Thanks for taking the time to give a detailed explanation. I had two follow up questions. You already answered one in saying time is not considered in possible

reaching the targets. So my only other question would be what would have to happen for these targets to get canceled? Breaking a certain support or a certain

price? Or maybe something inside the Precious Metals Summation index?

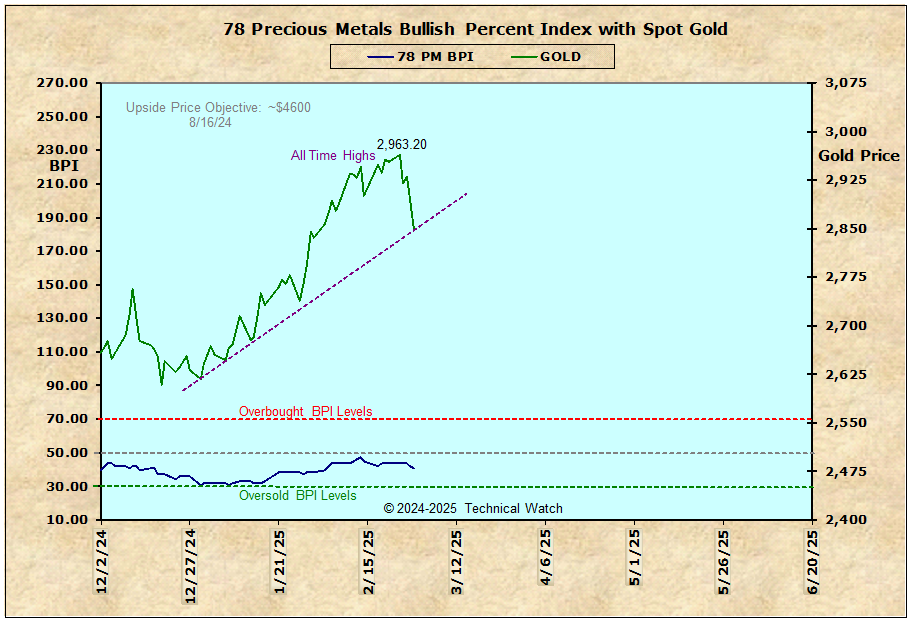

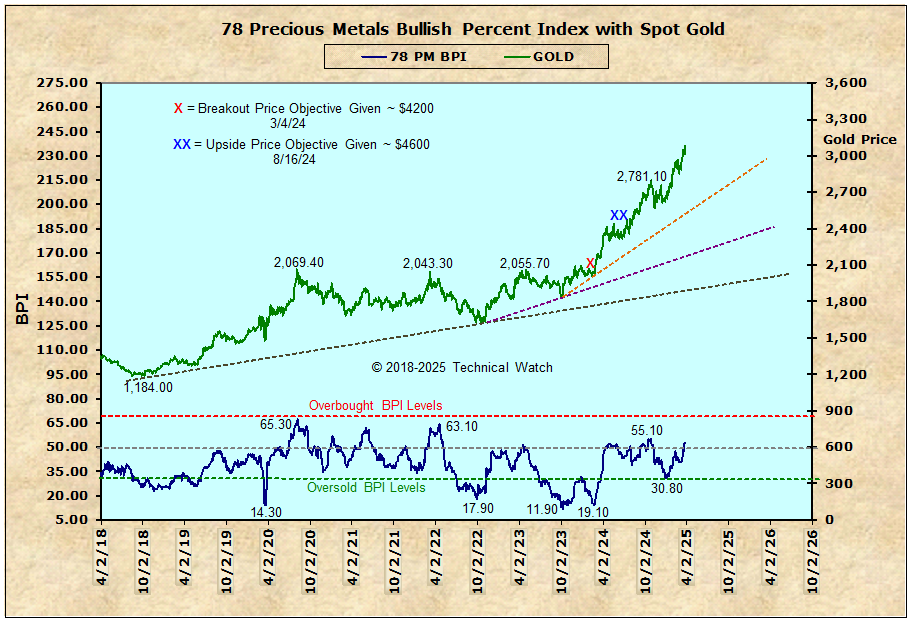

Cancellation of price targets of this type vary, but usually the first warning shot comes with a shorter term breadth measurement tool such as the McClellan Oscillator. If the MCO makes a new multi monthly low, for example, this might suggest that a prior price consolidation level will be tested and even violated if the "foot remains on the accelerator pedal" and lower lows are seen. But if we're talking intermediate to longer term price projections of which these are, then their births and deaths are based more on the position of the McClellan Summation Index in relation to its zero line which will give you a better roadmap of where prices are likely to reach during this same correctional (or advancing) sequence. Keep in mind that all of this also depends on where the 200 day EMA is in relation to price. For example, if you do see new MCO lows (money moving out the market at an accelerated pace), and the MCSUM moves down and through its zero line (the 19 day EMA crosses down and through the 39 day EMA on a breadth chart), but prices are above their 200 day EMA, then this would likely be more of a correctional sequence (a pause to refresh) than a change in trend. This would also mean that if prices are below their 200 day EMA under these same MCO and MCSUM conditions, then the odds increase greatly that you have bear market conditions and any upside targets would then be cancelled.

Unlike most who attempt to be strategic in providing price targets in either direction, if the money isn't there to reach such objectives, you're not likely going to attain them no matter what the time value would be. So, in this case, the current upside targets will remain until proven otherwise either by a change in the directional trend of money flow and/or by how prices are trending either above or below the magical 200 day EMA.

Bottom line...everything in trading is based solely on supply and demand, and the use of analytic tools that measure this basic monetary concept will provide the necessary insight to either enter or exit a trade without prejudice, emotion or hyperbole.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.