ALGO's using a lot of our TA against us

Edited by Rogerdodger, 10 March 2023 - 07:54 PM.

Posted 10 March 2023 - 07:54 PM

ALGO's using a lot of our TA against us

Edited by Rogerdodger, 10 March 2023 - 07:54 PM.

Posted 10 March 2023 - 08:00 PM

I noticed the lack of shorts some time ago and it was confirmed recently. It seems you are more of an expert on this topic than I am but my point would be the same as yours. If it's a bear trap, who is going to buy to make it go up? they already bought. The dummies bought the dips all last year and this year then stupid followed stupid and bought the breakout. I've been short since Dec 13th on that morning spike and I've never been badly under water ever since, so I'm not going anywhere. I have a nice profit since I added to shorts on the breakouts. Look at my posts on NVDA. a few short term shorts of that and then reshorted between 238 and 240.50 ish. I've been voting almost every day. The only person voting 100% short for almost 3 months. wait till the dippers pee their pants and hit the sell all button. it will be epic. I think we'll get a big down day this year. VIX had a nice move up today. If it gets past 40 it will probably go to 80-100

Posted 10 March 2023 - 08:39 PM

That's pretty good roger. At my age it's probably too late to do anything about it.

Posted 11 March 2023 - 02:16 PM

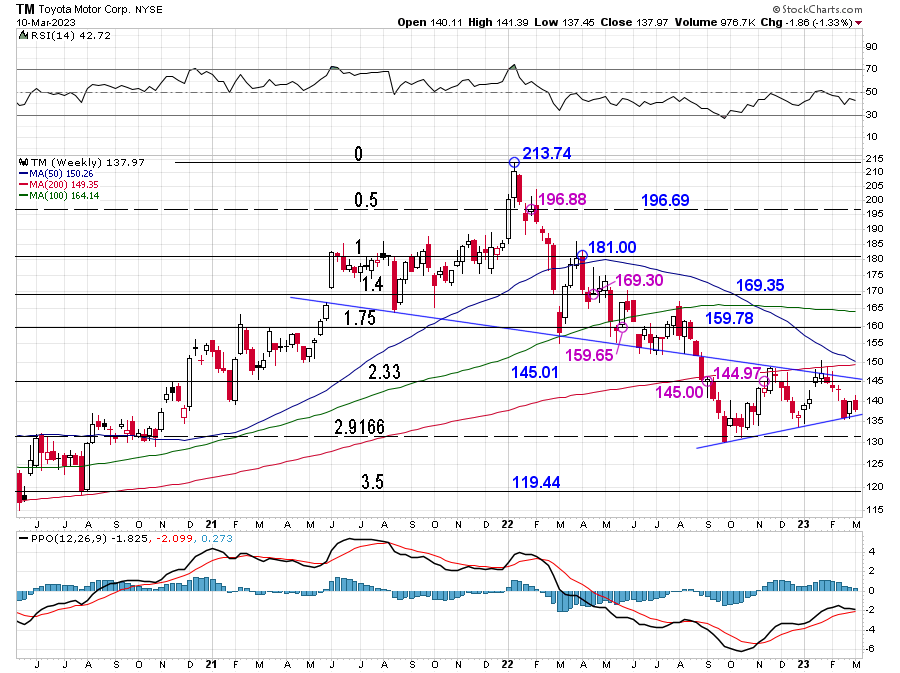

There are many possible daily counts for the fangs - this one that finished on Friday isn't a bad fit - could be good for a bounce at least. I notice that all of the 'actuals' are a tad higher than the predicted values - maybe due to overshoot from Friday's declining momentum into the low, which is one of my two reference points.

Looks like a small spike in volume at the close, and after-hours ended on a positive note. Not predicting a rally next week - just sharing observations.

Posted 12 March 2023 - 01:04 AM

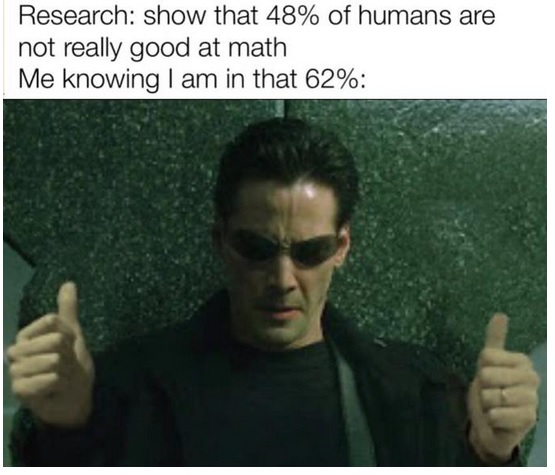

Well this isn't pretty - these are the cars driven by 'regular' people with 'regular' jobs. That H&S looks to be about half done with its business, and the wedge looks positioned to finish the job. Not sure how this could fit into a rally scenario - unless it could rally up to the neckline before crashing. This company has a p/e of 8.32 and yield of 2.87%. Tsla has a p/e of 47.82 and yield of zero - and lost over 12% of its market cap last week. Investors are yet a long way from sanity.

Posted 12 March 2023 - 01:10 PM

If this does find a bottom at around 120 and is symmetrical over time then we might see it in late June.

And if this is a bull flag we could be watching the sky into April.

Posted 12 March 2023 - 06:53 PM

Well, since there are no remaining buyers, maybe just the sound of printing presses warming up is all that's needed to elevate asset prices.

Posted 13 March 2023 - 11:29 AM

You excluded the russell 2000 from your "buyers" snapshot.

Posted 13 March 2023 - 01:31 PM

possible inverse H&S bottom forming on intraday time frame for QQQ neckline around 293. strong resistance at 294. If the pattern works it would project back into the super support/resistance zone of 300-302. off to work

Edited by skott, 14 March 2023 - 10:48 AM.

Posted 14 March 2023 - 10:49 AM

Looks like the inverse H&S pattern is playing out for qqq. I forgot the word inverse yesterday but it should have been obvious what i meant