Site Navigation

Advertisement

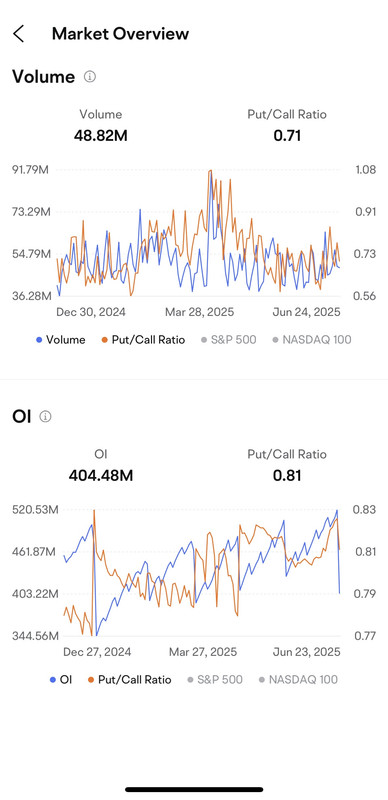

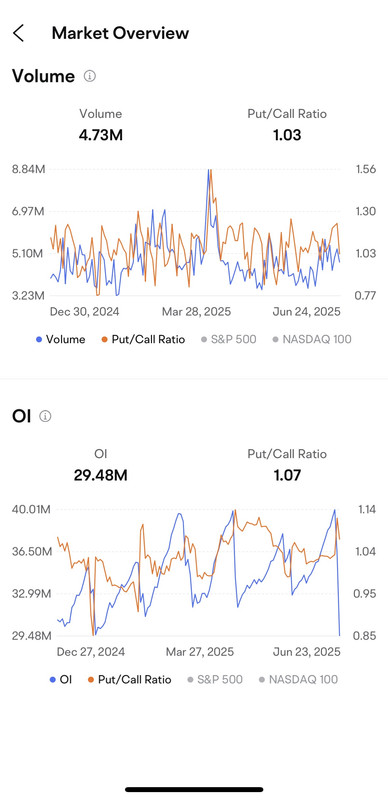

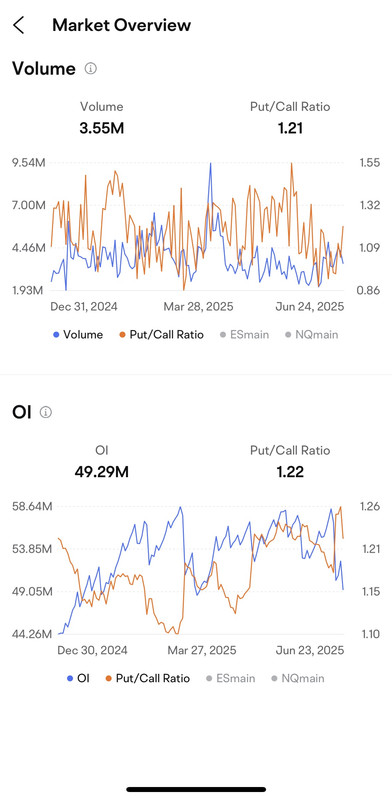

Index and Futures Options OI Put/Call Stays High

25 Jun 2025

Posted by

risktaker

in Fearless Forecasters

176 Views · 4 Replies ( Last reply by 12SPX )

169 Views · 2 Replies ( Last reply by risktaker )

I suspect nasdaq may visit higher levels before correcting

24 Jun 2025

Posted by

andr99

in Fearless Forecasters

20100 in the cards ? Then the dip I've expected since I closed my longs, may finally start ? Something like one thousand points to 19100 ?

230 Views · 4 Replies ( Last reply by andr99 )

Fed Governor Bowman favors July interest rate cut if infl...

23 Jun 2025

Posted by

dTraderB

in Fearless Forecasters

Momentum building for JULY RATE CUT!

Second Fed Official Indicates Support for Faster Rate Cuts

Fed Governor Bowman favors July interest rate cut if inflation stays low

KEY POINTS

Federal Reserve Governor Michelle Bowman said Monday she would favor an interest rate cut at the next policy meeting in July so long as inflation pressures stay muted.

Bowman's comments are similar to those from fellow Governor Christopher Waller, who told CNBC on Friday that he also thinks the Fed could consider cutting in July.

https://www.cnbc.com...-stays-low.html

https://www.nytimes....-rate-cuts.html

Second Fed Official Indicates Support for Faster Rate Cuts

Fed Governor Bowman favors July interest rate cut if inflation stays low

KEY POINTS

Federal Reserve Governor Michelle Bowman said Monday she would favor an interest rate cut at the next policy meeting in July so long as inflation pressures stay muted.

Bowman's comments are similar to those from fellow Governor Christopher Waller, who told CNBC on Friday that he also thinks the Fed could consider cutting in July.

https://www.cnbc.com...-stays-low.html

https://www.nytimes....-rate-cuts.html

"Trumpís Iran Strikes Didnít Move Stock Markets. Why...

23 Jun 2025

Posted by

dTraderB

in Fearless Forecasters

Two of ny best 2025 Trades during trades since 6pm Sunday. Initially, I did not go long when markets reversed but I soon realizrd BULLS HAD STAMPEDED BEARS....

8 ES, NQ trade last night & 2 more this morning.

BARRON'S: The calm after the storm or just a lull? Early Monday trading was surprisingly tranquil after the U.S. struck Irans nuclear infrastructure over the weekend, backing up Israels initial attacks on the country, but it might be a logical reaction.

Tehrans most powerful option to strike back would be to blockade the Strait of Hormuzthrough which around 20% of the worlds oil flowslikely propelling crude prices above $100 a barrel. However, such an action would be more damaging to Irans own economy and that of its biggest oil customer China, than to the U.S.

That calculation accounts for the muted reaction in oil markets and safe-haven assets such as gold. The market seemed to be betting both Washington and Tehran will step back from further escalation, disregarding President Donald Trumps musings on potential regime change in Iran.

Still, there are plenty of unanswered questionswas Irans nuclear enrichment program truly obliterated? Will Israel step up its own actions? Could Iran opt for partial disruption of oil shipping rather than a full blockade?

That uncertainty could mean the Federal Reserve will hold out against pivoting to rate cuts as higher oil prices would drive inflation, despite pressure from the White House to lower interest rates. Fed Chair Jerome Powell will have to defend that stance in congressional testimony on Tuesday and Wednesday. The debate will also be influenced by Fridays publication of the core PCE price index, the Feds favored inflation gauge, which is expected to rise 2.6% for May from the previous year.

The market has gotten used to shrugging off geopolitical tensions in the past couple of years. Its a pattern thats still holding and investors might be right to focus on concerns closer to home.

Adam Clark

8 ES, NQ trade last night & 2 more this morning.

BARRON'S: The calm after the storm or just a lull? Early Monday trading was surprisingly tranquil after the U.S. struck Irans nuclear infrastructure over the weekend, backing up Israels initial attacks on the country, but it might be a logical reaction.

Tehrans most powerful option to strike back would be to blockade the Strait of Hormuzthrough which around 20% of the worlds oil flowslikely propelling crude prices above $100 a barrel. However, such an action would be more damaging to Irans own economy and that of its biggest oil customer China, than to the U.S.

That calculation accounts for the muted reaction in oil markets and safe-haven assets such as gold. The market seemed to be betting both Washington and Tehran will step back from further escalation, disregarding President Donald Trumps musings on potential regime change in Iran.

Still, there are plenty of unanswered questionswas Irans nuclear enrichment program truly obliterated? Will Israel step up its own actions? Could Iran opt for partial disruption of oil shipping rather than a full blockade?

That uncertainty could mean the Federal Reserve will hold out against pivoting to rate cuts as higher oil prices would drive inflation, despite pressure from the White House to lower interest rates. Fed Chair Jerome Powell will have to defend that stance in congressional testimony on Tuesday and Wednesday. The debate will also be influenced by Fridays publication of the core PCE price index, the Feds favored inflation gauge, which is expected to rise 2.6% for May from the previous year.

The market has gotten used to shrugging off geopolitical tensions in the past couple of years. Its a pattern thats still holding and investors might be right to focus on concerns closer to home.

Adam Clark

1,008 Views · 45 Replies ( Last reply by 12SPX )

- 923,698 Total Posts

- 3,188 Total Members

- Michael Lu Newest Member

- 64,402 Most Online

2530 users are online (in the past 60 minutes)

3 members, 2526 guests, 1 anonymous users (See full list)

Bing, Google, dougie, claire, jacek