is that this weeks numbers????56% AAII bears

25% bulls !!!

NDX:VXN weekly 11 weeks in the dumper (12 weeks in 2002 before recovery began)

Once the light goes off in investors minds and all that sidelined money comes flowing back in it's LOA.

The chasers "cause the rally"

post expiration adjustment time...

#101

Posted 27 July 2006 - 11:01 AM

#102

Posted 27 July 2006 - 01:20 PM

#103

Posted 27 July 2006 - 01:22 PM

#104

Posted 28 July 2006 - 02:50 PM

#105

Posted 29 July 2006 - 08:59 AM

#106

Posted 29 July 2006 - 12:12 PM

#107

Posted 29 July 2006 - 08:58 PM

monday is a pivotal day........geometry at its finest.....on friday the sept sp nailed its 200 day ma at 1286.......off the low of 7/18 of 1231 a 75% retrace is at 1244.75........the gap fills at 1244.70.......the wed before the week of expiration comes in 8 trading days on aug 9th......soooooo...in a perfect world 1244.75 will be reached on or about aug 9th.....however.....

That is what I am seeing ...

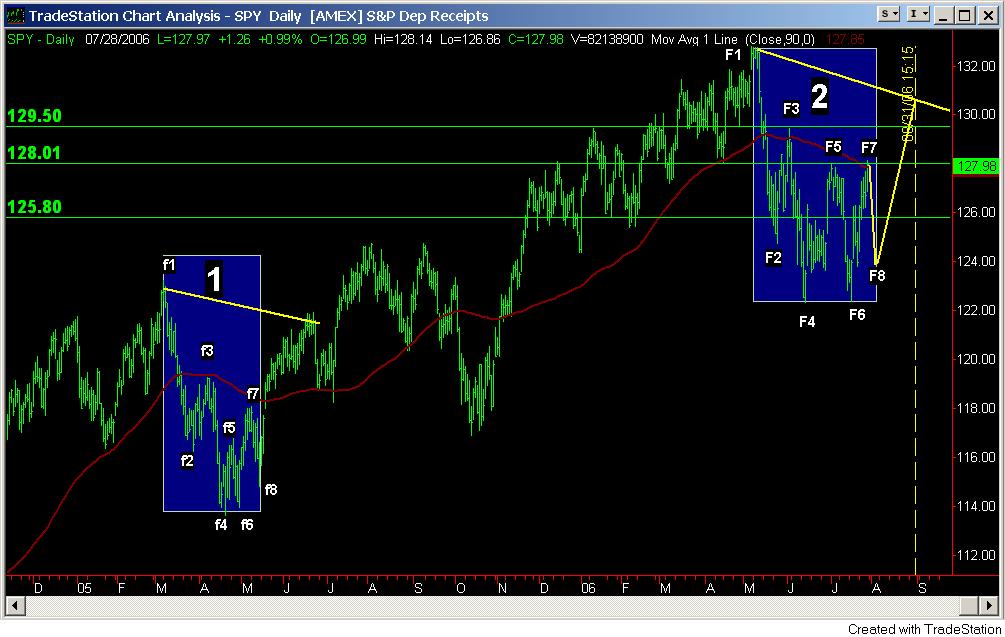

If this ....

Then this ...

KC

#108

Posted 29 July 2006 - 10:10 PM

#109

Posted 30 July 2006 - 05:16 PM

#110

Posted 01 August 2006 - 06:56 AM

http://www.nowandfut...ield_curves.png