Gold Wars: the US versus Europe During the Demise of Bretton Woods

Jan Nieuwenhuijs

Published: February 05, 2024

The story on the emergence of the US dollar hegemony

After the collapse of Bretton Woods in 1971 several European central banks tried setting up a new gold pool to stabilize the price and move to a quasi gold standard. The US wanted to phase out gold from the system and enforce a dollar standard on the world.

What frightened the US was that Europe held the most gold and alluded to raising the gold price periodically to create liquidity, giving them the dominant means of creating reserves. Through its military presence in Germany, protecting it from the Soviet Union, the US was able to pressure the Germans not to cooperate with the gold pool. Without Germany the other European countries couldn’t materialize the pool and gold lost its anchor role in the monetary system. In the meantime, the US made a secret deal with Saudi Arabia to recycle oil dollars into US government bonds.

The United States didn’t manage to phase out gold from the system altogether, but it did succeed in establishing a global dollar standard which yielded them unprecedented power.

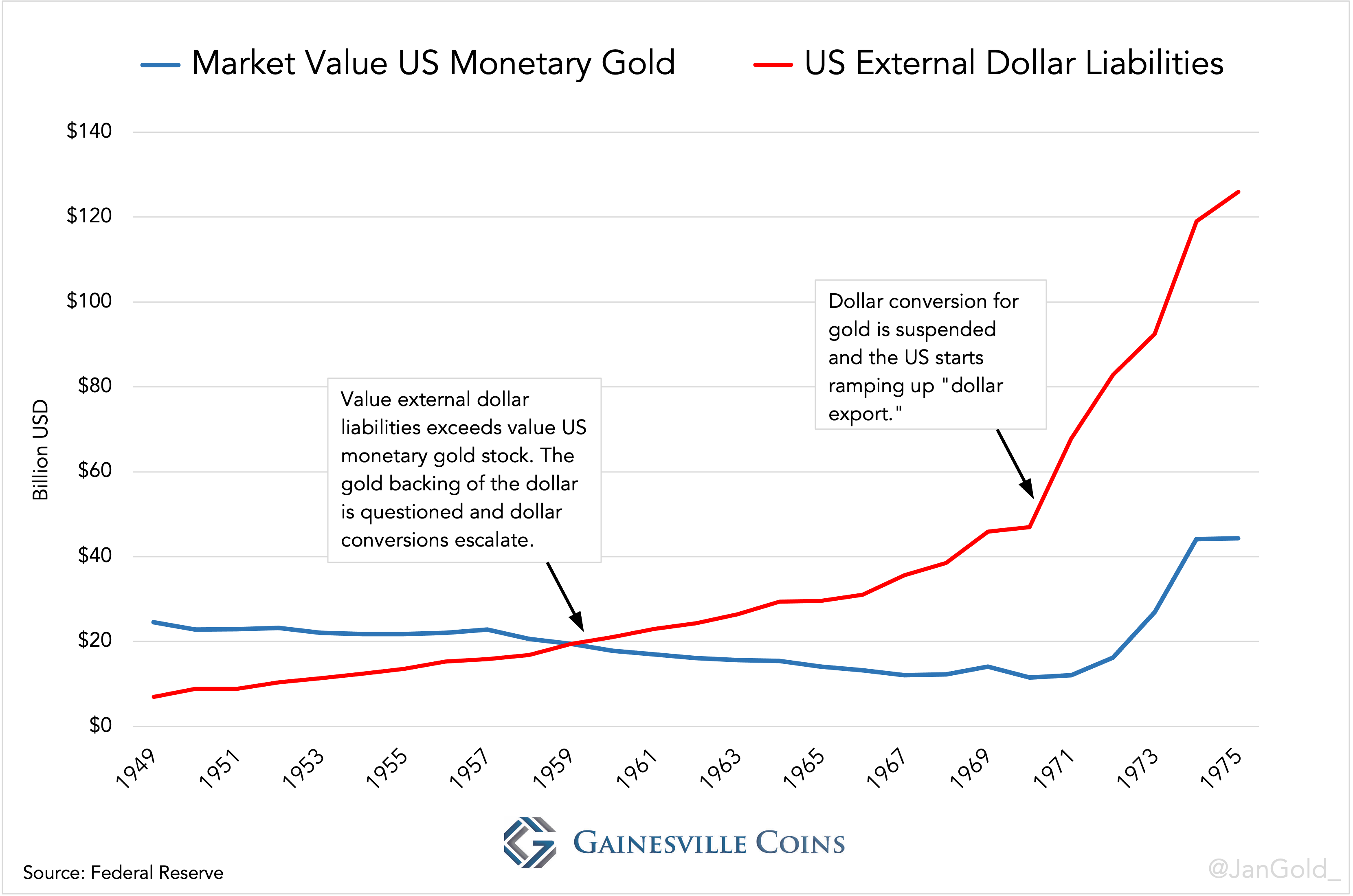

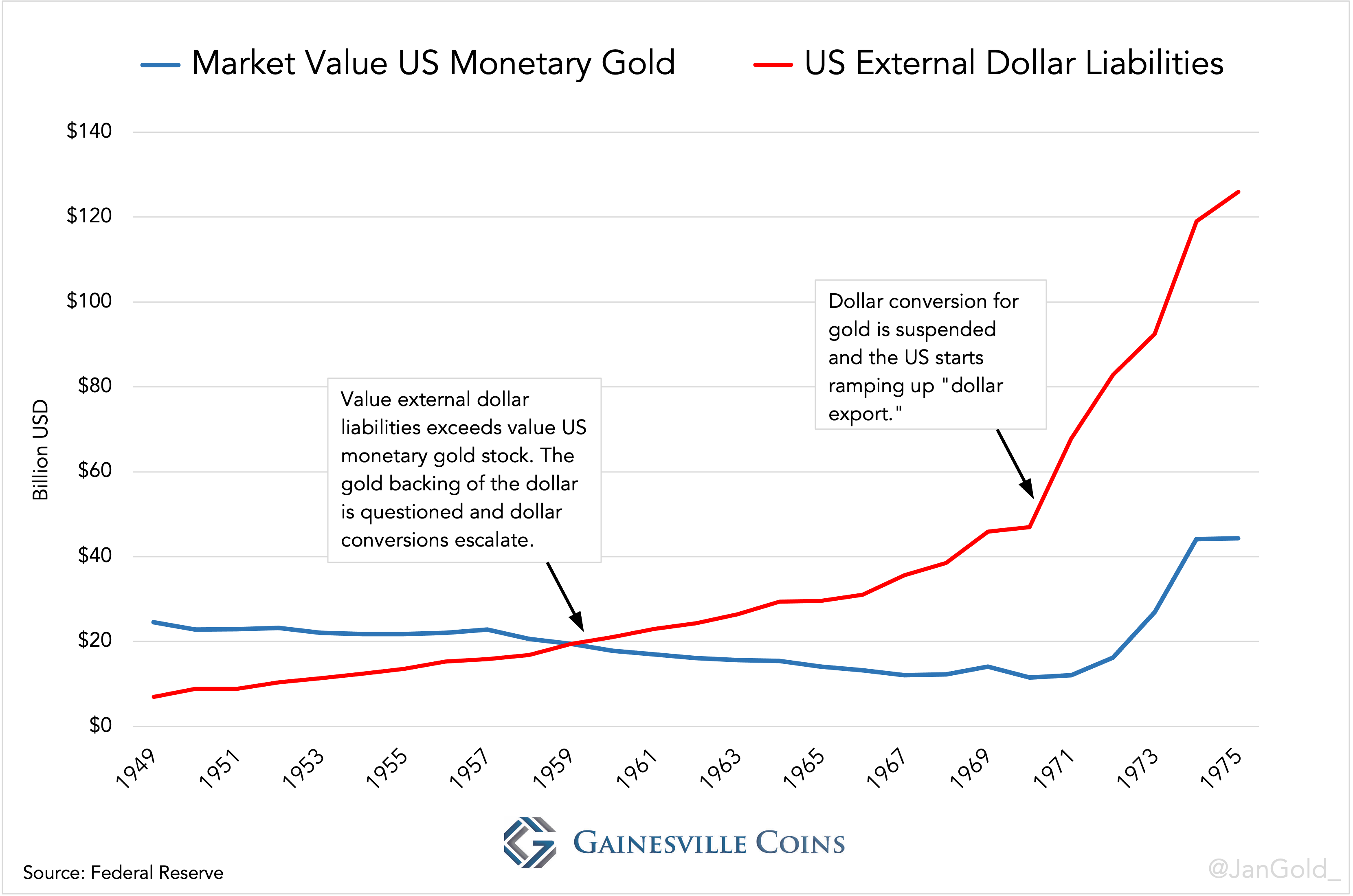

Chart 1. A negative balance of payments position was settled in gold, and, because the US issued a reserve currency, increased foreign-held dollars. Source: Federal Reserve Bank of St. Louis.

In February 1965, the President of France, Charles de Gaulle, gave a speech in which he conveyed his criticism of Bretton Woods and America’s “exorbitant privilege”: to the extent countries were willing to hold dollars in reserve, the US could print dollars out of thin air to pay for imports and make investments abroad. In reality, Bretton Woods was designed for the world to accumulate dollars. Additionally, the inflationary policies of the US in the late 1960s were exported abroad through its balance of payments deficit and fixed exchange rates, pushing foreign central banks to buy dollars with their printing presses.

According to De Gaulle, international settlement should be done in gold and the use of reserve currencies had to be limited. De Gaulle and his economic advisors foresaw a dollar crisis advancing. To protect itself from devaluation France ramped up dollar conversions into gold at the Fed, in part to supply the Pool.

...

In favor of the Americans, the IMF’s Articles of Agreement (Article IV Section 2) stipulated that no central bank would buy or sell gold at a price other than the official price. And so, as a consequence from the Pool’s moratorium, a two-tier gold market was born. Private entities could trade gold at the free market price and central banks could transact at the official price.

This setup subsided the role of gold in the international monetary system, as it severed the link between gold production and other sources of gold and monetary reserves. Gold also became increasingly illiquid, because no central bank wanted to sell at $35 an ounce knowing gold was worth much more. Gresham's Law assured the use of the dollar as intervention and trade currency by its presumed overvaluation with respect to gold. The world began creeping towards a dollar standard.

Europe got cornered. By then they held the largest gold reserves, and it would have been a pity, to say the least, to render it useless.

Conclusion

It wasn’t all smooth sailing for the dollar in the 1970s, but the US managed to secure its currency as the sun in the international monetary cosmos. In his memoirs, Zijlstra looks back on how it happened:

"Gold disappeared as the anchor of monetary stability. An attempt to replace it with a newly created substitute (the IMF's [SDR] …) virtually failed. The fixed parities, apart from our own EEC system, have disappeared. … The road from dollar supremacy, through endless vicissitudes, to a new dollar hegemony was paved with many conferences, with faithful, shrewd, and sometimes misleading stories, with idealistic visions of the future and impressive professorial speeches. (For every notion, no matter how extreme, there is always a professor of economics available.) The political reality was that Americans supported or fought any change, depending on whether they saw the dollar's position strengthened or threatened."

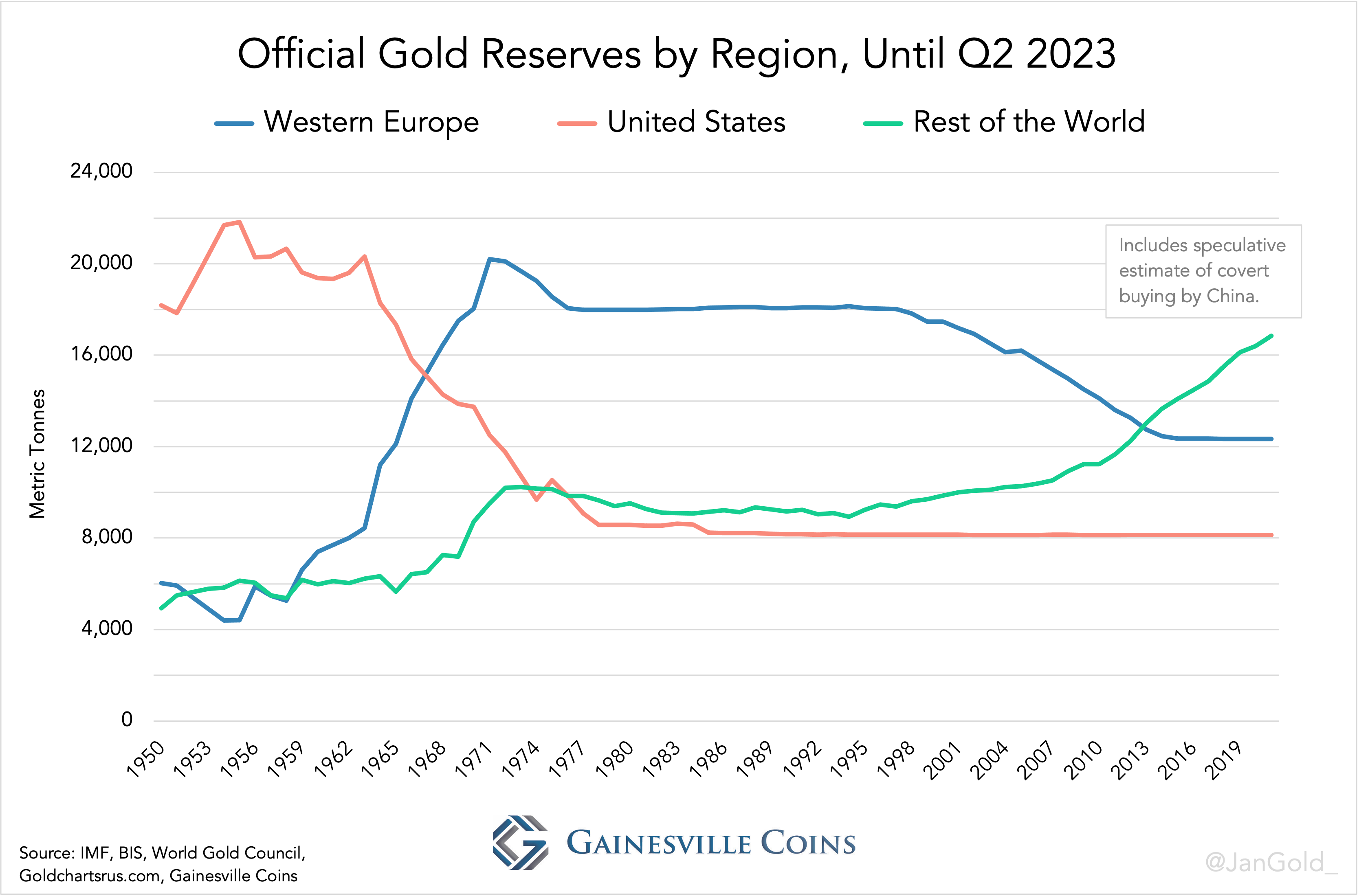

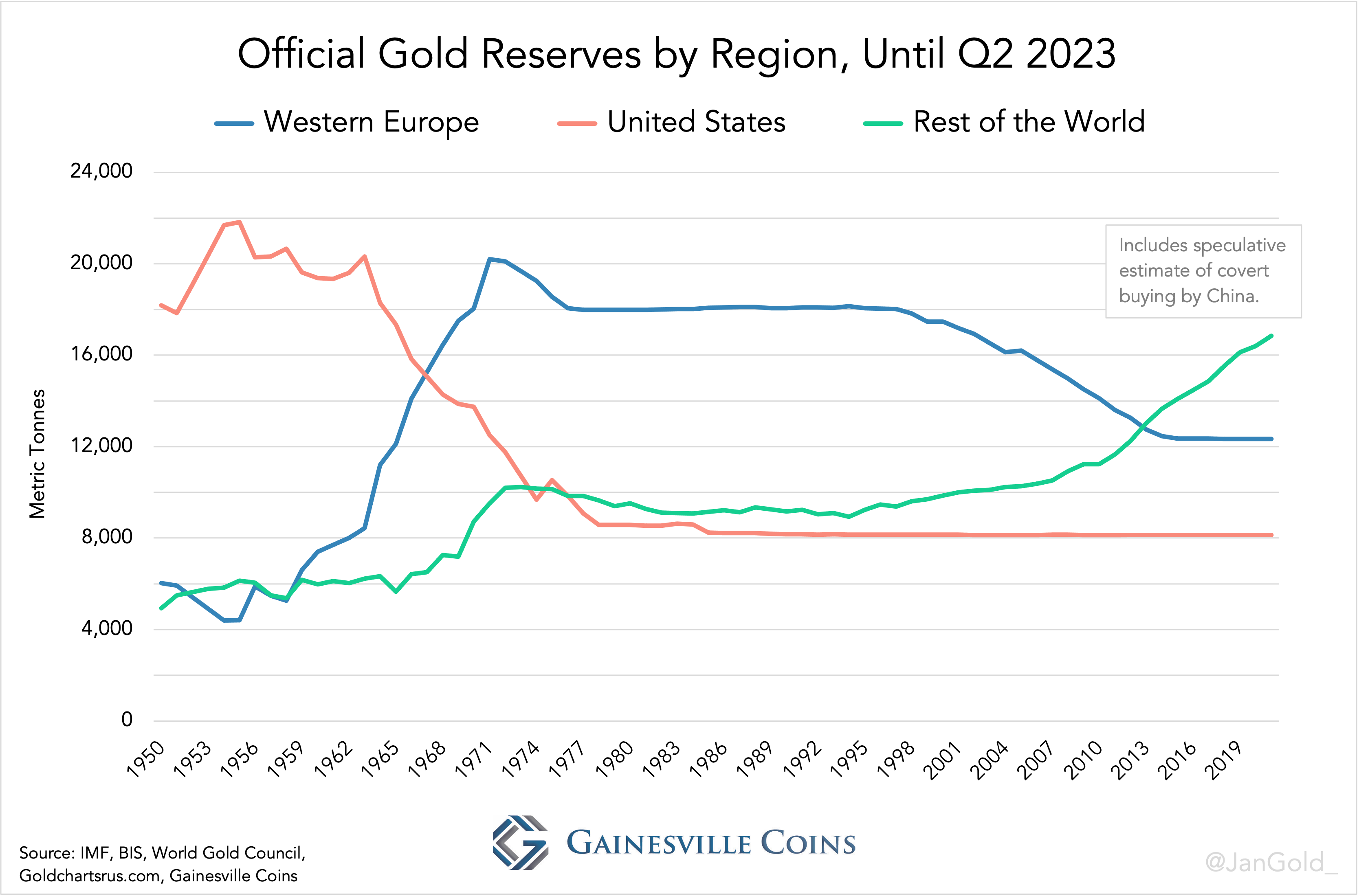

According to Zijlstra and De Gaulle, final settlement in cross-border trade should be done in gold and the use of reserve currencies restricted. What frightened the US was that Europe held the most gold and alluded to raising the gold price periodically to create liquidity, giving them “the dominant means of creating reserves.” A few days after the Zeist conference an advisor of Kissinger explained it to him well:

Mr. Enders: It’s against our interest to have gold in the system because for it to remain there it would result in it being evaluated periodically. Although we have still some substantial gold holdings … a larger part of the official gold in the world is concentrated in Western Europe. This gives them the dominant position in world reserves and the dominant means of creating reserves. We’ve been trying to get away from that into a system in which we can control—

Secretary Kissinger: But that’s a balance of payments problem.

Mr. Enders: Yes, but it’s a question of who has the most leverage internationally. If they have the reserve-creating instrument, by having the largest amount of gold and the ability to change its price periodically, they have a position relative to ours of considerable power.

Remarkably, everything that held back the envisioned monetary system of Zijlstra and friends in the 1970s has been resolved. Since Germany repatriated gold from New York several years ago we may assume it has released itself from bondage. Gold is globally more evenly distributed (chart 5), there is a gold leasing market for those that are looking for a yield, and the gold market is liquid. The fact the Dutch central bank recently signaled that it has prepared for a new gold standard makes perfect sense from a historical perspective.

.png)

Experience from Bretton Woods and the need to periodically increase the gold price suggests that Europe would target the price in the free market in order to stabilize it. The remaining questions are, (i) what could trigger Europe to stabilize the gold price in the future, and (ii) at what price level?

Read more

.png)