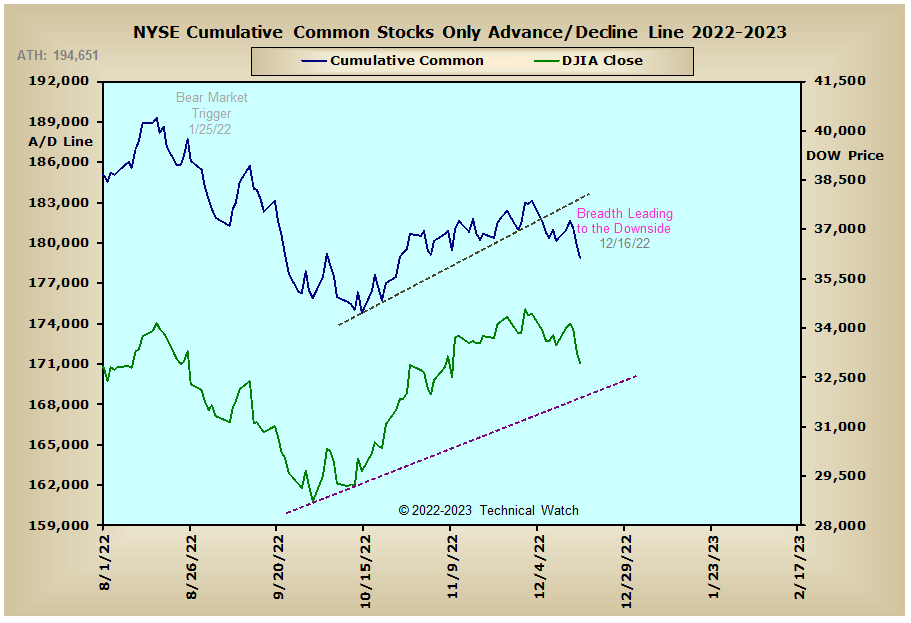

With the CPI number on Tuesday seemingly acting as an intraday bookend with that of October 13th's CPI data for the 2 month rally phase, the major market indexes turned sharply lower for the rest of the week, and then ending on Friday with an average loss of -2.18% and giving up all of the gains made in November. Daily volume with Friday's final OPEX event was the highest of the year for the Dow Industrials, the S&P 100, the S&P 500 and the S&P 600 adding further emphasis that an intermediate term top is now likely in place as we go into the final 2 weeks of the year.

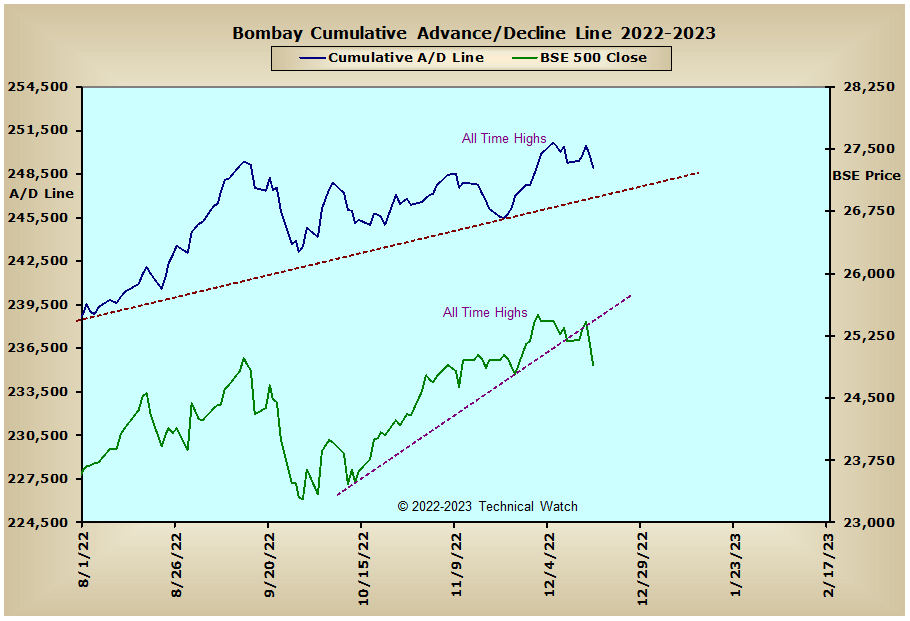

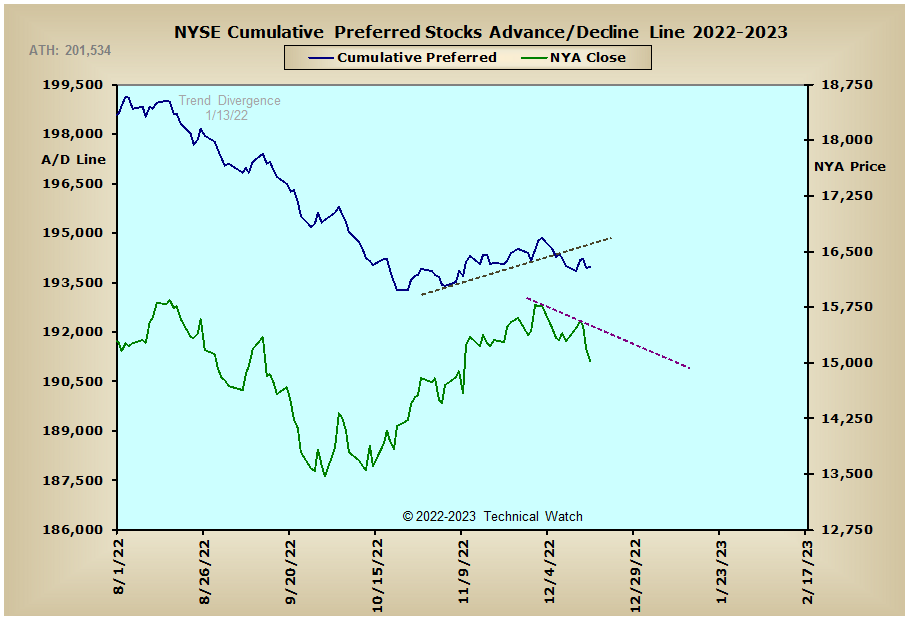

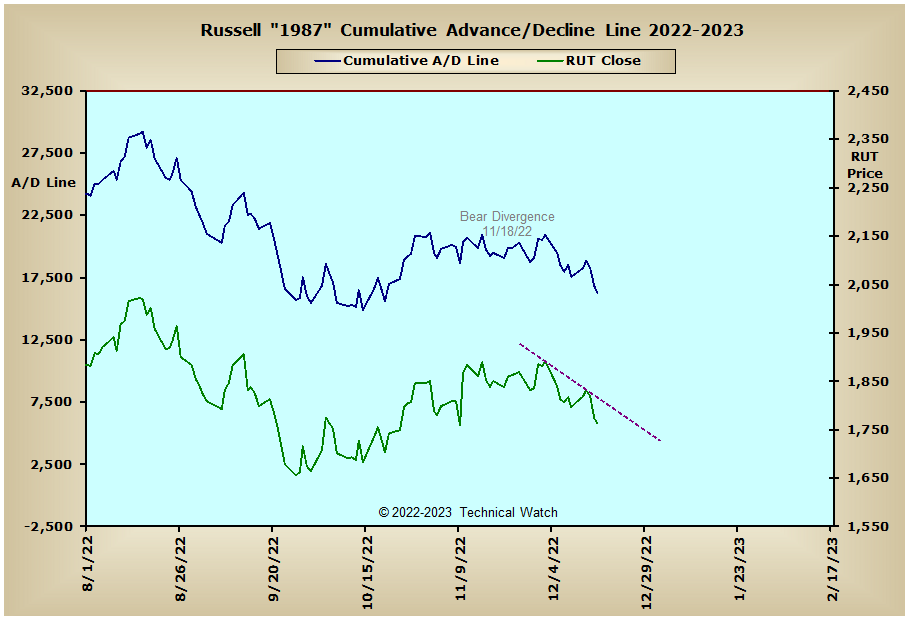

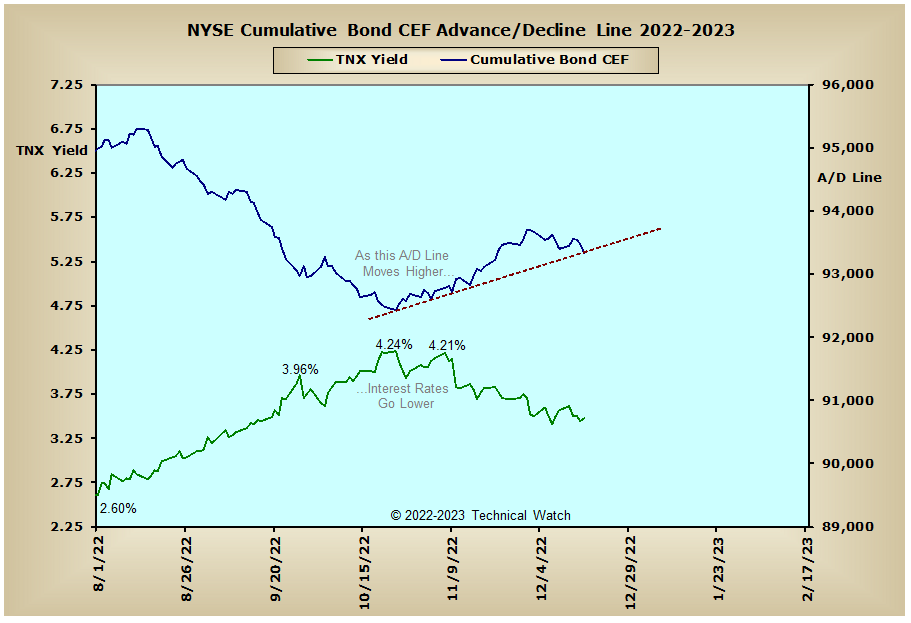

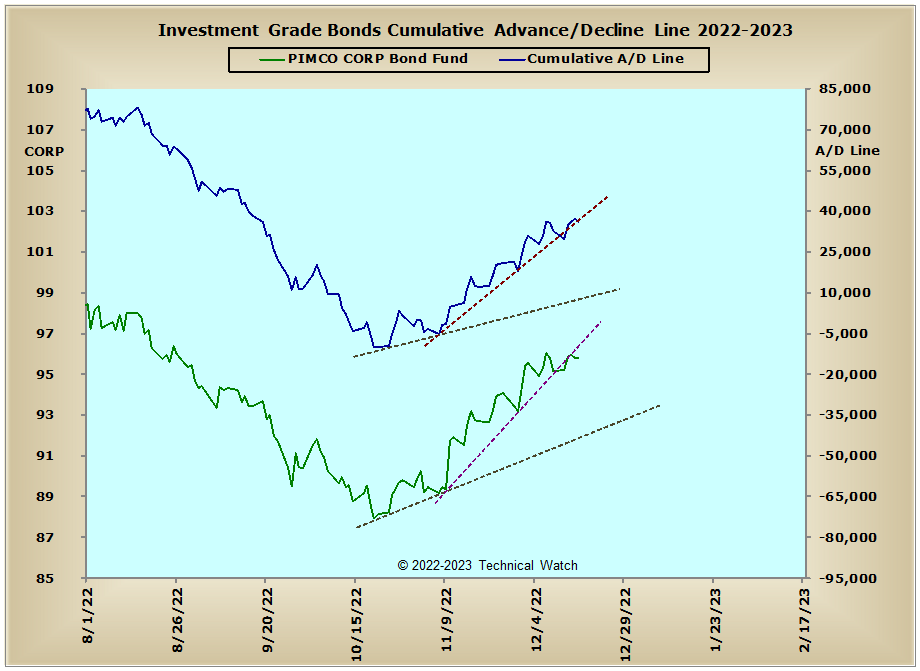

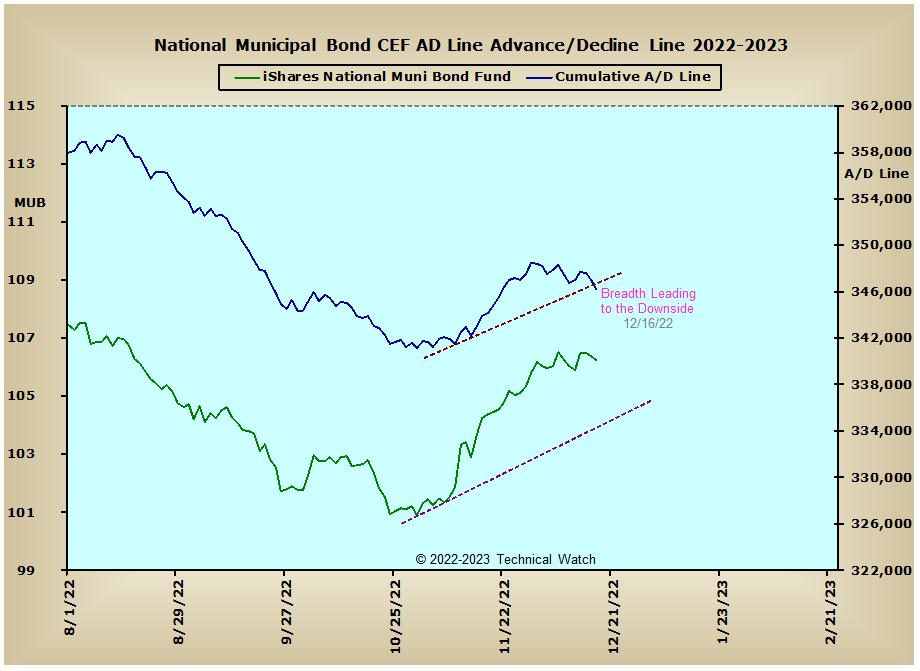

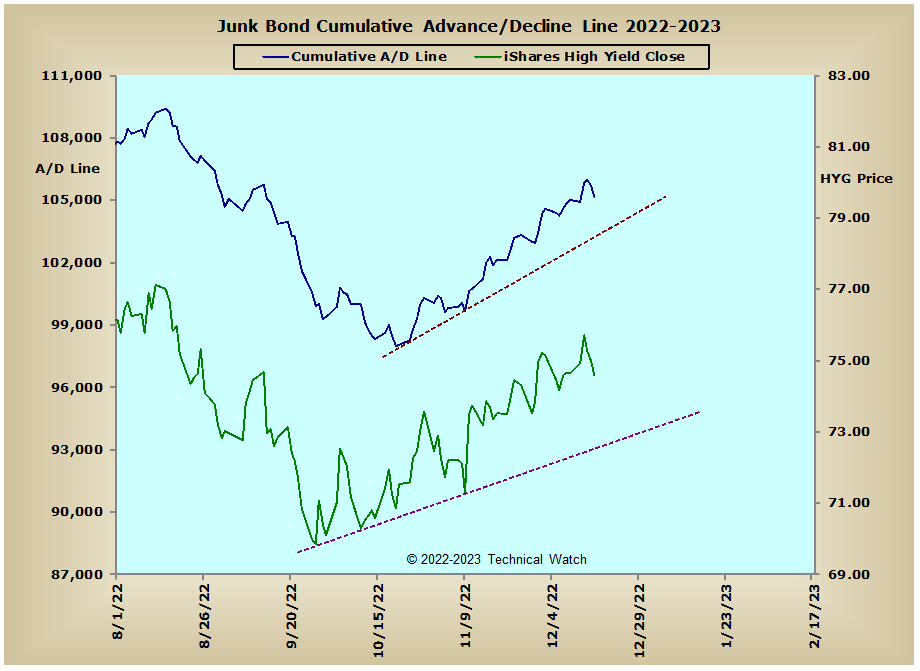

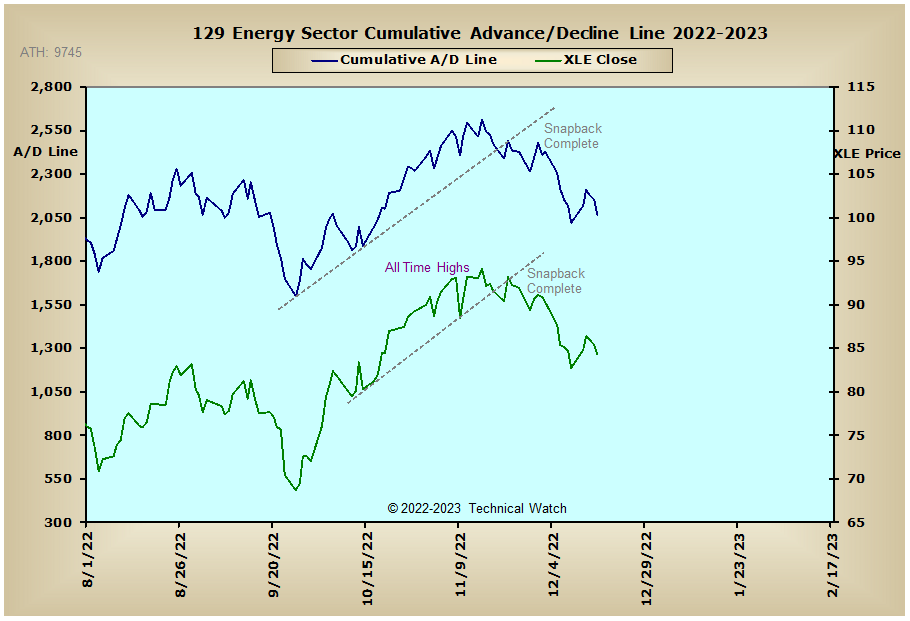

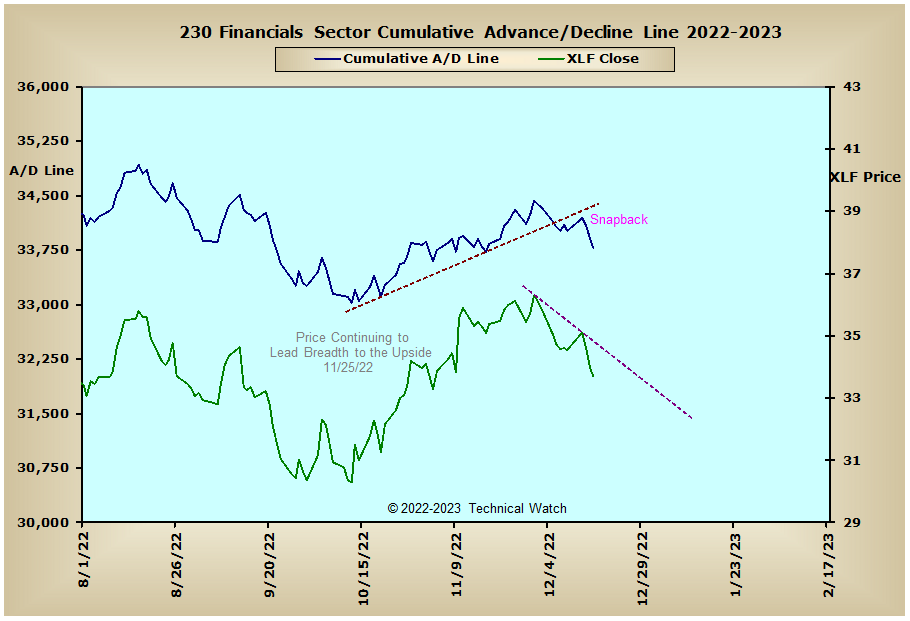

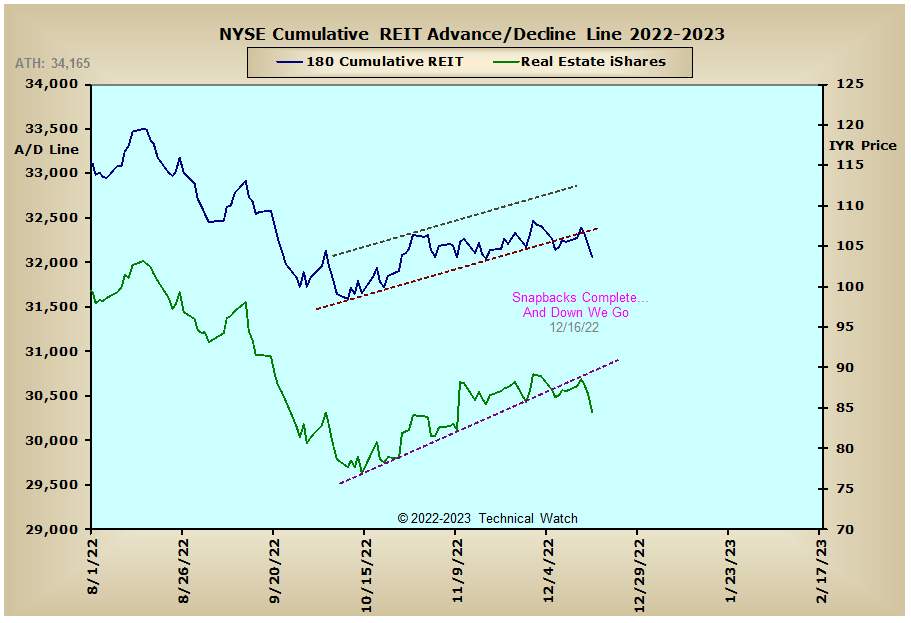

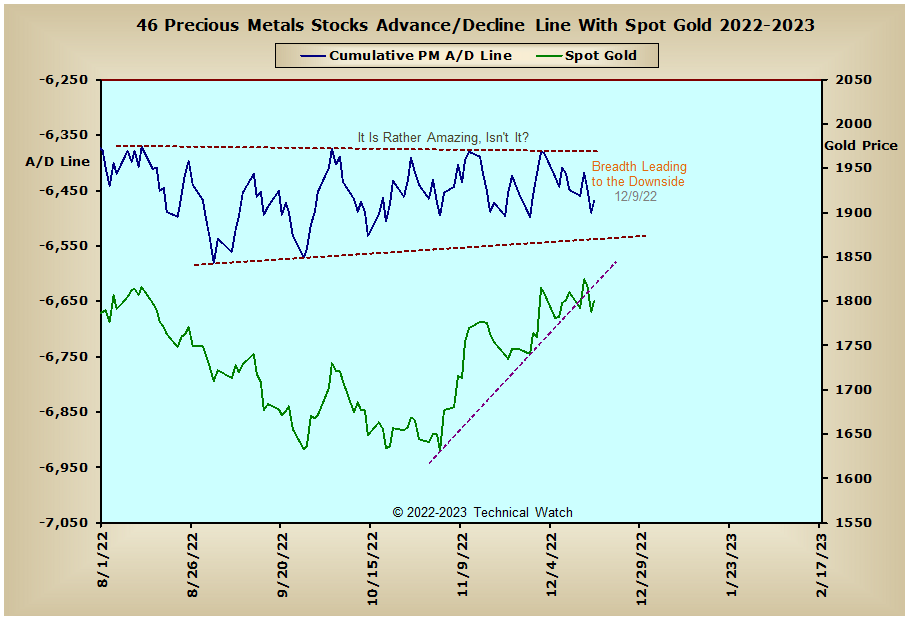

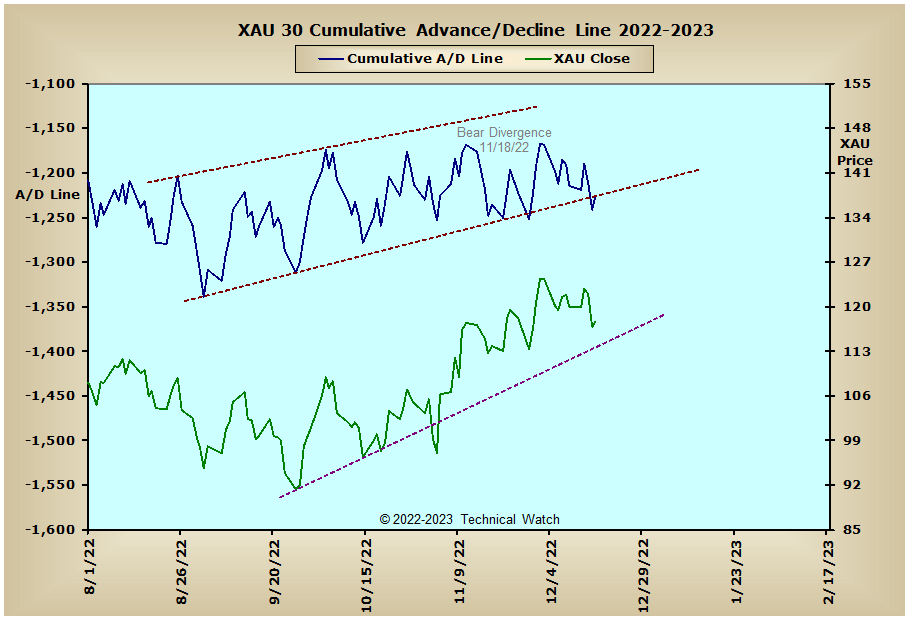

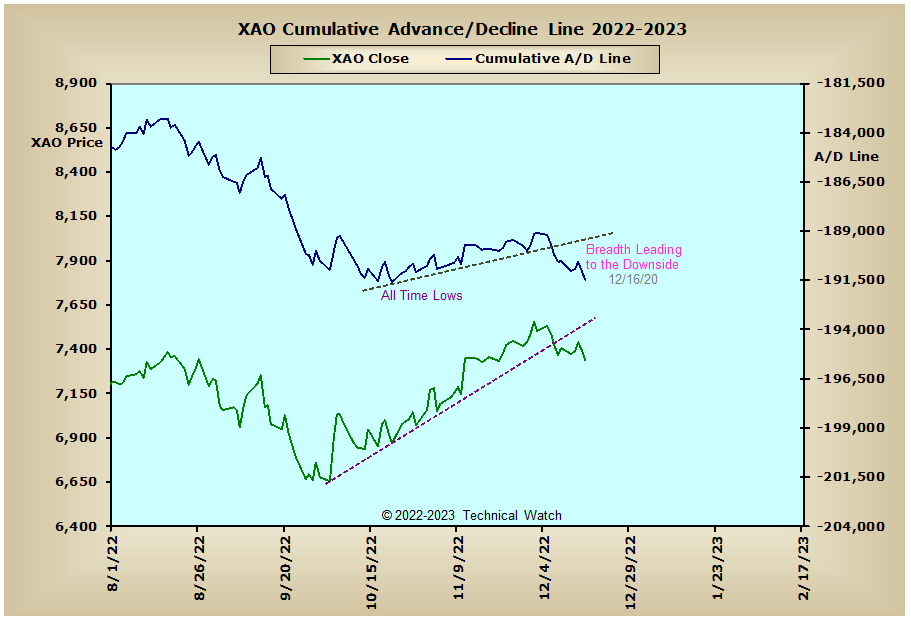

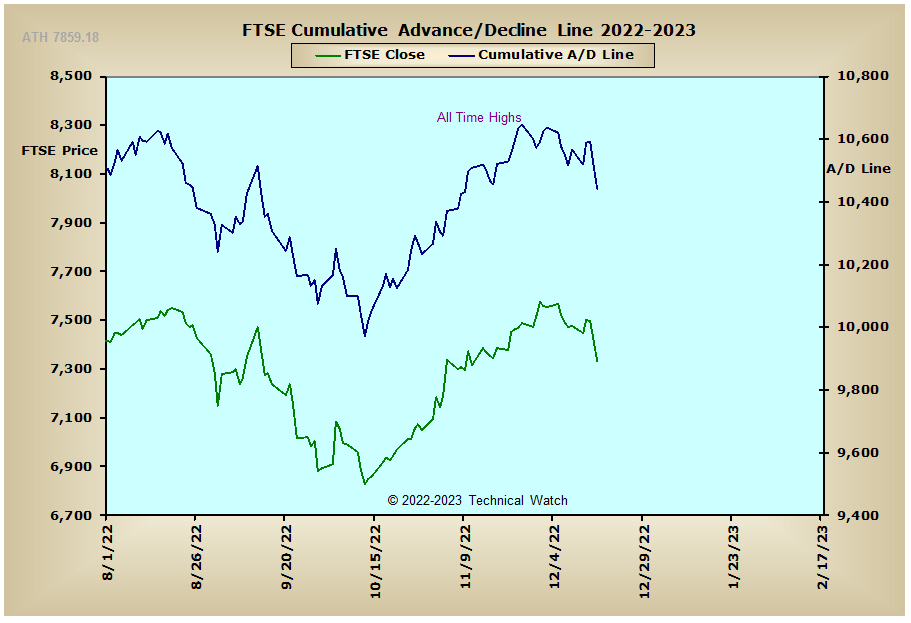

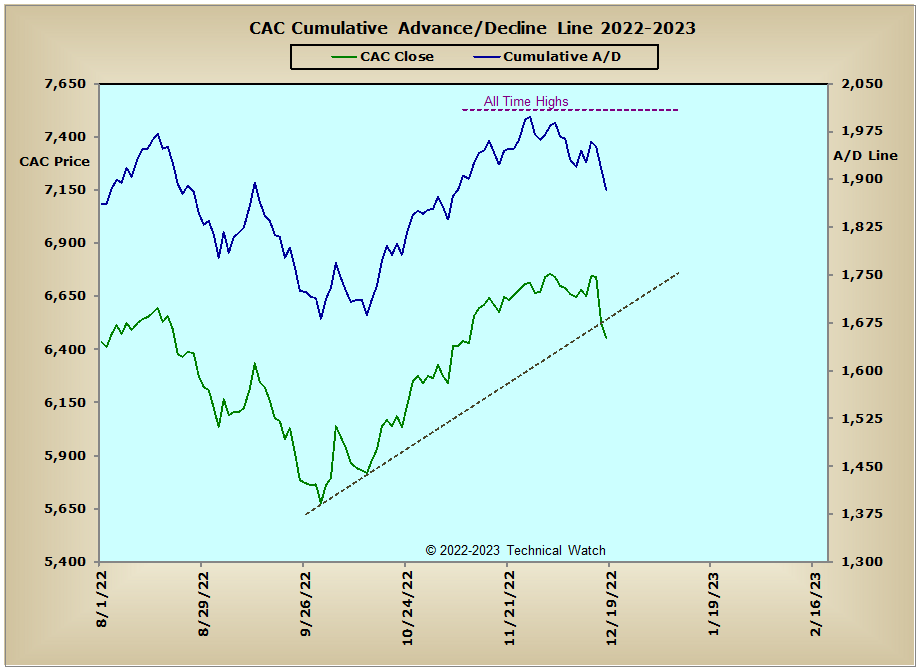

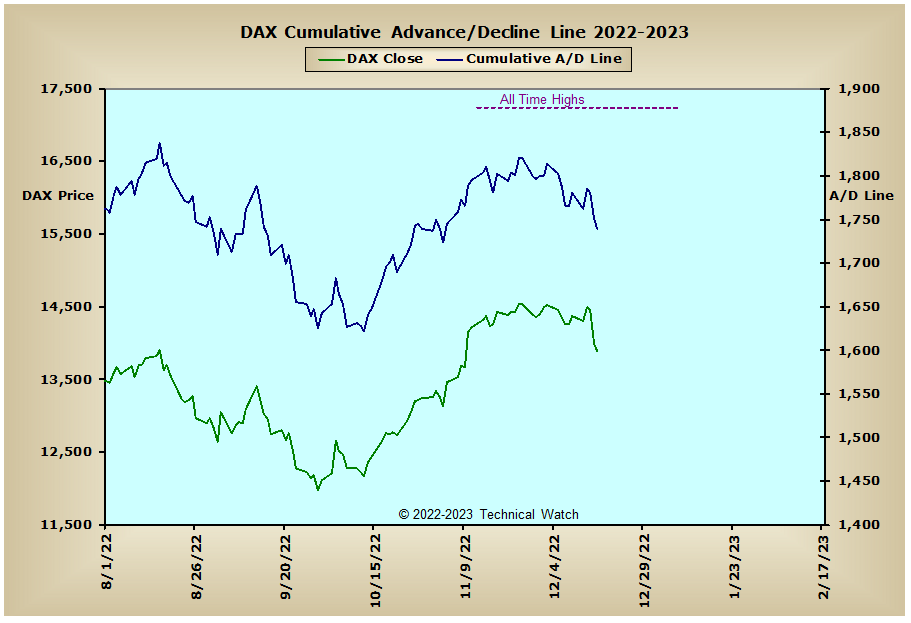

Looking at this week's edition of our standard array of cumulative breadth charts shows many snapback events to or toward previous trendline breaks from the week before as breadth of market begins to lead prices to the downside. Interest rate sensitive issues have now turned mixed with the Junk Bond advance/decline line continuing to support a pattern of higher lows and higher highs, while both the NYSE Bond CEF and Municipal Bond advance/decline lines finished the week perceptively below their short term trendlines of support from early November. Precious metals issues remain within the confines of their multi month consolidation channels, while weakness continues with the Energy Sector advance/decline line, as well as, the Financials Sector and the REITS. Looking overseas and we see that the CAC, DAX and FTSE advance/decline lines continue to trend to the downside, while Australia's Old Ordinaries advance/decline line is now 125 net declining issues from seeing new all time cumulative lows.

So with the BETS holding steady at -60, traders and investors continue to work with a defensive bias. After showing snapbacks of their own to their respective zero lines early in the week, all of the breadth and volume McClellan Oscillators finished on Friday below their October 13th pattern lows. This is another indication that the bear market rally of the last 2 months has come to a conclusion, and that the larger downtrend in prices is resuming with the short term trend of volume (for the most part) leading breadth in this same direction. On an intermediate term basis, we see that many of the breadth and volume McClellan Summation Indexes are nearing or are currently moving down and through their zero lines at this time, with growth issues remaining the weakest areas of market behavior. Chart wise, we see that both the 200 day EMA and the August price highs continued to provide solid "double top" price resistance for the great majority of equity indexes, while the NASDAQ Composite Index maintains its leadership as the weakest area of investment. On a near term basis, however, the NYSE Open 10 TRIN finished on Friday with a deeply "oversold" reading of 1.29, while the 10 day average of CBOE and equity put/call ratios saw a sudden surge toward the put side to finish off the week. This pushing and pulling of opinions, along with end of year holiday seasonality tendencies, will likely keep stock prices choppy, if not volatile, as we finish off the month of December with the markets also attempting to work off their near term "oversold" readings in their respective MCO's. With all this as a platform to work with then, investors should continue to add to their short positions in those sectors that continue to show market weakness, while traders can continue to work with their "hit and run" strategies until we get into January.

Happy holidays to one and all!

US Interest Rates:

US Sectors:

Precious Metals:

Australia:

England:

France:

Germany:

India: