golds next leg higher

#81

Posted 02 April 2020 - 11:27 AM

#82

Posted 02 April 2020 - 12:05 PM

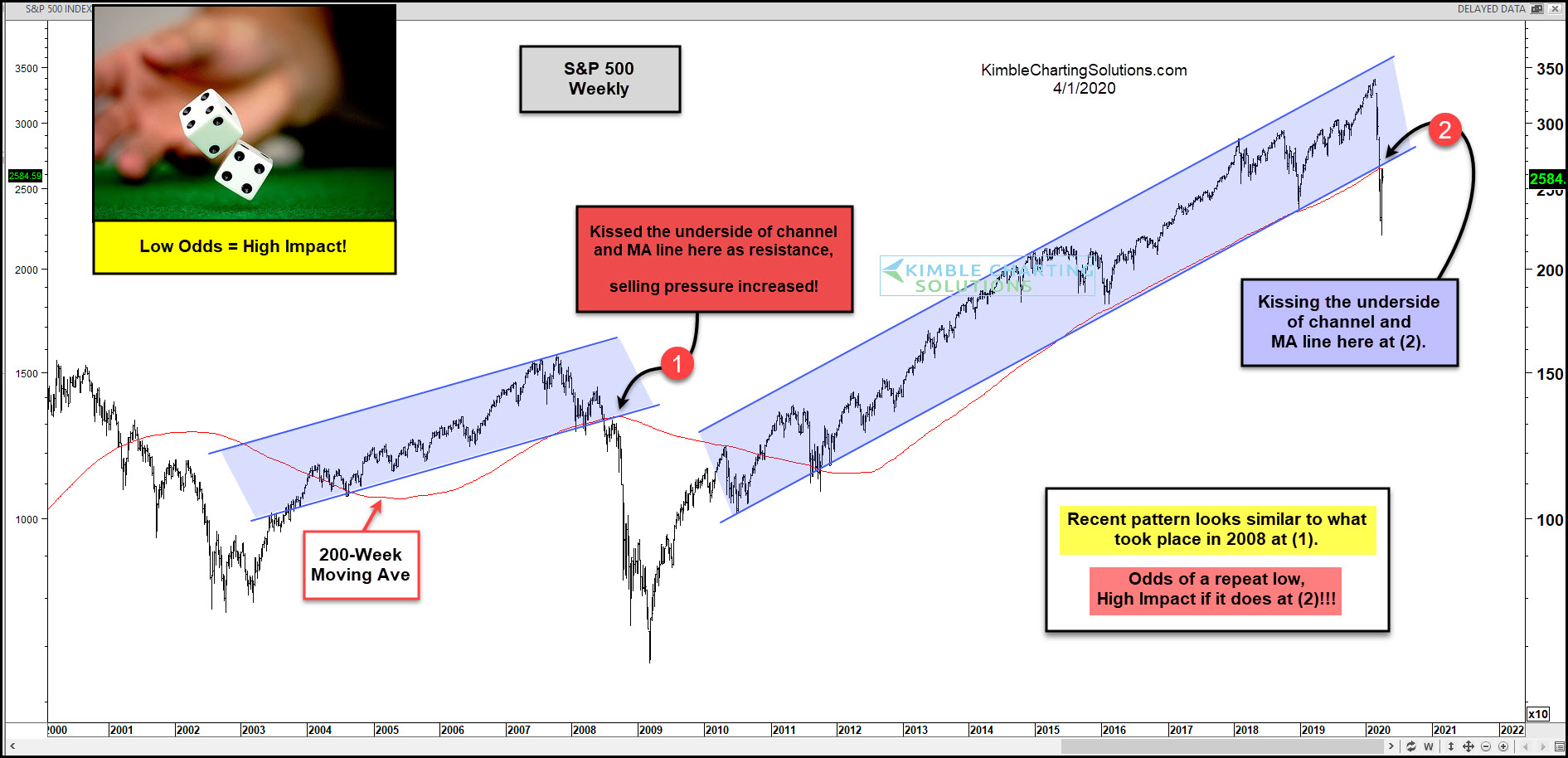

We have a situation here very similar to the Gold/Platinum conundrum with SOX/NDX vs SPX/DOW.

One set, SPX/DOW appears to be in a bear market, while the other, SOX/NDX is clearly still in a LT bull trend.

Until they "Sync up" very tough to tell yet who will eventually win out.

But what I can tell you, is that if you are thinking about longs, SOX/NDX is where the relative strength is, and IF bulls do win out, that is where the parabolic rise will likely happen, while DOW/SPX will likely lag for some time to come.

IF..we get another big wave down, and SOX/NDX do eventually crack the LT uptrends, then the downside leaders in SPX/DOW is the place to be short.

With this volatility, I could care less about being "right" on the long term while things are trying to sync up.

Way too much good money being made on short term swings. Literally months (years in some cases) worth of profits on some of the swings made in a matter of days.

Edited by K Wave, 02 April 2020 - 12:06 PM.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

#83

Posted 02 April 2020 - 01:58 PM

agreed the swings are quick and phenomenal

avi , who i think is the best

https://pbs.twimg.co...pg&name=900x900

dharma

golds dsi =57

hgnsi= -16 last time we were negative was 3/19.3/20.3/23 right before gold surges

doing some light buying

Edited by dharma, 02 April 2020 - 02:03 PM.

#84

Posted 02 April 2020 - 02:25 PM

agreed the swings are quick and phenomenal

avi , who i think is the best

https://pbs.twimg.co...pg&name=900x900

dharma

golds dsi =57

hgnsi= -16 last time we were negative was 3/19.3/20.3/23 right before gold surges

doing some light buying

Really like the near term action, to me with today's rally odds favoring 1 up from 1450-55 area to 1643, 2 down to recent low at 1564 and now we see if a wave 3 up just might "finally" be underway, love those HGNSI numbers as well

Senor

#85

Posted 02 April 2020 - 03:31 PM

the time segmented volume on the hui looks better now than when we went up to

the 50 dma on mar 26. it broke thru an overhead moving averageon the tsv which is bullish

hopefully this thing can take out the overhead resistance at its 200 and 50 with authority on this move

#86

Posted 02 April 2020 - 06:55 PM

Gold's Bull flag with an ABC?

"In order to master the markets, you must first master yourself" ... JP Morgan

"Most people lose money because they cannot admit they are wrong"... Martin Armstrong

http://marketvisions.blogspot.com/

#87

Posted 02 April 2020 - 09:25 PM

Gold's Bull flag with an ABC?

Methinks si but we'll soon know

Senor

#88

Posted 03 April 2020 - 12:19 PM

one thing about marty is he is not a conspiracy theorist . although, he does think the shutdown of the northern hemisphere is socialist inspired

so far nothing new in the pms

the jobless # is astounding.

dharma

#89

Posted 03 April 2020 - 04:13 PM

until that DT broken...

#90

Posted 03 April 2020 - 10:30 PM

until that DT broken...

Small Head and Shoulders bottom (with slanted neckline as your DT) forming on all the indices (and many individual stocks)