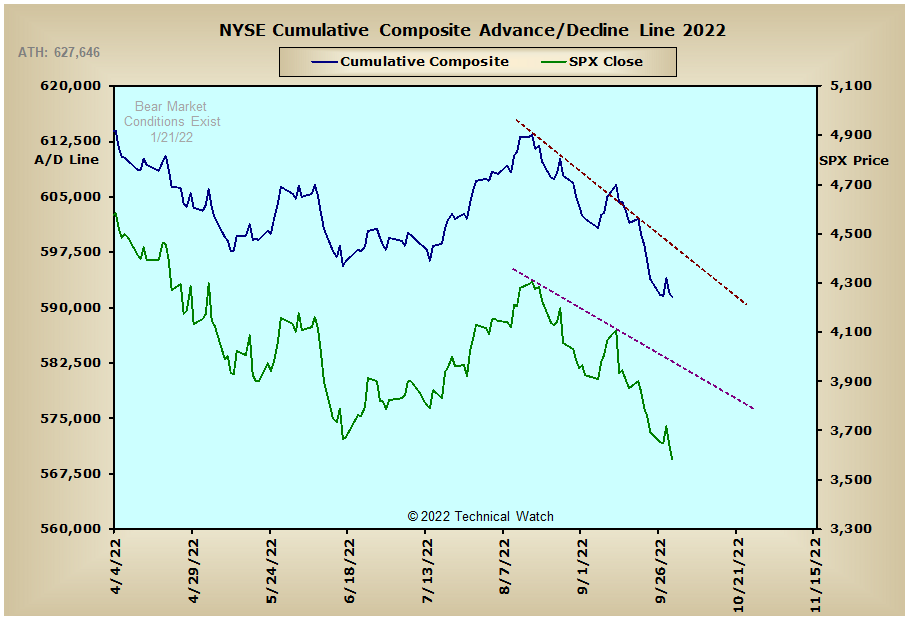

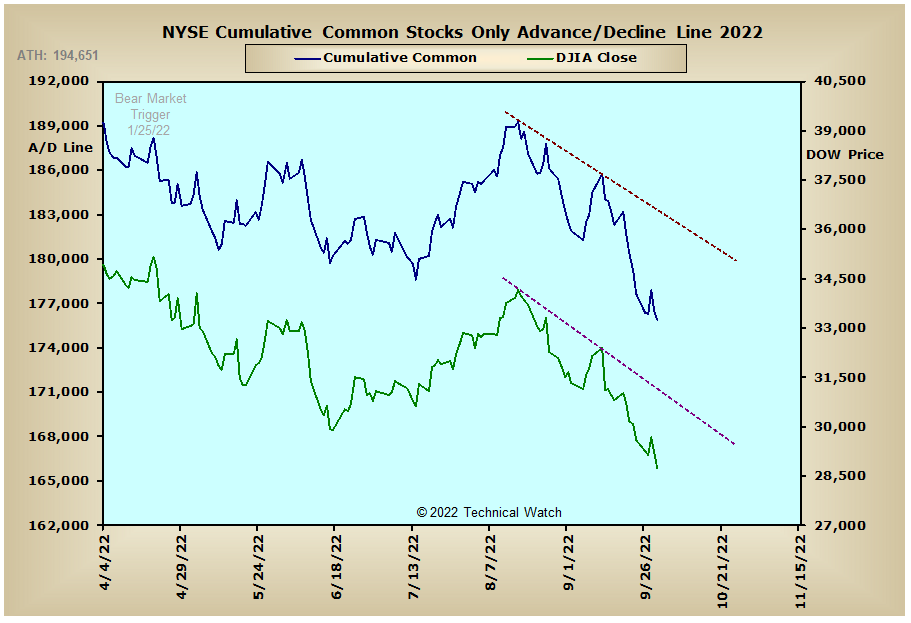

It was another rough week for the buyers as end of quarter program buying on Wednesday failed to reverse the ongoing downside pressure on prices as the major market indexes finished with an average weekly loss of -2.33%. For the month of September itself, the equity markets lived up to their infamous reputation of weakness by settling with an average loss of -9.51% which surpassed that of April's -8.06% and June's -8.46% readings. Closing out the 3rd quarter of 2022, the U.S. markets ended with an average loss of -5.26% which brings the total loss for the year to a whopping -24.35%, with the NASDAQ Composite Index leading the way as it has given back -32.40% since bear market conditions technically began back in January.

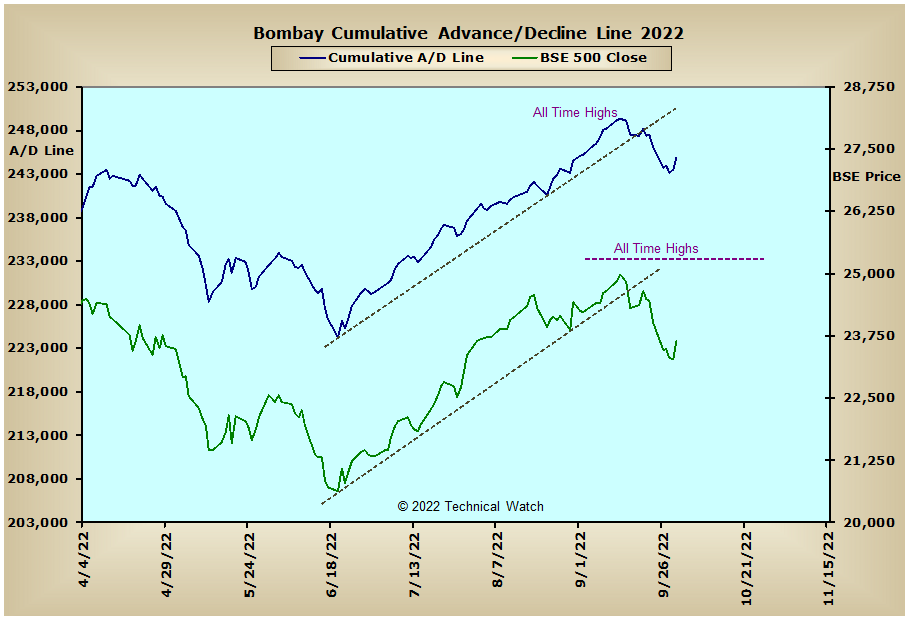

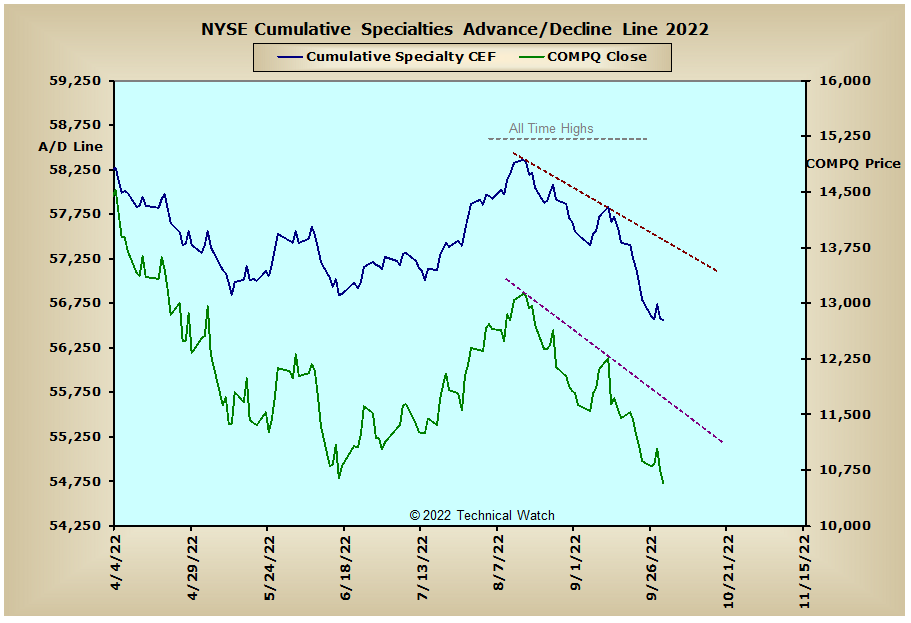

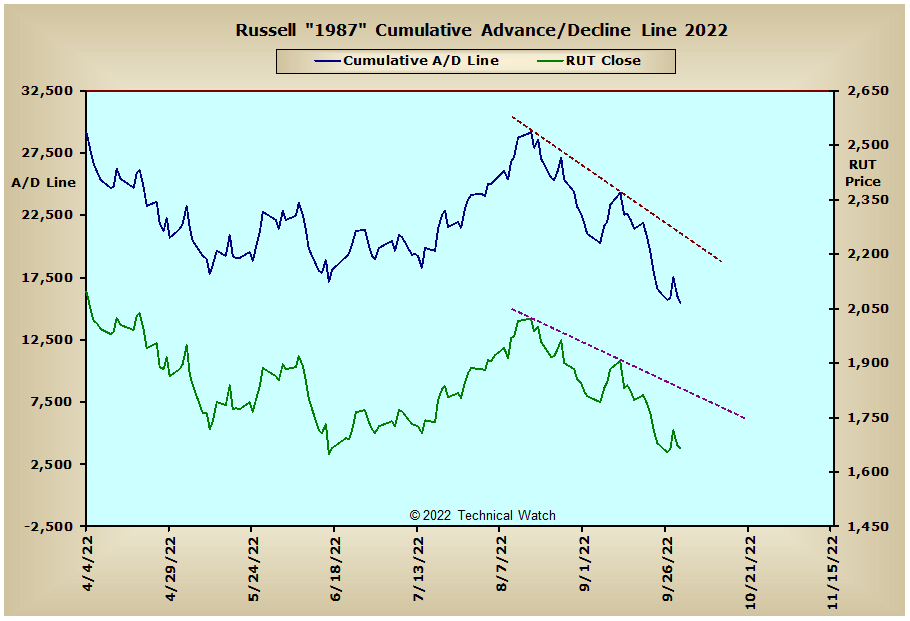

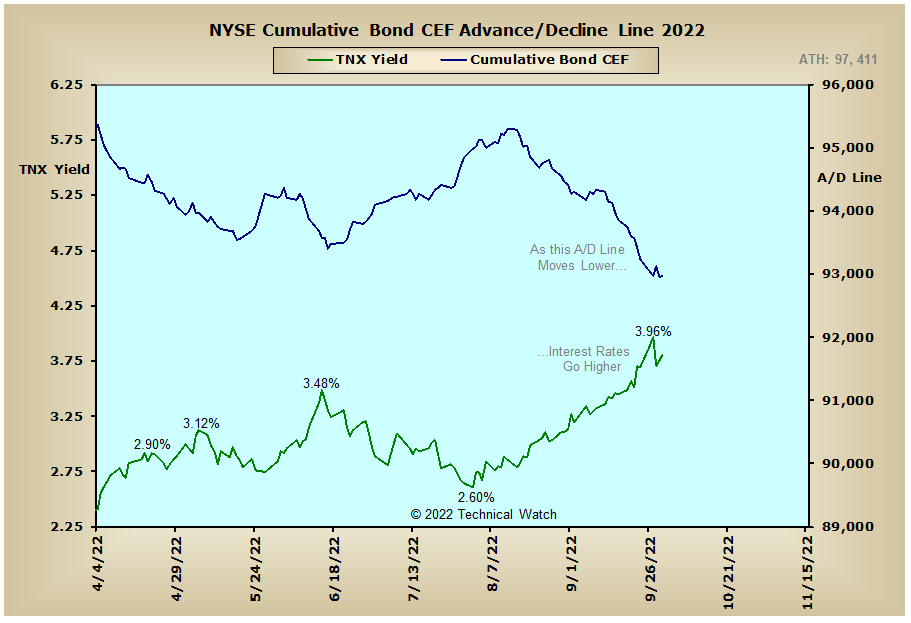

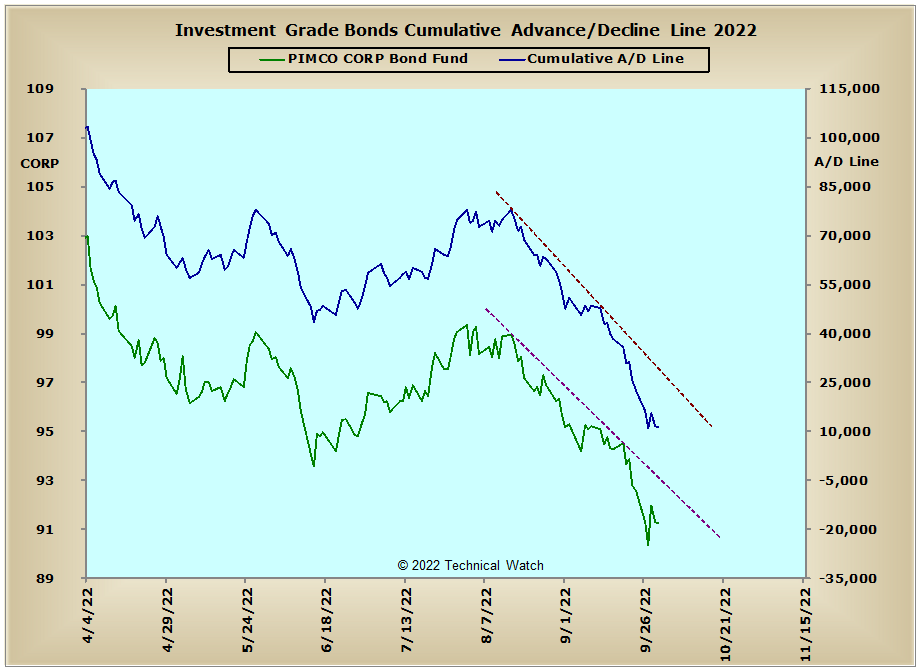

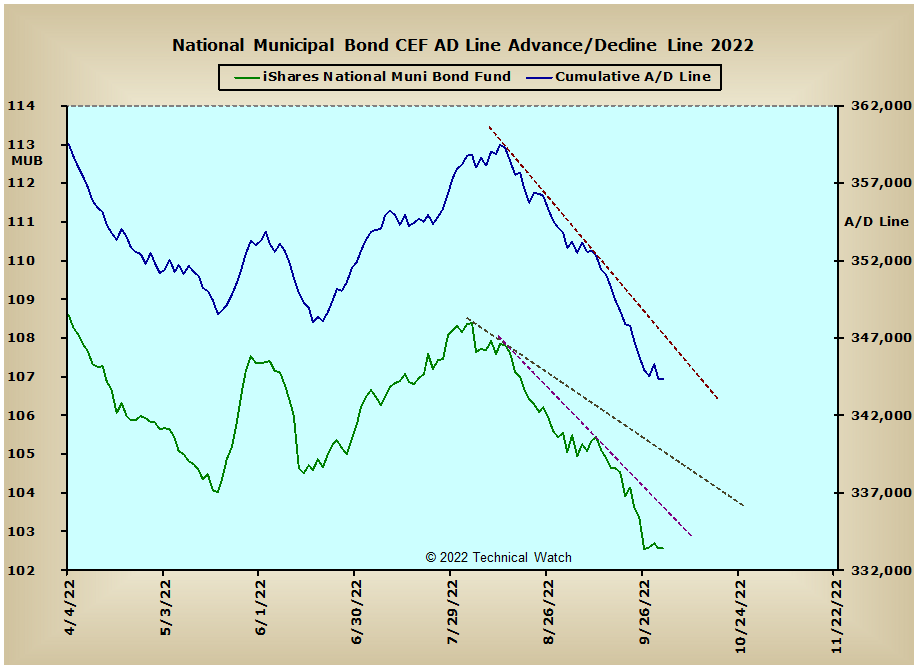

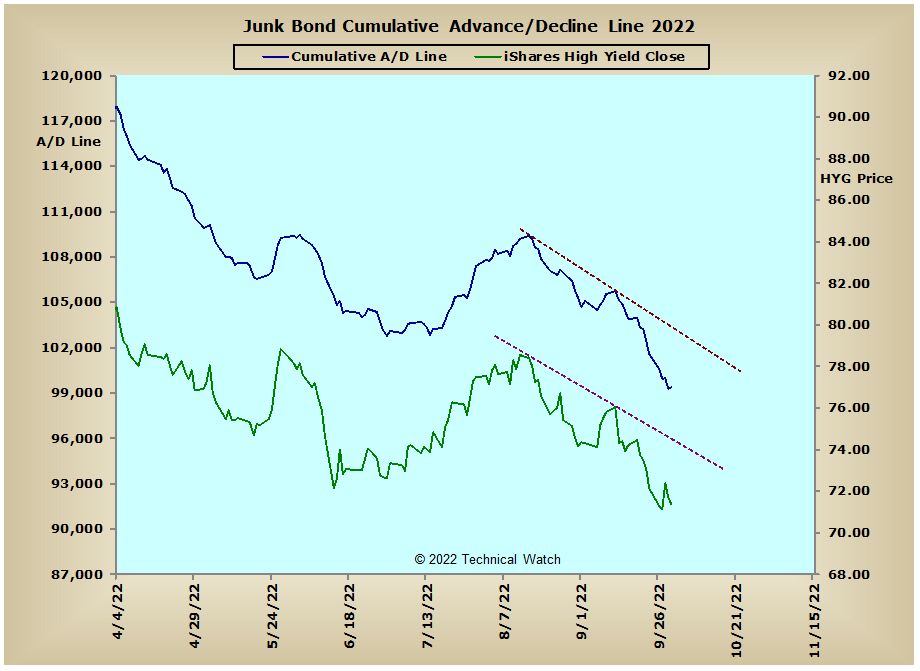

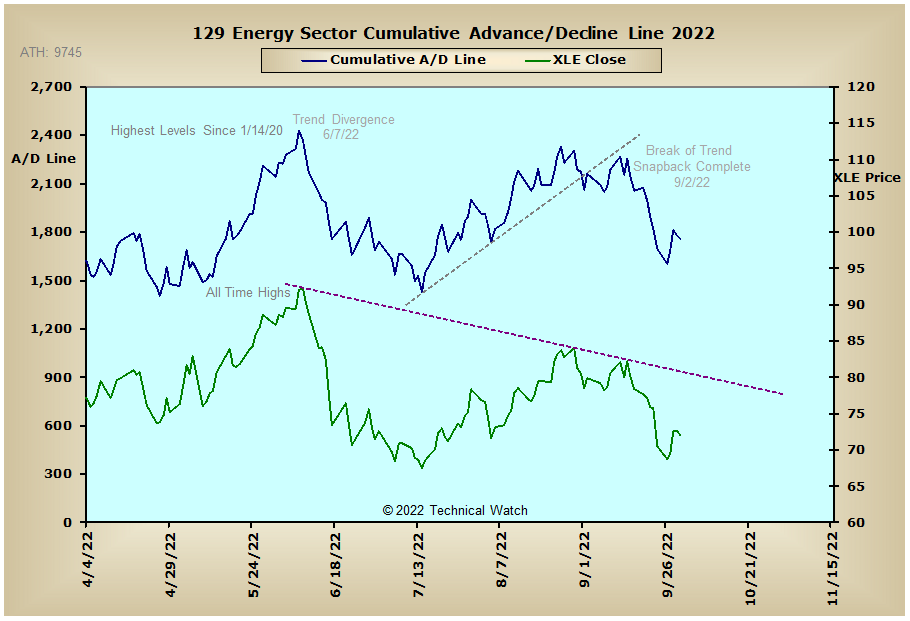

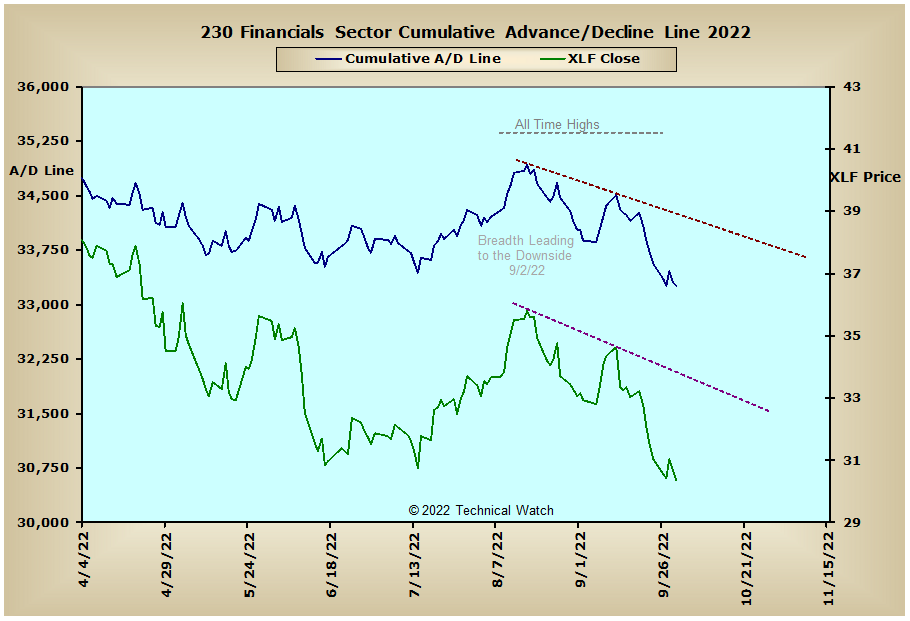

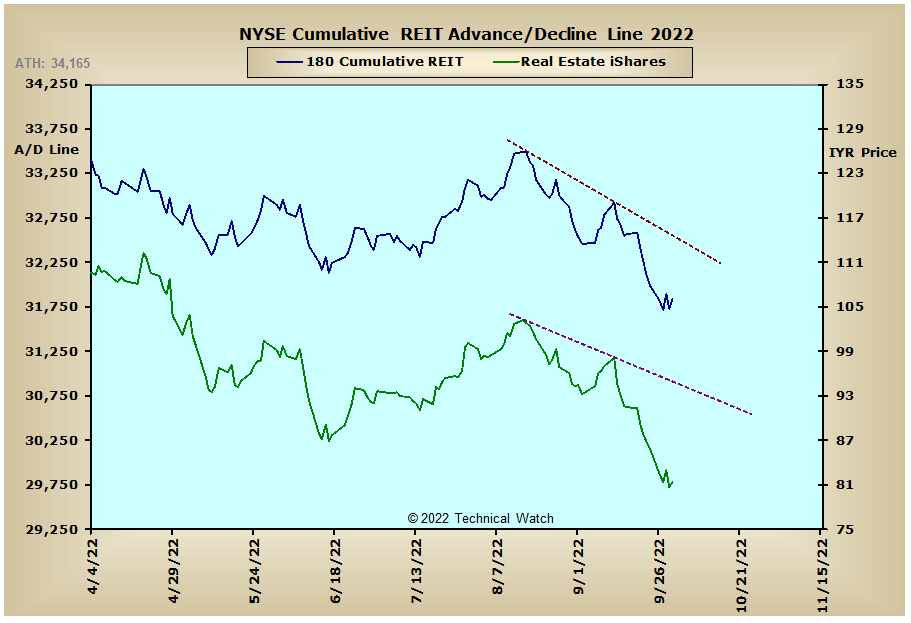

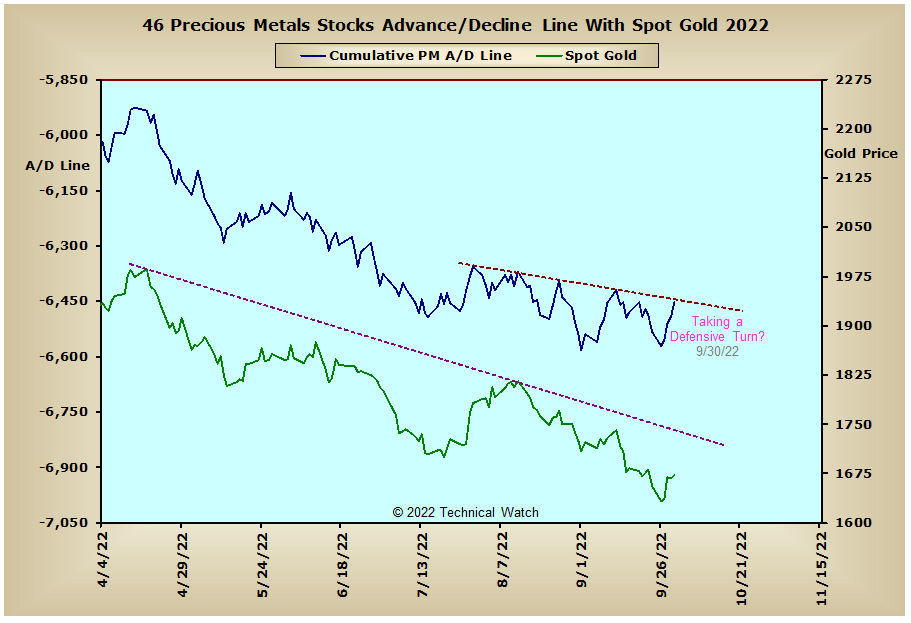

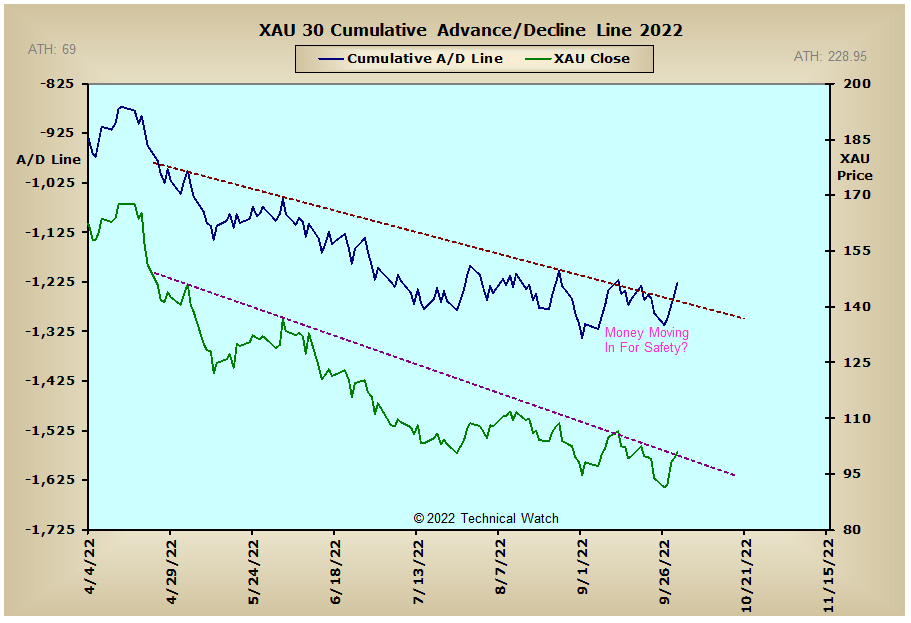

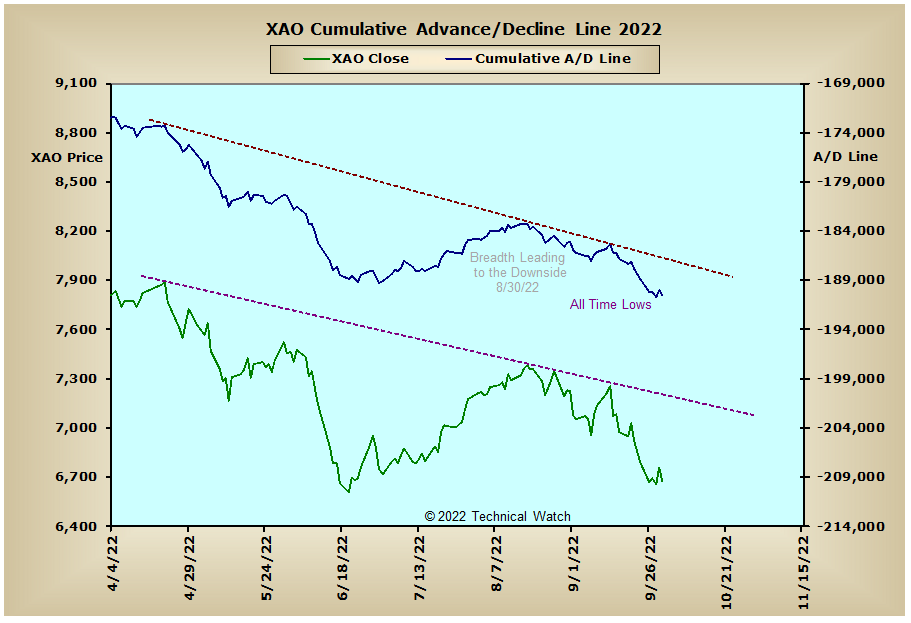

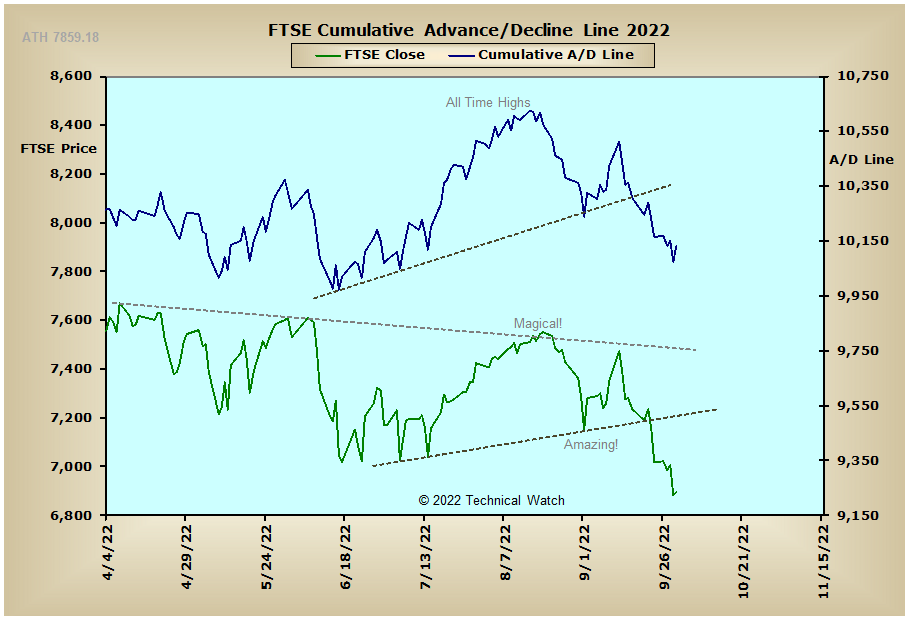

Looking at this week's edition of our standard array of cumulative breadth charts shows that all continue to trend to the downside with the interest rate sensitive issues showing a more acute angle of descent as the yield on the 10 year note came within 8 ticks from reaching our upside target of 4% on Tuesday. The only area of investment holding up right now are the Precious Metals and XAU advance/decline lines as they continue to flirt with their intermediate term declining trendlines. With the next cyclical lows for this asset class still due in December, and as long as the pressure of rising interest rates remains Fed policy, there is an outside chance that money may be moving into the "safety" of precious metals as stock market losses continue to deepen. But even if this is the actual case, history has shown that nothing is really safe when market participants need to build cash reserves during a crisis phase, so let's not let the emotions of the day take away from our trading disciplines.

So with the BETS staying steadfast for the second week in a row with a reading of -80, traders and investors continue to work with highly unfavorable market conditions. With market indexes at or just below their June price lows on Friday, along with a great majority of breadth and volume McClellan Summation Indexes at their lowest levels of the year, the overall market trend remains to the downside as we begin the month of October. There are, however, some potential bright spots for the buyers as the majority of index and sector Bullish Percent Indexes are currently washed out with readings below 20%, while the NYSE (1.20) and the NASDAQ (1.13) Open 10 Trading Indexes are both showing "oversold" conditions that may allow for a digestion period as we start the week ahead. On the negative side, however, the 10 day running average of equity and CBOE put/call ratios remains quite reserved in spite of the market's large losses for the month of September. Taken together, and outside of any short covering to begin the week, the expectation is for continued market volatility with the overall trend of prices showing a strong negative bias. With all this in our hip pocket then, let's continue to walk the bearish path of least resistance for the upcoming week ahead, while continuing to keep our stops relatively close to lock in any highly profitable short positions that we may have in our portfolios.

Have a great trading week!

US Interest Rates:

US Sectors:

Precious Metals:

Australia:

England:

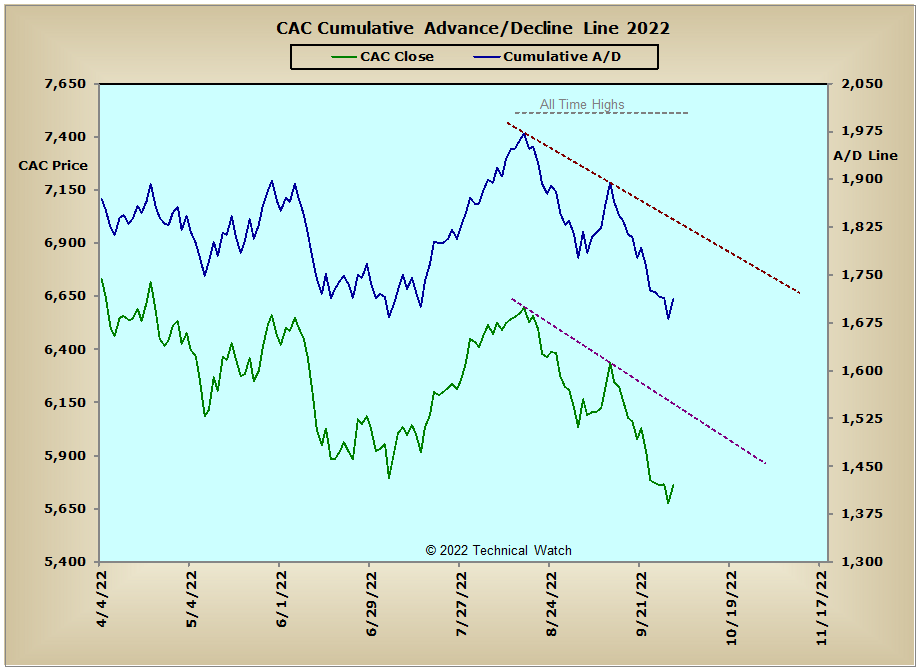

France:

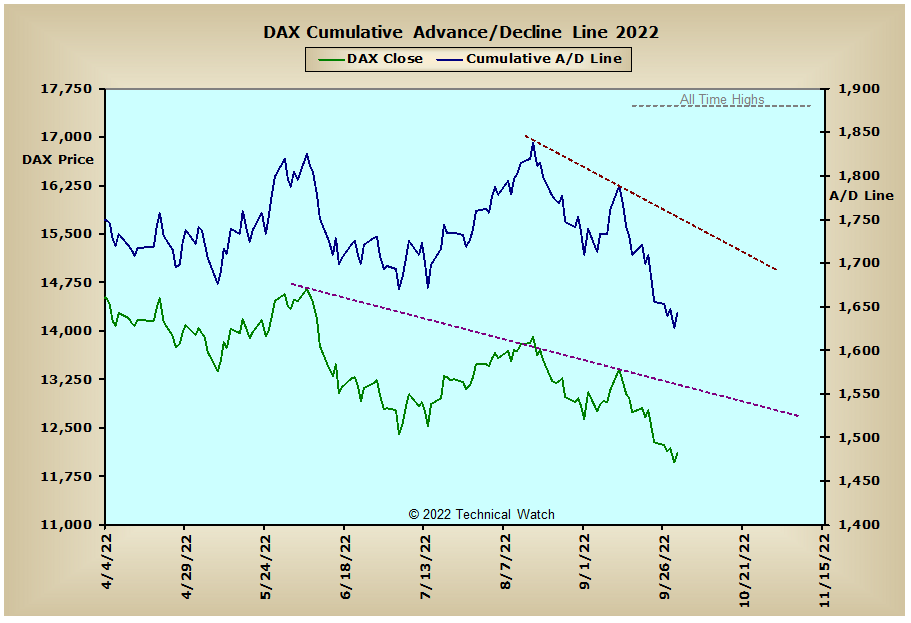

Germany:

India: