With a myriad of both divergent internals and receding liquidity levels as its impetus, the major market indexes finally succumbed to this negative backdrop to register its largest weekly declines since the March crash of 2020 with an average loss of -6.15%. Leading the sell off was the NASDAQ Composite Index as it lost another -7.55% for its 4th consecutive weekly loss in a row, while the great majority of stock market indexes finished at or just below their 200 day exponential moving averages of longer term support.

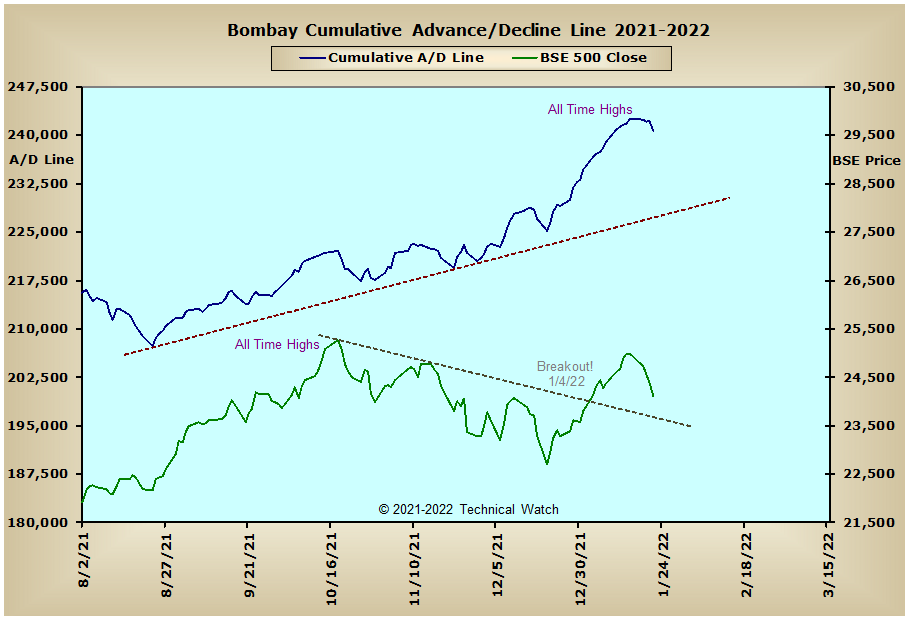

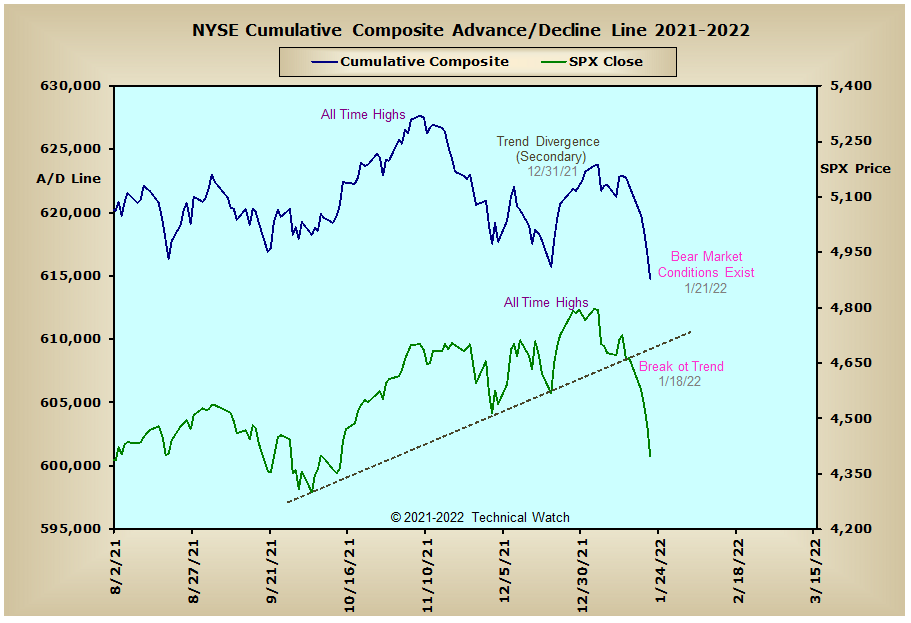

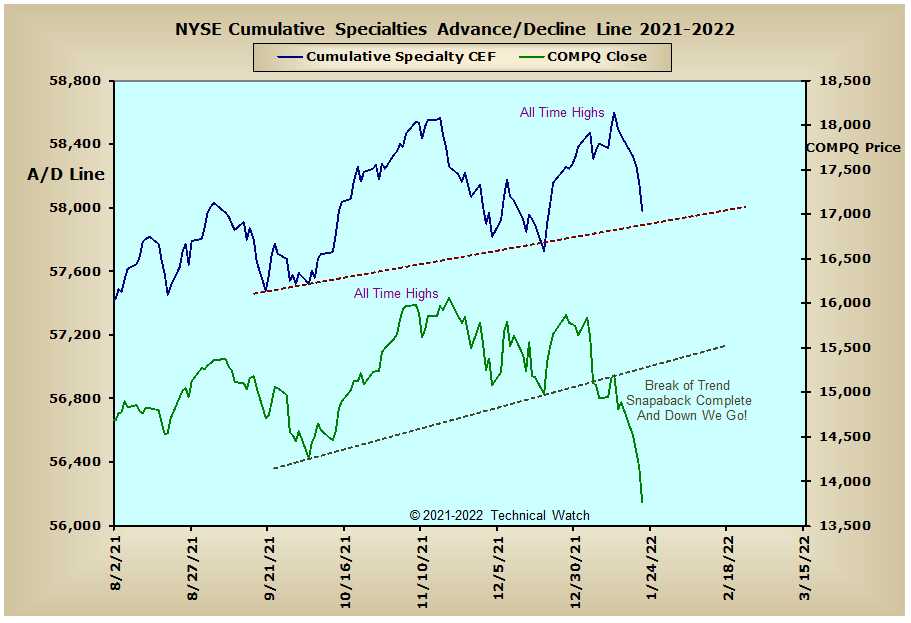

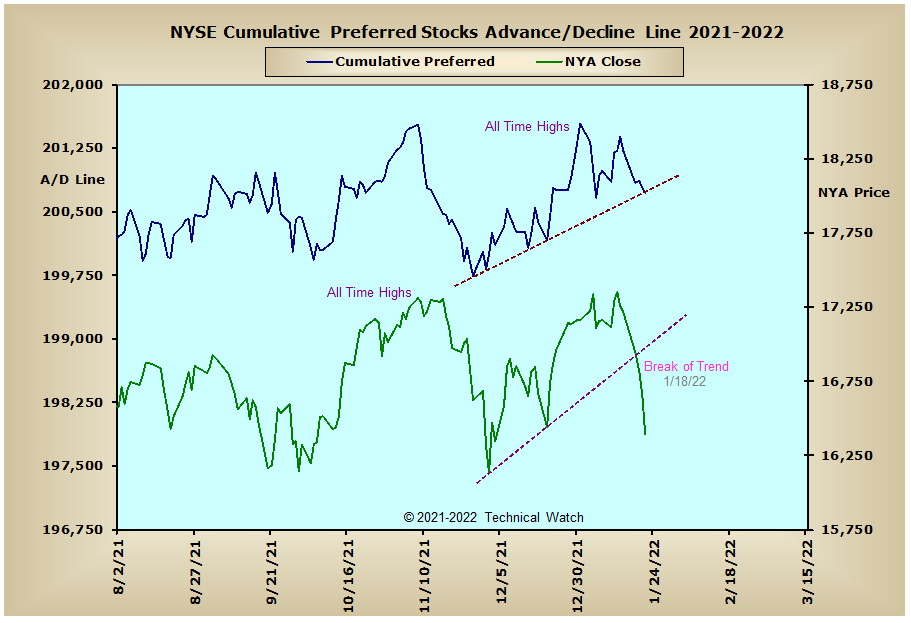

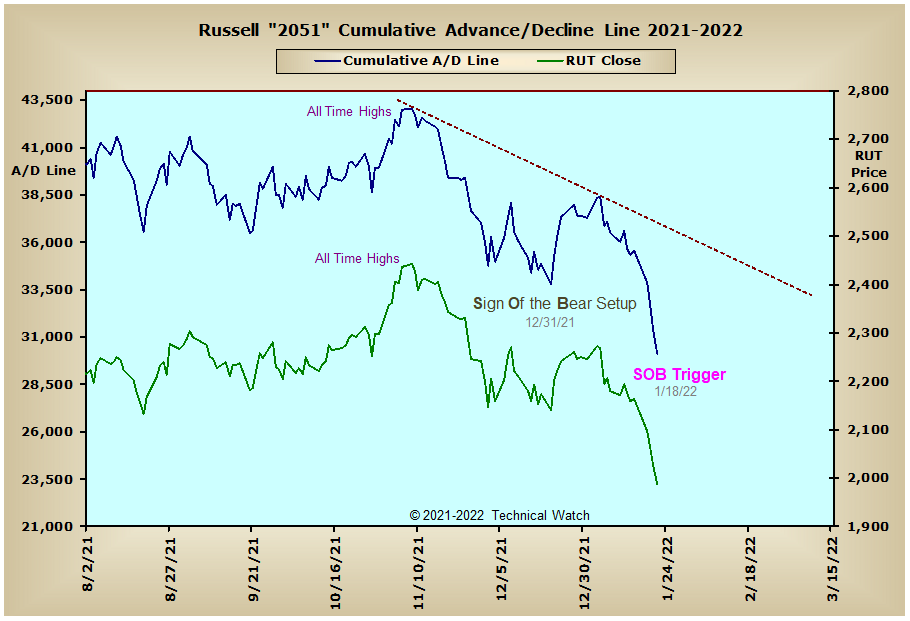

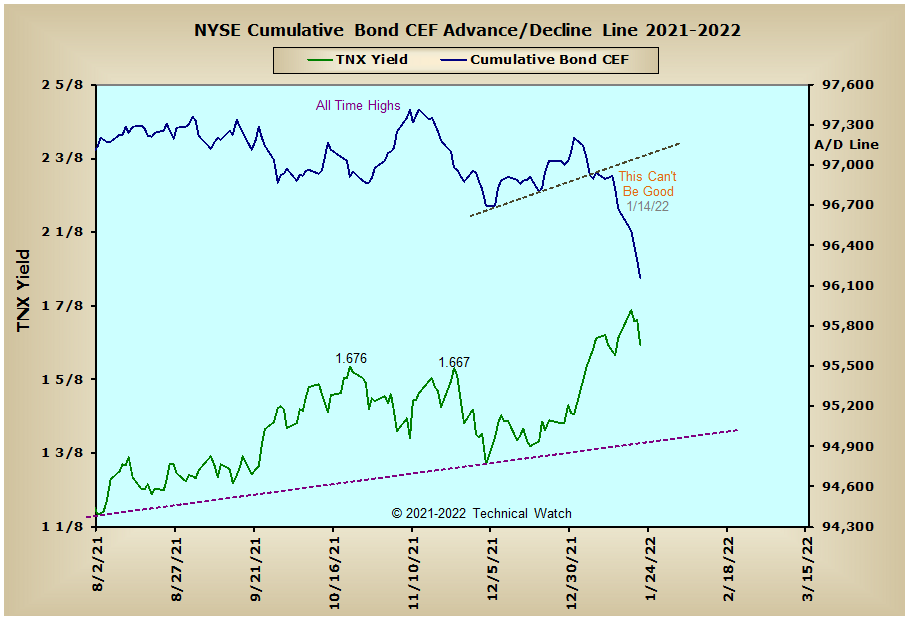

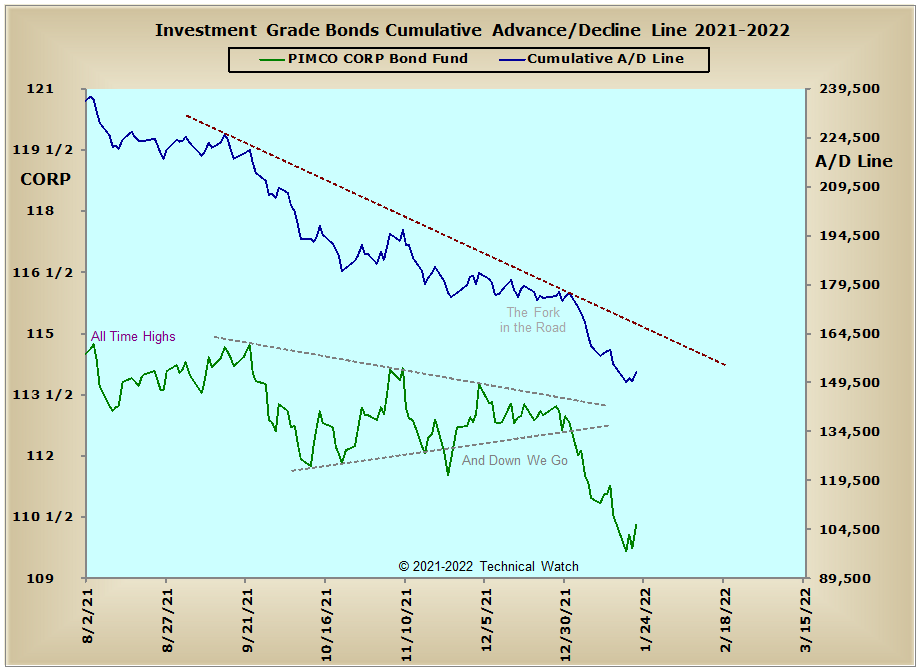

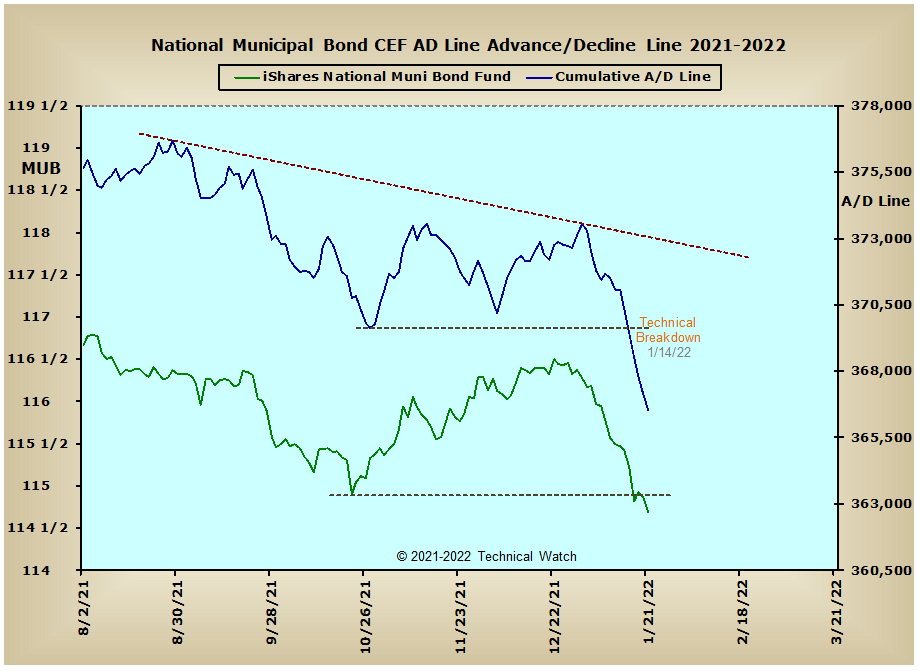

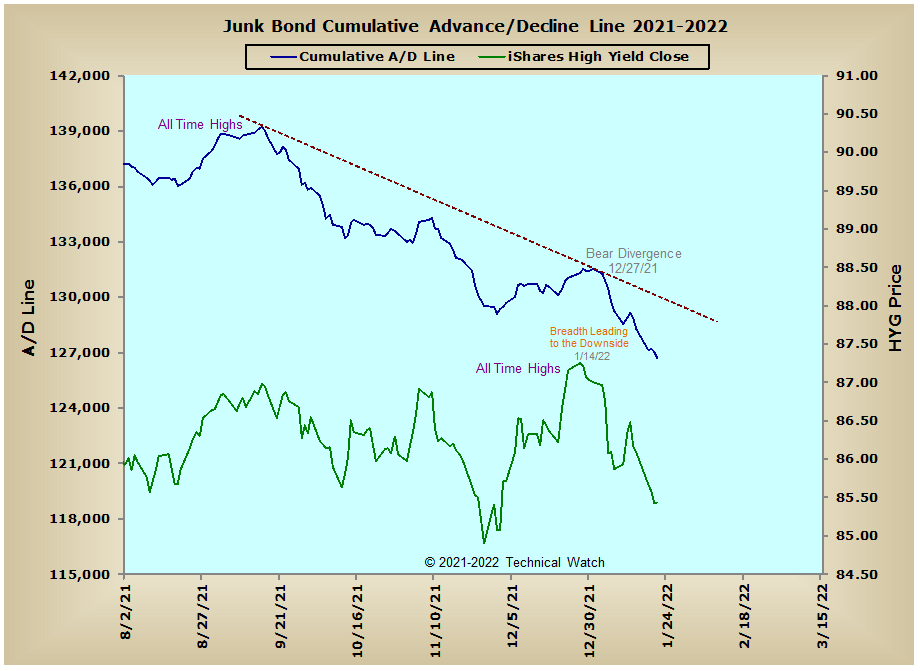

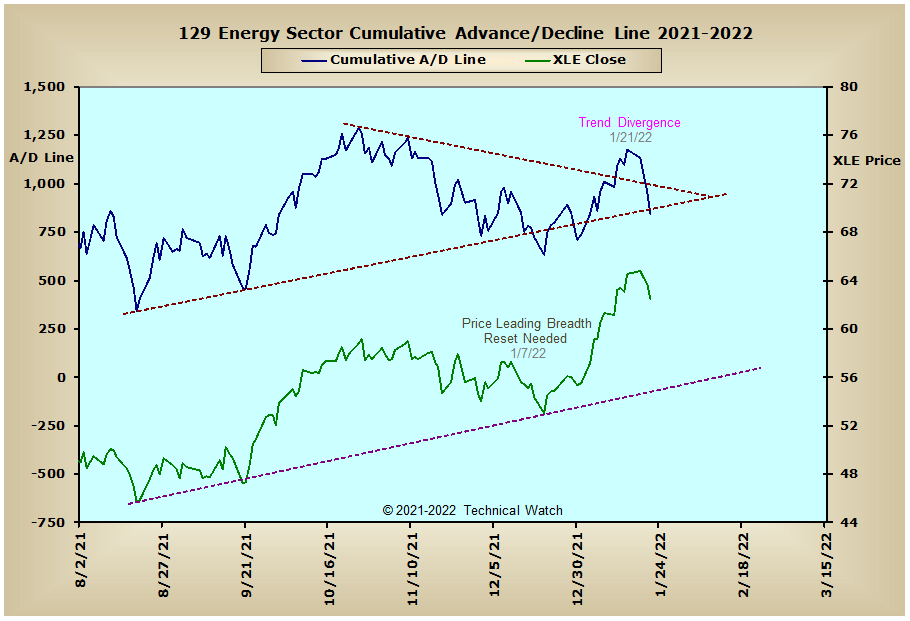

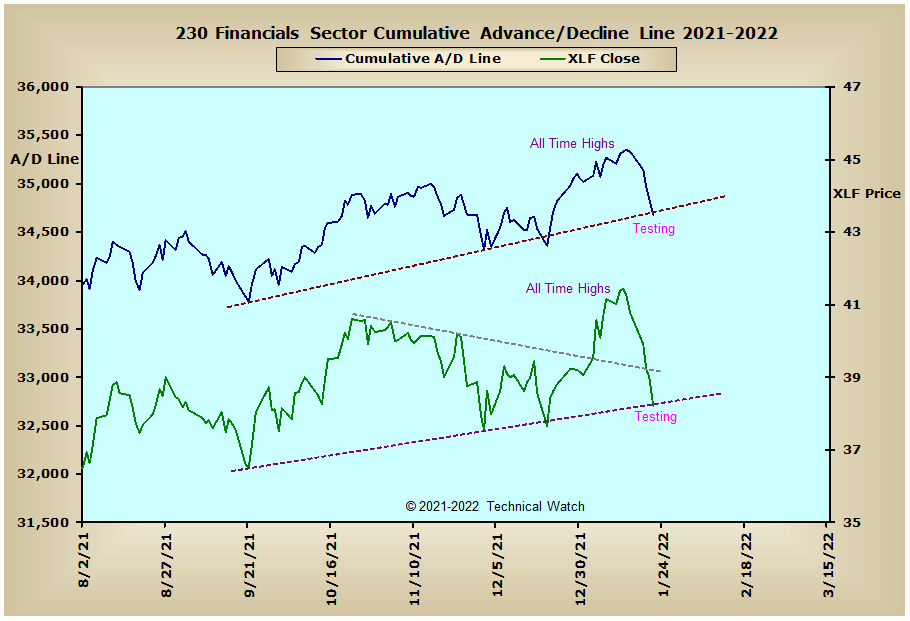

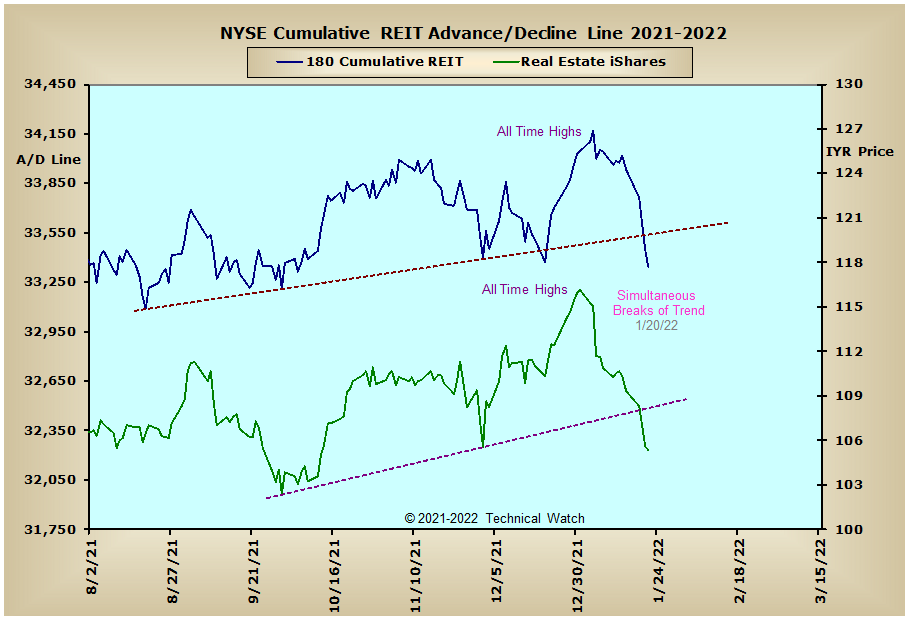

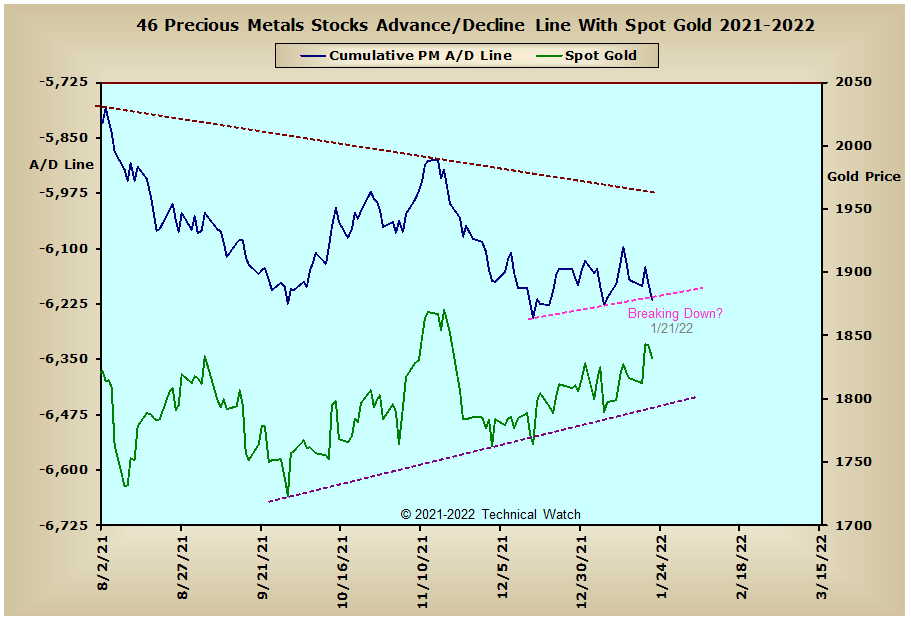

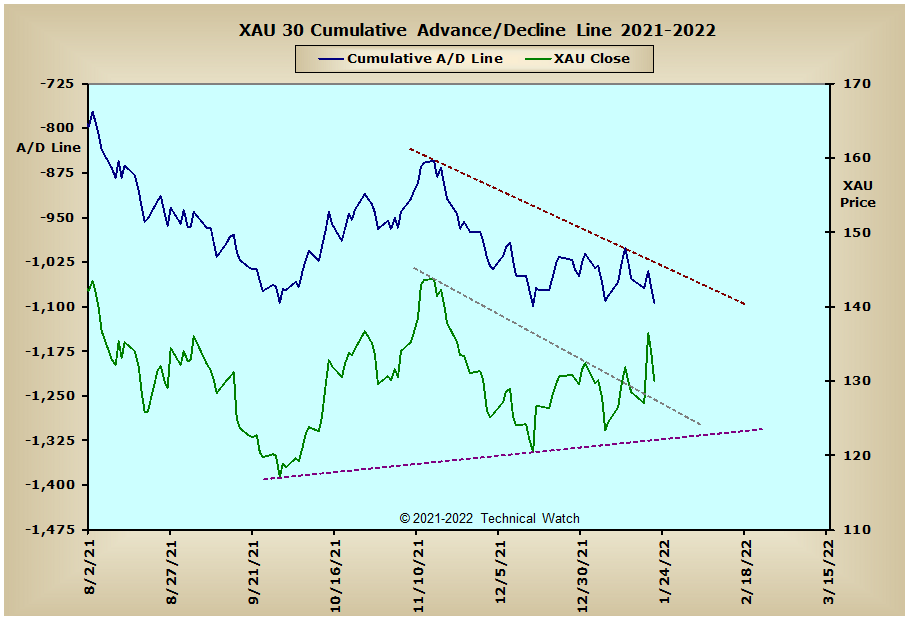

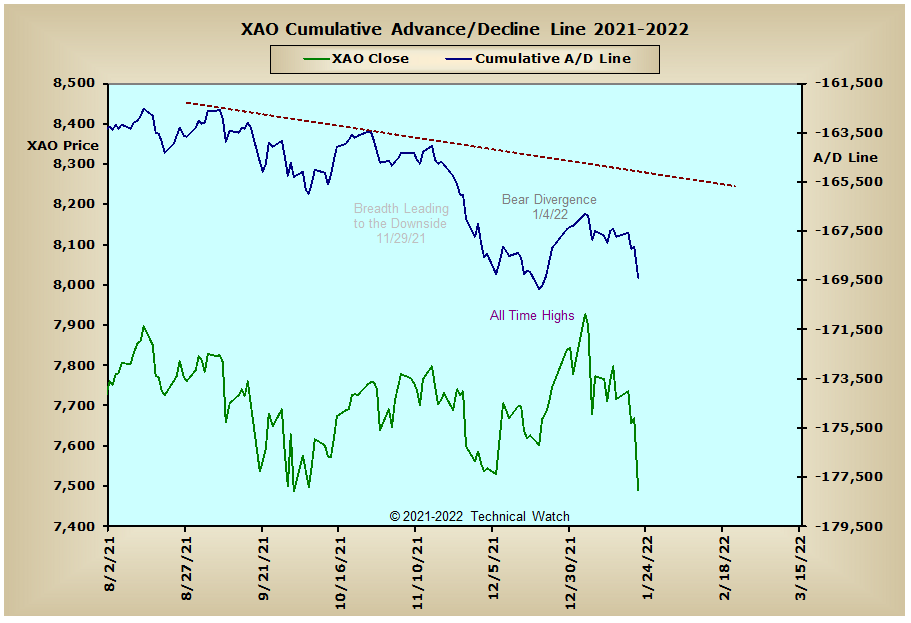

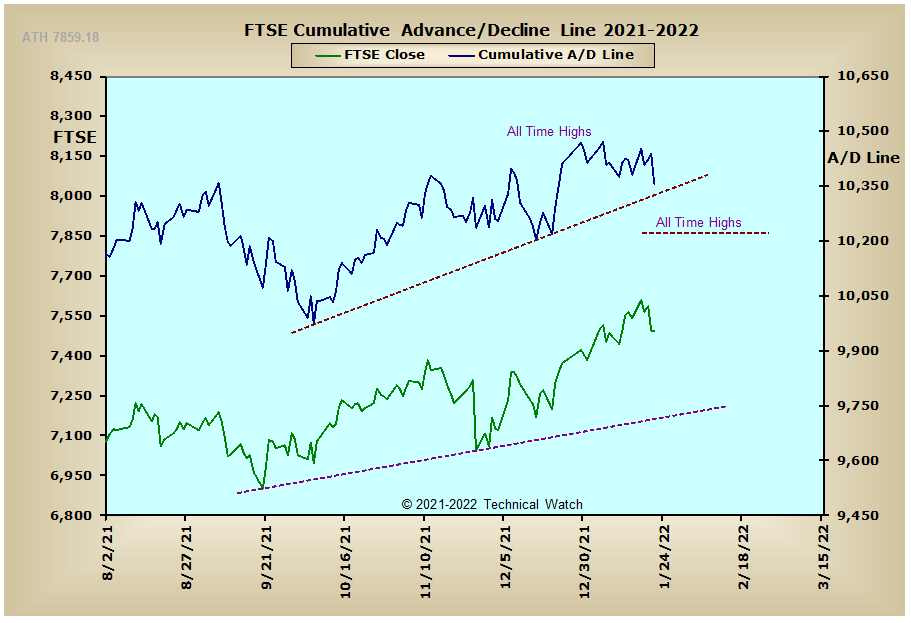

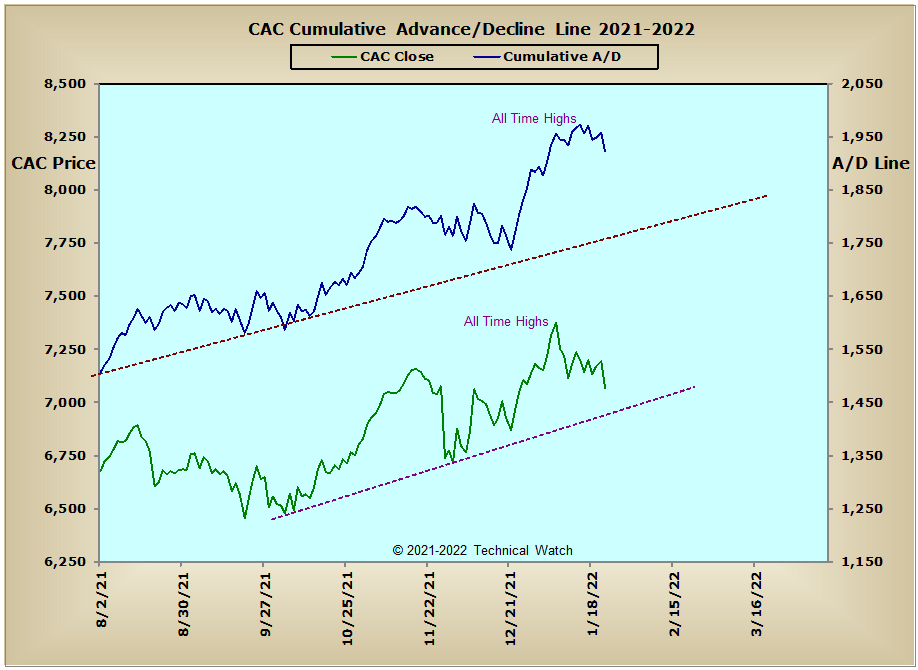

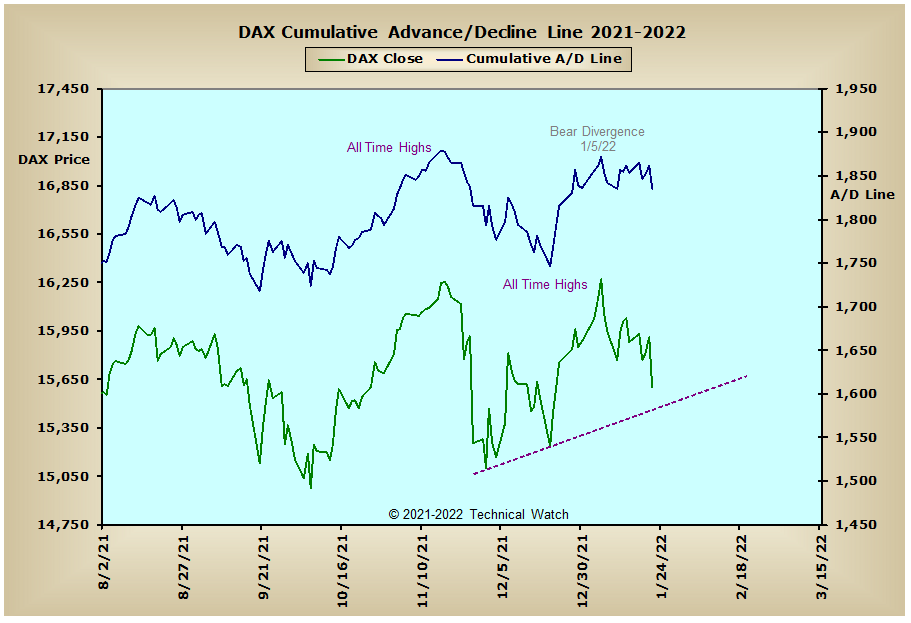

Looking at this weeks edition of cumulative breadth charts shows the damage that was created by the holiday shortened, OPEX driven week of trading here in the United States with the NYSE Composite advance/decline line actually finishing below its December lows. With the prior negative structure of "trend divergence" noted during this same time, bear market conditions now exist for the first time since the deep recession of 2007-2009. Last week also triggered the Sign Of the Bear structure that's been noted in the Russell "2051" since the end of last year and providing a minimal downside price target of around 1850. Giving a rather uncomfortable feeling about last week's pullback in equities was that there was very little in the way of a "run to safety" allocation response into the interest rate sensitive issues which generally extended their multi month declines. This expectation of higher benchmark rate increases full stopped positive money flow going into the Precious Metals and XAU advance/decline lines where both are now testing their reaction lows of the last 2 months. Also getting hit hard last week was the Energy Sector advance/decline line which moved sharply to the downside after its recent upside breakout. With prices in the XLE moving to new reaction highs without the benefit of breadth leadership, this has now left behind another potential "trend divergence" structure that would be fully triggered on any finish below the late December lows. Looking overseas, and we see that the CAC, DAX, FTSE and Bombay advance/decline lines continue to be in decent shape, but based on past history, all of these global indexes will likely play catch up with the world's largest economic engine...especially if last week's loses continue here in the United States.

So with the BETS moving sharply lower to a reading of -35, traders and investors are now working with a hostile market environment. As you might expect, all of the breadth and volume McClellan Oscillators are deeply in negative territory with some finishing on Friday below their lows of early December. This, along with the NYSE Open 10 TRIN moving back to an "oversold" reading of 1.08, would indicate that a reflex rally of sorts is likely sometime in the week ahead. Ideally, however, to break the back of a trend divergence structure, we will still need to have all of the MCO's unanimously making multi month lows to fully cleanse the system of any imbalances. Whether that time is now or in the future, as long as a full internal flush is not seen, bear market conditions will apply as we move forward. Currently, we're still working with only the 1st quarter of 2022 under such conditions, but as we saw with the last divergence trigger 15 years ago, and the 1999-2003 period before that, orthodox bear markets of this type can last for a year or more with all of the emotional large swings the accompany such technical phenomenon. We will also need to have all of the breadth and volume McClellan Summation Indexes at or below their respective -500 levels for this to be the kind of longer term bear market low to be analytically valid as well. With primarily the large cap indexes still in positive MCSUM territory, this is also suggesting that it's going to take time (weeks to months) to make this a reality. So, with all this as a backdrop then, and outside of any short and swift bear market rallies we might see in the weeks ahead, investors should now take a full defensive posture toward equities and maybe utilize the many bearish ETF products that are out there as an alternative to actually short selling, while traders can use bear market trading strategies and techniques until proven otherwise.

Have a great trading week!

US Interest Rates:

US Sectors:

Precious Metals:

Australia:

England:

France:

Germany:

India: