Looks like decision time for NYA real soon....

Posted 01 July 2020 - 03:10 PM

Sooner than most think

Than what? Did you add your remaining 30 percent?

Posted 01 July 2020 - 03:18 PM

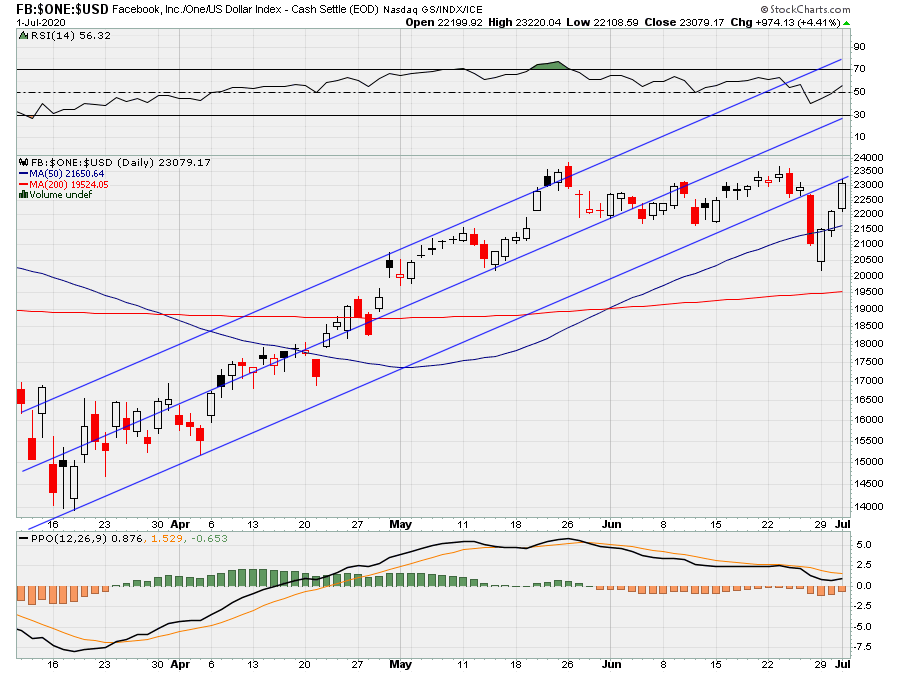

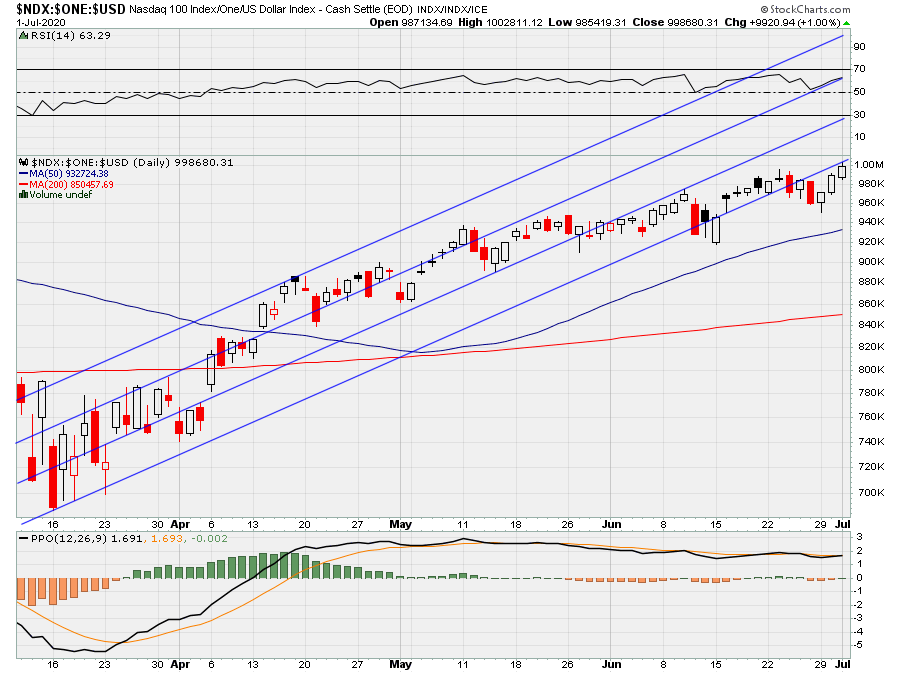

Well if you were talking about NDX...did not take long at all!

NDX NEW ALL TIME HIGH

That NDX is speedy Gonzales. New highs faster than delivery of a Jimmy John's sandwich ![]()

Posted 01 July 2020 - 03:19 PM

And $2.057 BILLION net new shorts added on the decline and subsequent rally. That's a lot of net shorts as background, and more adding every day recently.

There are plenty of Bears fueling the advance. SH over 130 mil added the last 5 days as well. Relative FEAR meter at 4.6% Bullish last Friday cls or 95.6% Bearish. The algos already learned what to do before NFP from last month.

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

Posted 01 July 2020 - 03:28 PM

SPX and INDU are just too slow for me, I may just trade Nasdaq for good next year.

Seems it may be another few weeks to break the FOMC highs, this is absurd.

Posted 01 July 2020 - 03:45 PM

Seems it may be another few weeks to break the FOMC highs, this is absurd.

All you should care about is direction...absurdity is in the eye of the beholder, and certainly not tradable.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

Posted 01 July 2020 - 04:14 PM

YM futures went out right in the middle of the slop zone.

If they breach 25,400, then bears might just have something to talk about for a bit.

But if they take out 25700 overnight, and we gap up tomorrow, bears would likely be in a heap o trouble.

If bears do manage to win out here, then that 23700 target zone would still be in play.

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 01 July 2020 - 04:21 PM

Rut futures could not quite punch through today. (YM looks nearly identical, but a tad weaker)

If they can get a 4 hour close over 1440 in the next few bars, then bears would likely go from mostly dead to fully dead.

But if the bears hold, they could still potentially wreak some havoc.

Seems like important action likely dead ahead...

The strength of Government lies in the people's ignorance, and the Government knows this, and will therefore always oppose true enlightenment. - Leo Tolstoy

Posted 01 July 2020 - 10:01 PM

Looking at the IWM russell.....I'm almost sure you make better gains trading short all the time, even though it's trending higher.

Posted 01 July 2020 - 11:32 PM

Might be prudent to see how the rally channel backtest plays out before placing large bets. It is hard to view a C19-muffled 4th of July celebration as bullish for the economy. And an October surprise of some sort should come as no surprise if the orange man continues to trail in the polls. Who believes he will rest on his laurels while his legacy circles the drain? One might recall W's approval rating peaked at 92% after Dick's demolition team the Saudis dropped the towers and building seven into their footprints. Although the omniscient stock market could price-in an October surprise ahead of time, it might prefer to play dumb and allow events to unfold in real time, thereby avoiding overt revelation of the guiding hand and subsequent conspiracy theories. With the empire and the entire world teetering on the edge of political and financial meltdown, an old-fashioned hot-war could be the vaccine that the elites determine would best treat our illness. Just saying IMHO it seems foolish to believe the markets are safe just because banksters are printing trillions - would they be doing so if not staring into the face of risk?