Good follow through action on Monday and Tuesday to the previous Friday's intraday reversal enabled the major market indices to finish with an average gain for the week of +1.55%, with the NASDAQ Composite Index showing the largest percentage recovery gain at +2.38%. Closing out the month of January itself, and we see that there was an average loss of -5.85% as growth stock issues were the weakest links of market activity with index losses of over -7.00%.

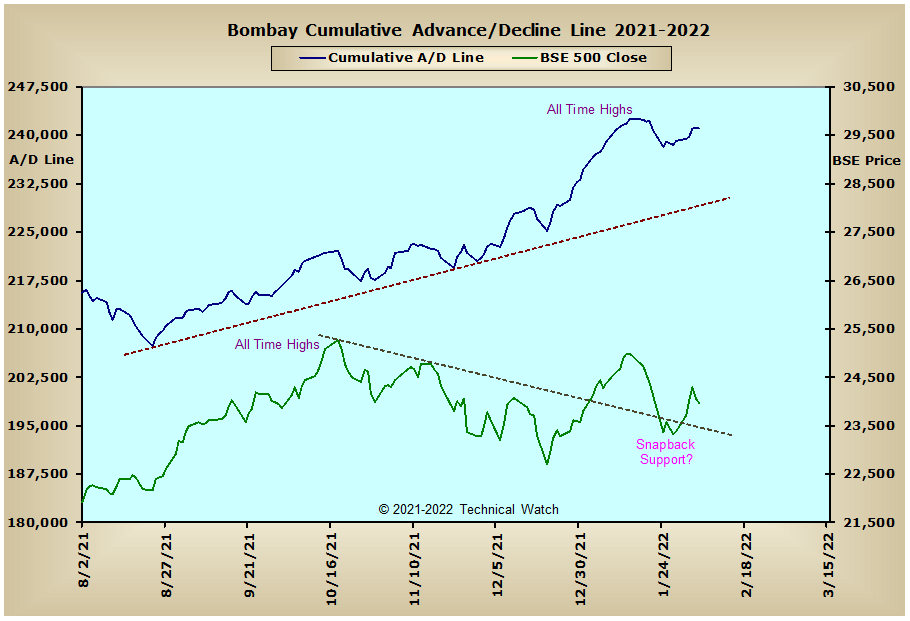

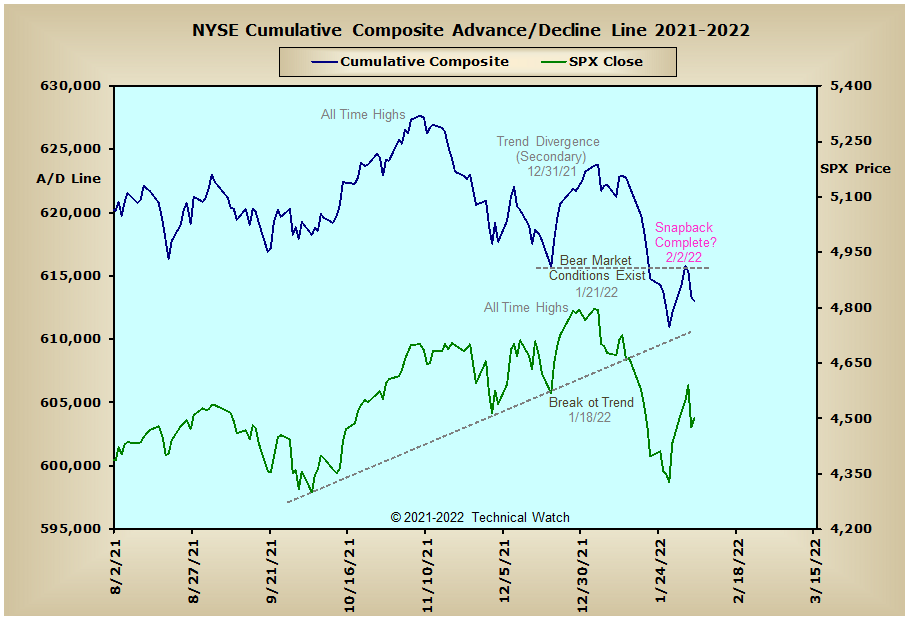

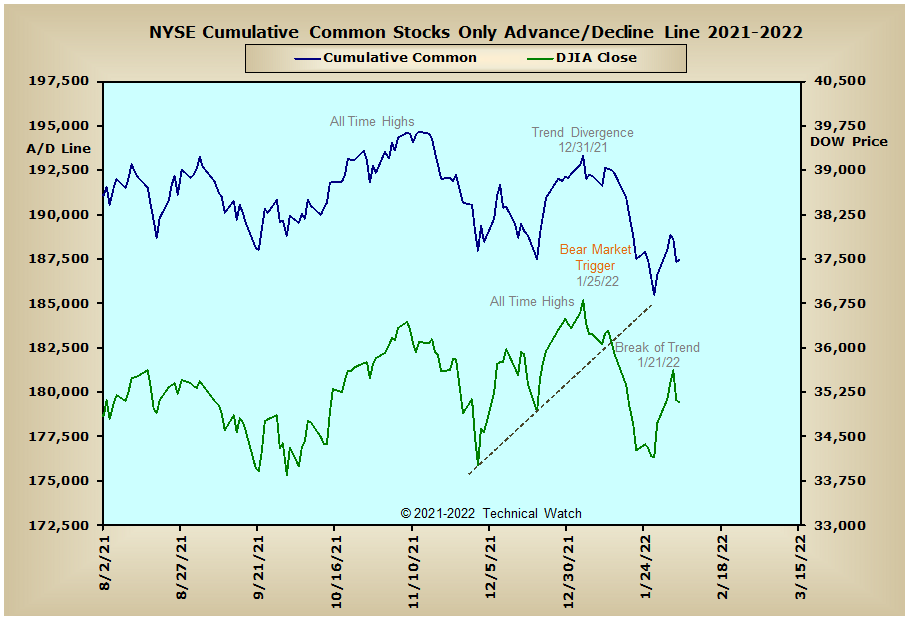

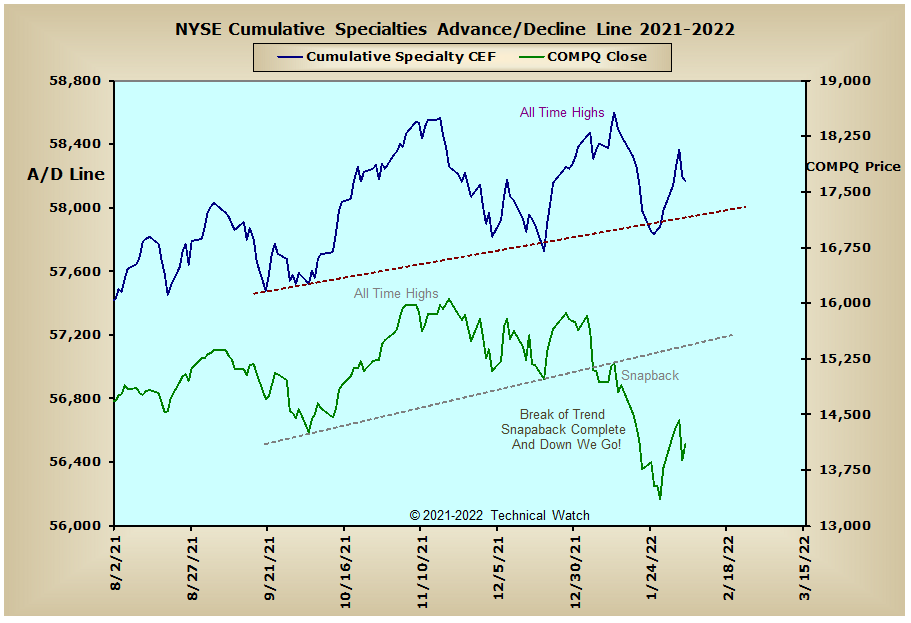

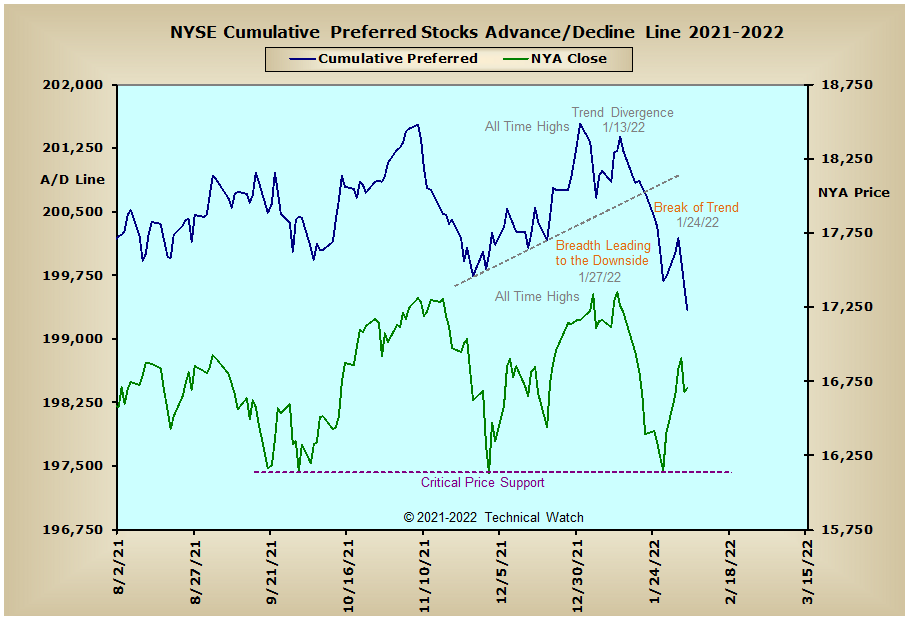

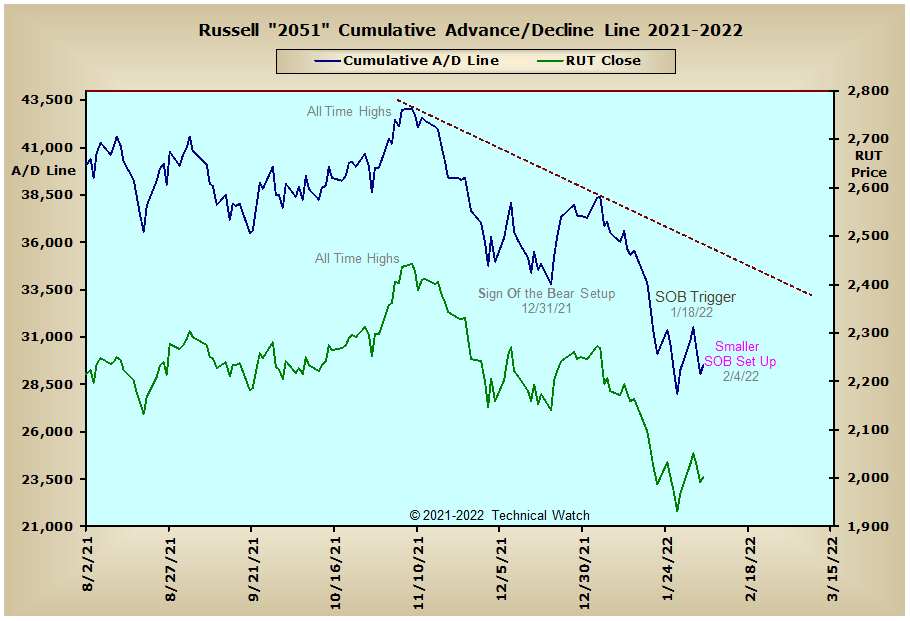

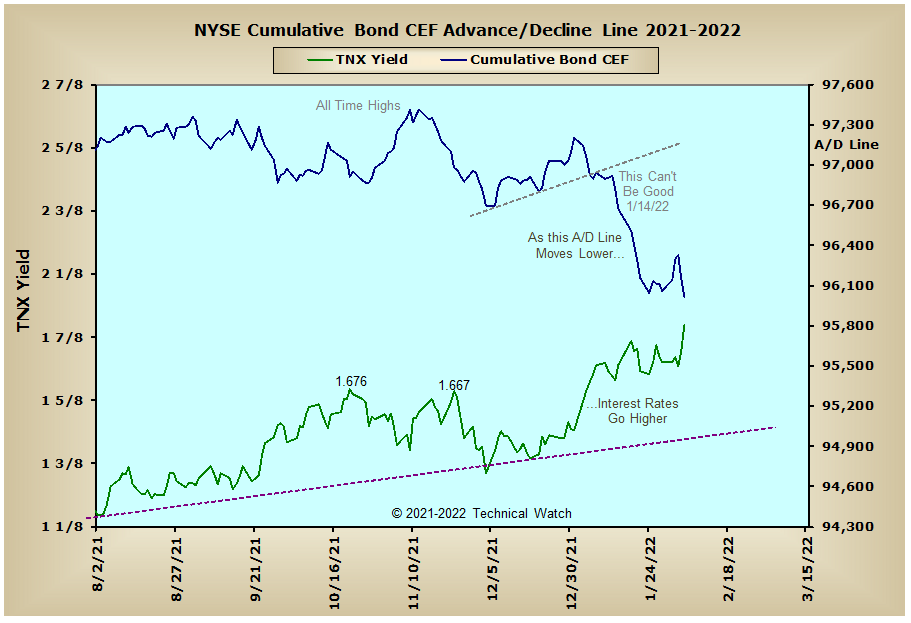

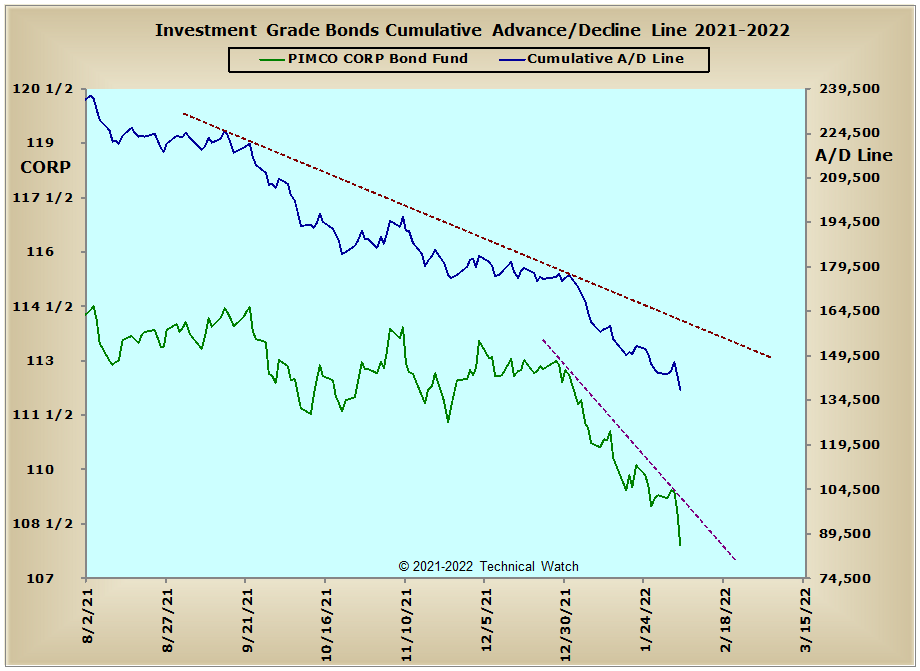

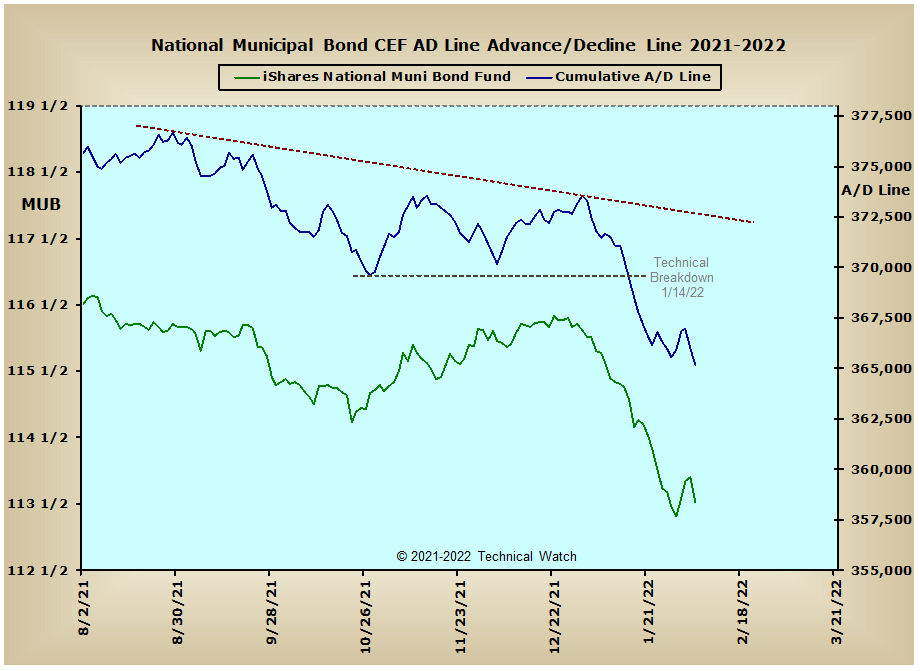

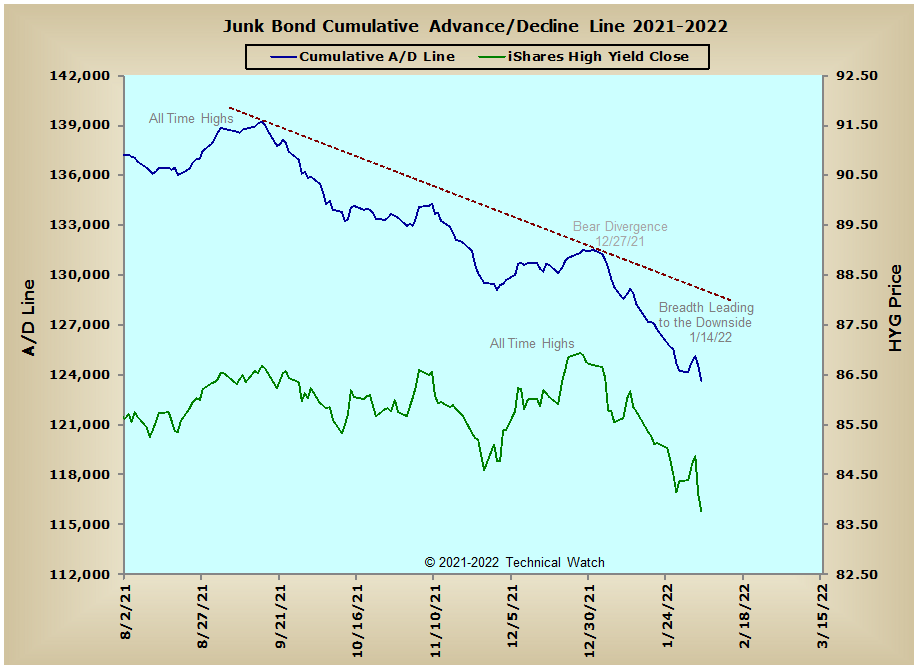

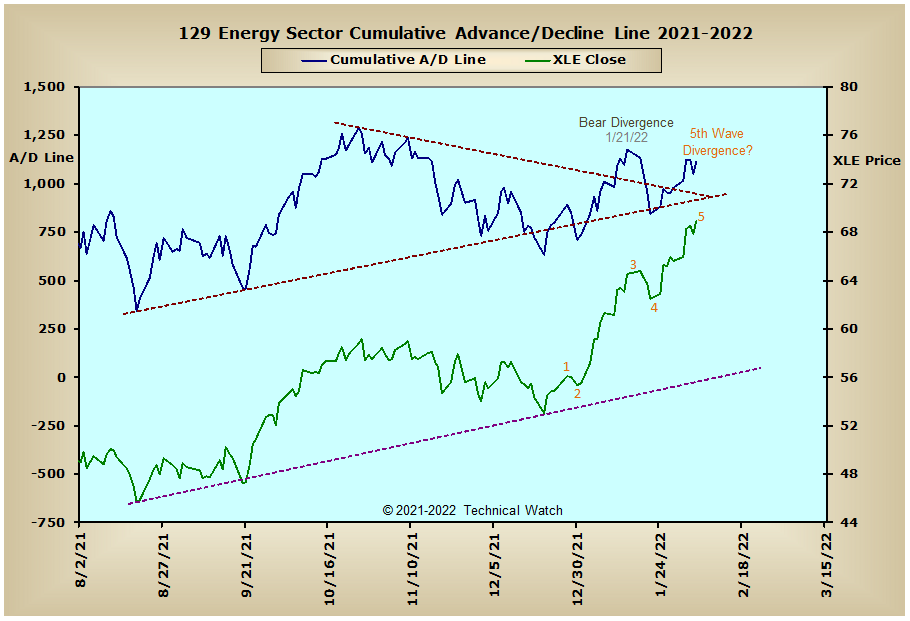

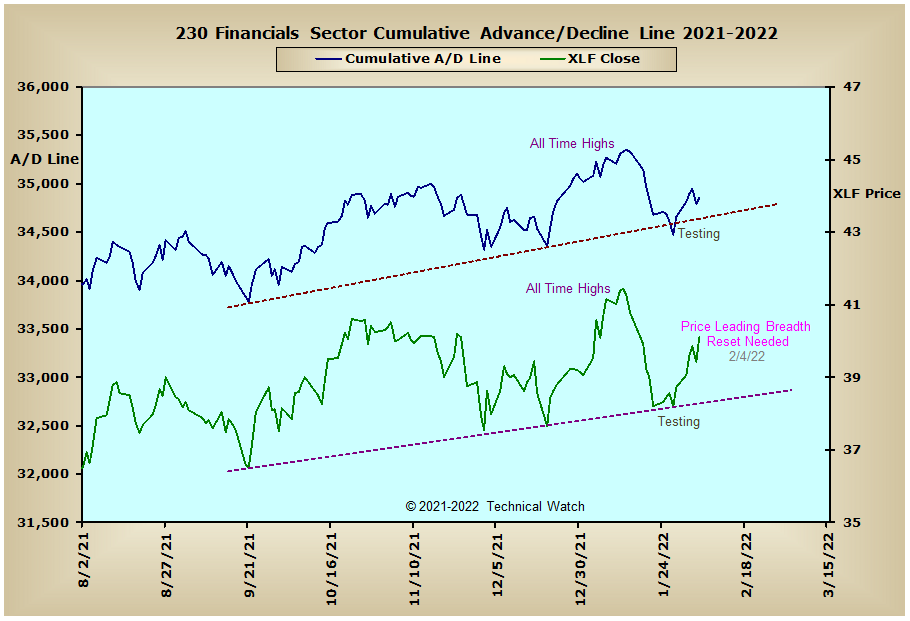

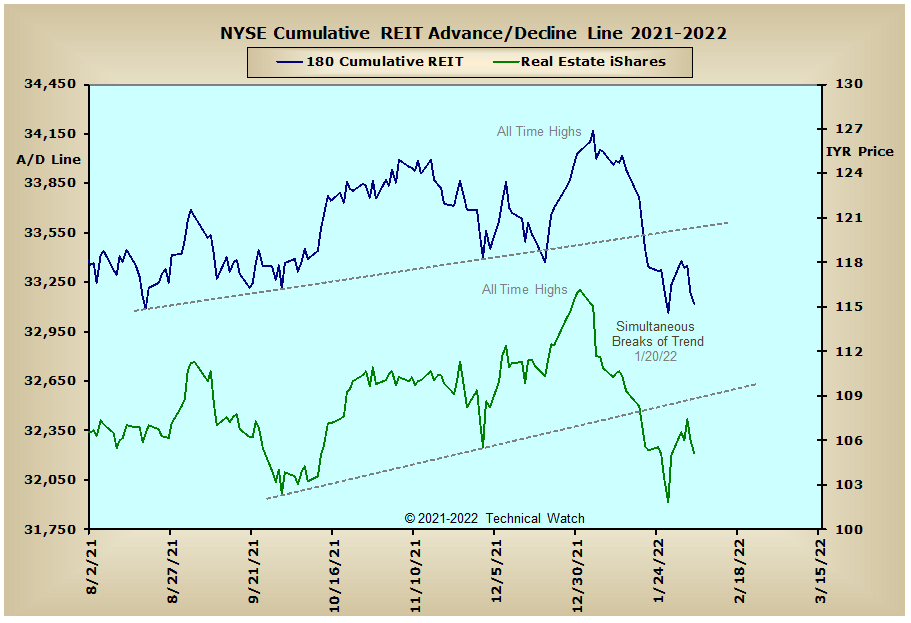

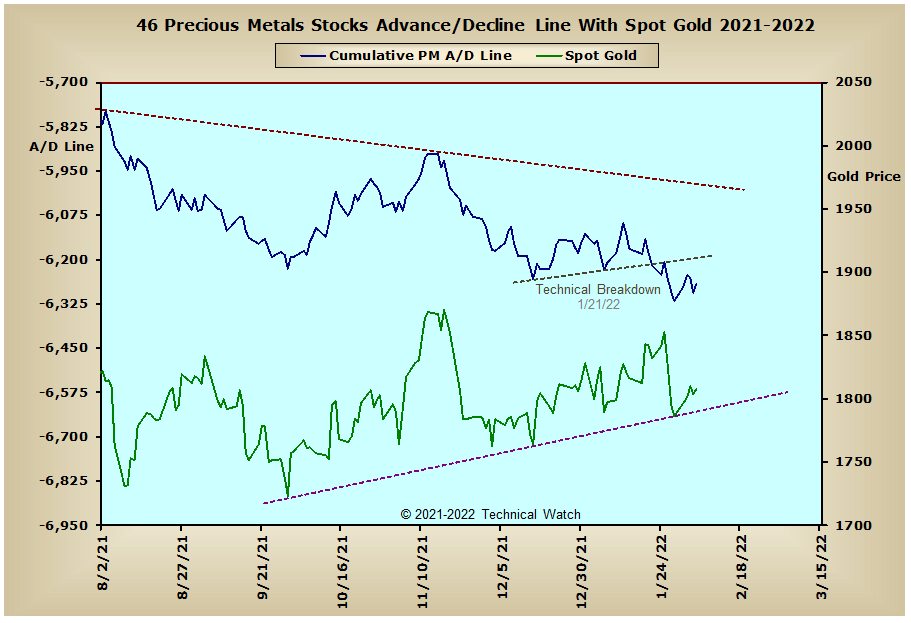

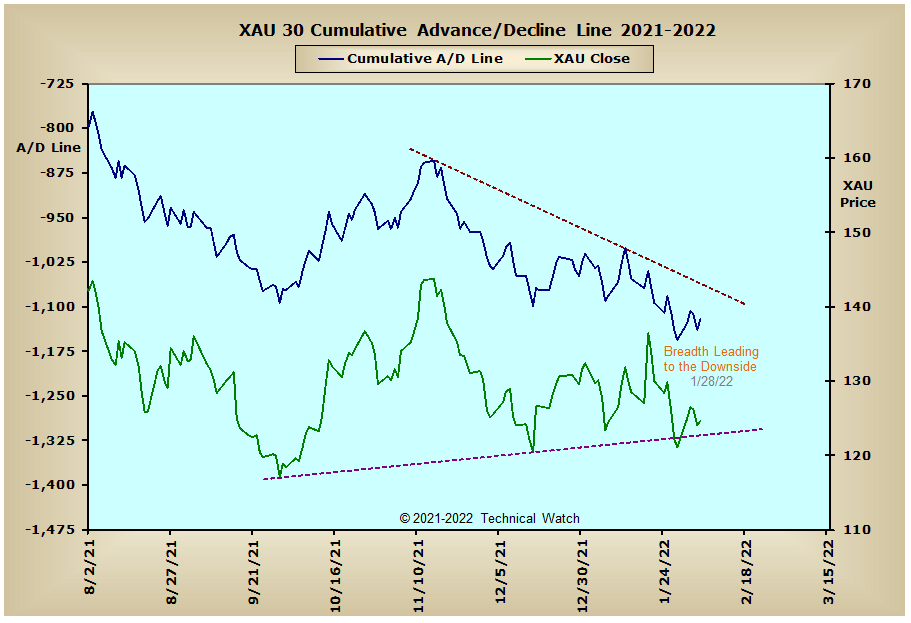

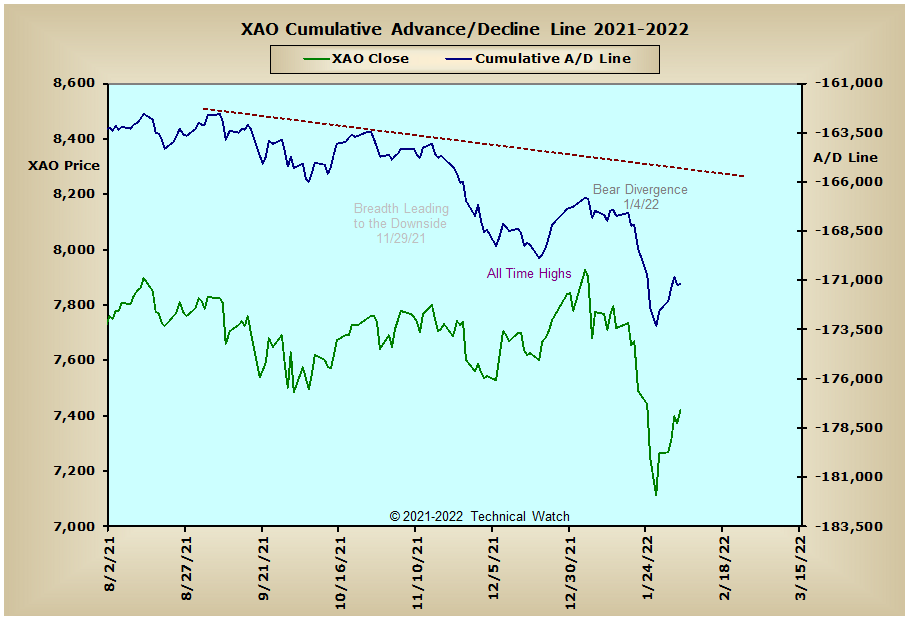

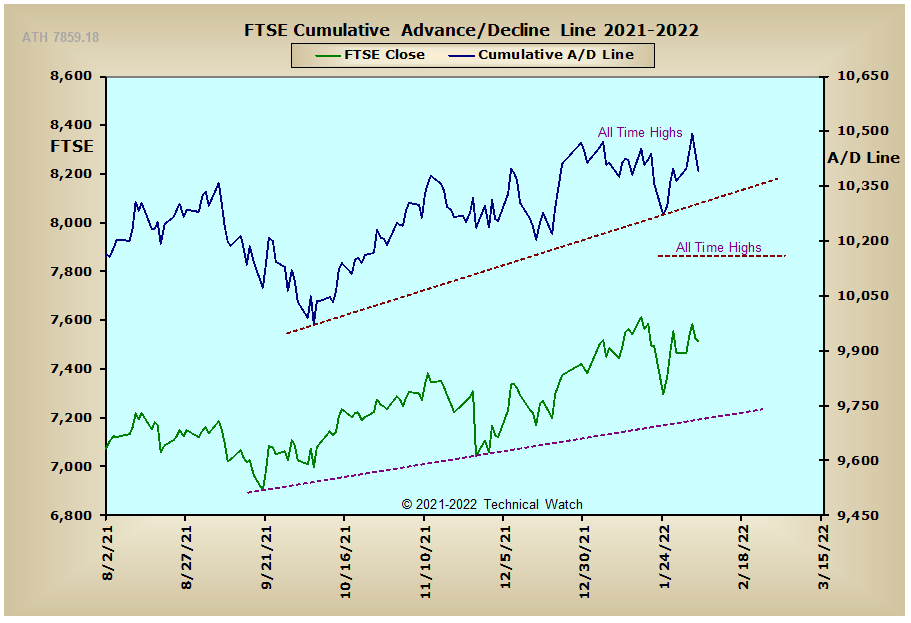

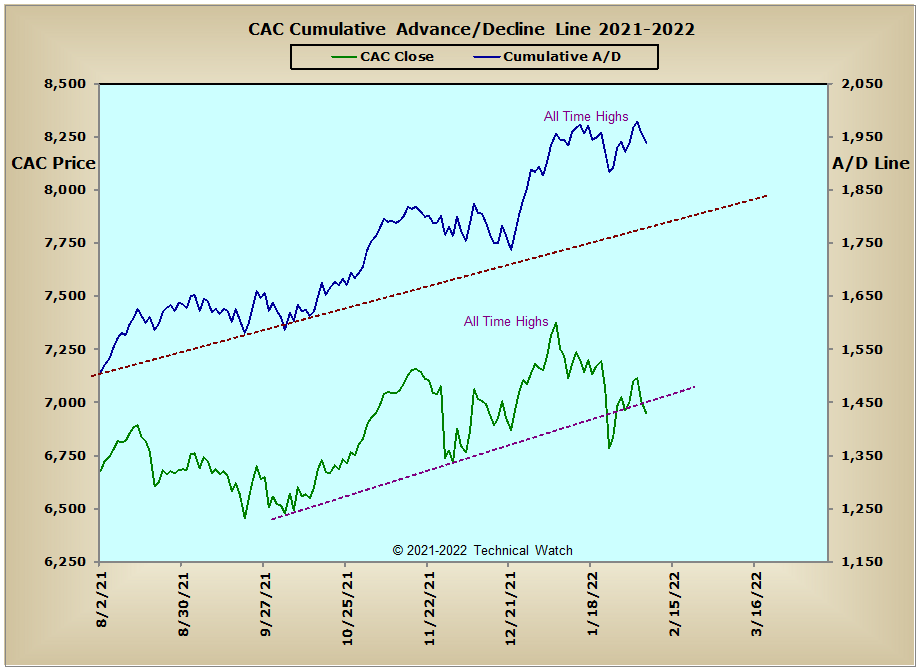

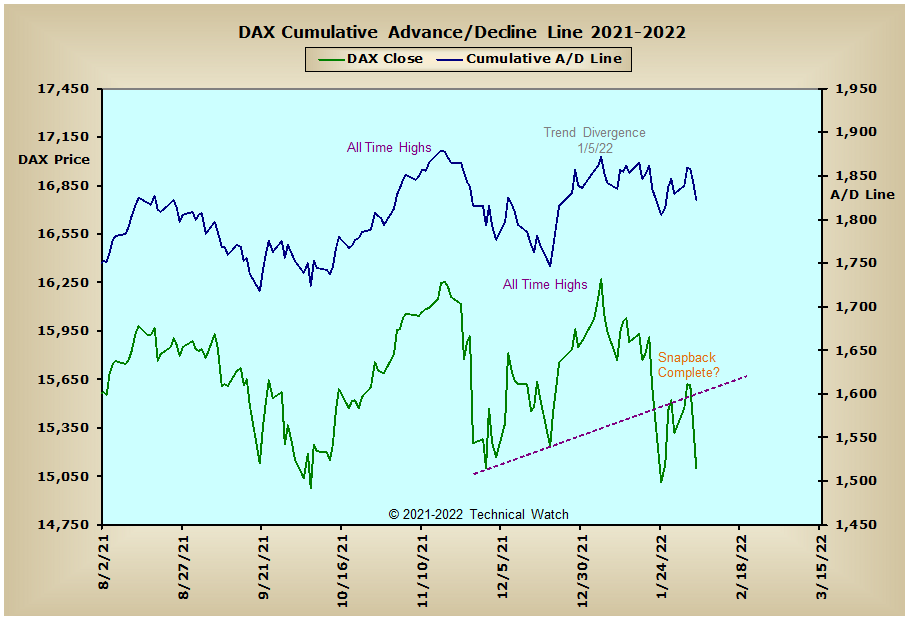

Looking at this week's usual array of cumulative breadth charts and we see that the NYSE Composite advance/decline line snapped back to what was previous pattern support before easing lower into the end of the week. The NYSE Common Only advance/decline line also saw a bounce as well, but its amplitude showed a bit more strength on the rebound. Between the two then, this would indicate that the interest rate sensitive issues that trade on the NYSE continue to be weak, and this is made all too clear with all of the interest rate sensitive A/D charts persisting in making lower lows. Without this important broader based participation of the debt asset class, equities will continue to struggle as we move forward as market liquidity, via higher interest rates, is drained from the system. Meanwhile, the precious metals complex continues to hold steady in spite of the liquidation we're seeing in the debt asset class, but if the dynamic of breadth leading price is to be maintained, it's only a matter of time before gold, silver and platinum succumb to the downside pressure we're seeing in the Precious Metals and XAU advance/decline line charts. On a more positive note, the Bombay, CAC, DAX and FTSE advance/decline lines continue at or near their all time highs in what may be more of a global allocation switch from investments in the United States and into other world markets that have more friendly monetary policies in place. We'll see.

So with the BETS moving back to a neutral rating of -20, investors should now take a more guarded view toward equities in what looks to be snapback action. The short term trend of cumulative breadth and volume, as measured by the McClellan Oscillator, is generally negative as we start the week ahead, and this is putting intermediate term downside pressure with their respective McClellan Summation Indexes. Also of note as we begin things on Monday is that the NYSE Composite breadth MCO had a small point change on Friday, so let's expect a dramatic move in the major market averages in the next two trading sessions. Both the NYSE and NASDAQ TRIN's showed quite a bit of short covering on Friday, while both Open 10 TRIN's finished near neutral for the week at .87. With the markets as deeply "oversold" as they were at the end of January, it wouldn't be too surprising if we continue to see choppy, if not volatile, market action next week as the bulls do their very best to keep the bears from tightening their grip. With all this in mind then, let's continue to give the benefit of any directional doubt toward the sellers for the week ahead, with the understanding that there might be one more upside push in an effort to trap retail investors into thinking that the worst is behind us.

Have a great trading week!

US Interest Rates:

US Sectors:

Precious Metals:

Australia:

England:

France:

Germany:

India: