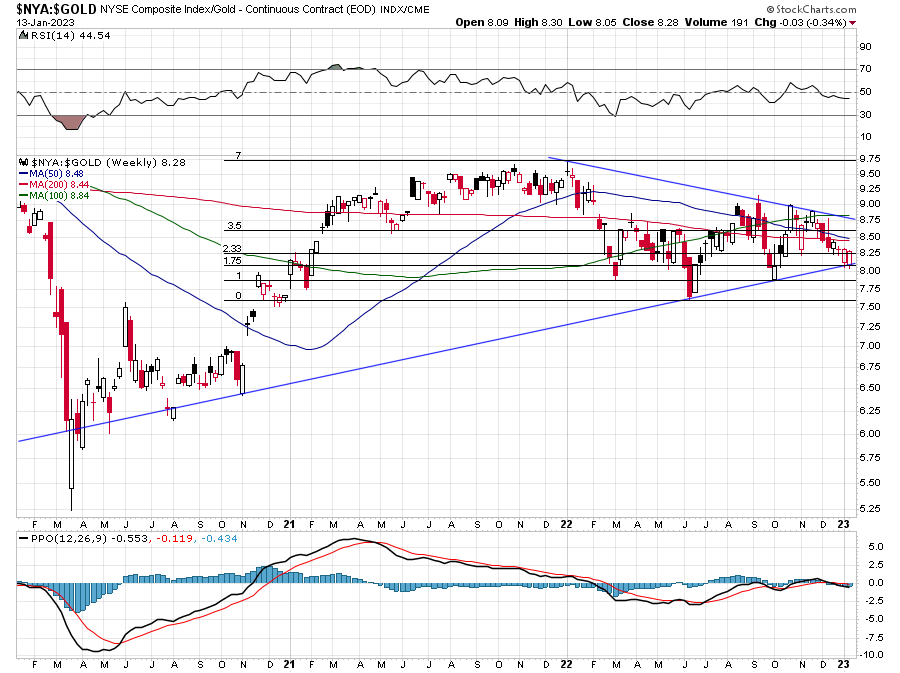

Assuming the soxx rally plays out as expected, and since 1.75 was backfilled last week and all the levels have now been hit, I'm thinking this ratio could plow right through the avearges and take out the January high.

Looks to have just bounced off uptrend support, which is a plus. If I weren't a notoriously reliable fade I might consider a trade with the next pullback.