I'm looking for a run at 4500 SPX. Whether it makes it or not, who knows. A move up here creates a massive triple NEG D. I'm looking for a large ~15% drop ahead into July 21-24 window. Could be an [A] wave low with more to go into mid August... Ideally I see a ~16/17 TD top July 13 +/- 1 TD...

#2

Posted 13 July 2023 - 12:33 PM

Good call on 4500. I suppose a decline could occur if a transient slowing of core inflation growth impacts the synthetic spx earnings - but 15% in two weeks?

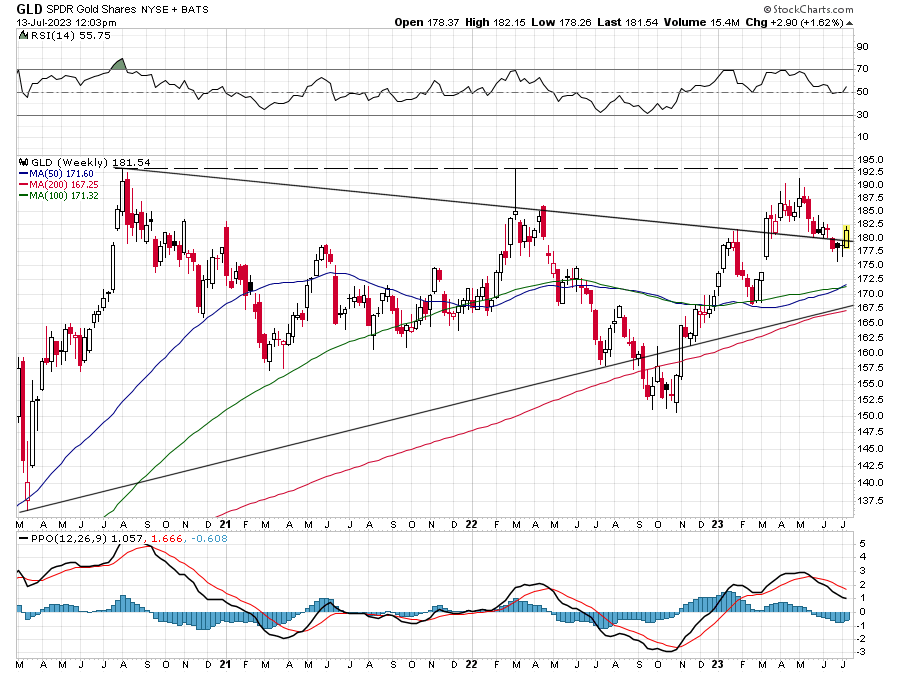

The metals are poised to send Jerome a message if he gets weak in the knees - looks like they're already sending him a warning. But joking aside - everyone knows inflation is government's favorite tax and the fed's best friend - they might slow the gravy train down a bit but they have no intention of stopping it.

Silver's reacting to a supporting convergence of weekly aveages.

#3

Posted 14 July 2023 - 08:34 AM

Today sees the cycle top maximum for the stock market as a whole, however, I'm seeing signs of an irregular topping action around July 19/20 for some indexes, but not all. The PM's could rally into Monday July 24. Landrey's McClellan Osc low is July 28, which rhymes with Feb 28, 2020. The PM's look to make an ideal low on August 14, which rhymes with March 16, 2020. I see 3808 SPX by July 28, 2023. I'm seeing a crash signal IF we make a new high on the SPX and QQQ by July 19/20. There is an ideal 8 TD low due Tuesday next week and again on July 28. The highs and lows are extremely irregular in wave and cycle action and that spells trouble. Mark is seeing much call buying here by the public. I see a crash low on August 14 and maybe a secondary irregular low on August 21. Today, late, sees the Sun sextile Uranus and there is a new moon Monday, so an a-b-c decline into Tuesday is likely. On July 20th, the Sun trines Neptune Rx (topping action) plus Mars opposing Saturn Rx. This is extremely warlike. The next day the Sun opposes Pluto Rx and then July 22 sees Jupiter in warlike Aries semi-square Neptune Rx while Venus turns retrograde. This looks like a set up for some fear porn ahead. Destruction of crops and/or life in general looks likely. A 35/36% drop looks likely from next week's expected top.

#4

Posted 14 July 2023 - 09:37 AM

Yay blu, were on the same page this time although I think 3800 is a bit steep in that time frame but who knows. I do believe it wouldn't be a surprise to wake up one morning with a -5% print happening at anytime though but we'll see.....

#5

Posted 14 July 2023 - 09:45 AM

Yay blu, were on the same page this time although I think 3800 is a bit steep in that time frame but who knows. I do believe it wouldn't be a surprise to wake up one morning with a -5% print happening at anytime though but we'll see.....

https://www.whitehou...to-active-duty/ click link

Also tagged with one or more of these keywords: SPX

TTHQ Directory →

Fearless Forecasters →

Slight Correction at Hand?Started by blustar , 08 Mar 2024 |

|

|

||

TTHQ Directory →

Fearless Forecasters →

More Reasons Than One to Believe that March 20th Will Be THE TopStarted by blustar , 19 Feb 2024 |

|

|

||

TTHQ Directory →

Fearless Forecasters →

SPX -- 2024Started by iloli way , 18 Feb 2024 |

|

|

||

TTHQ Directory →

Fearless Forecasters →

4 Year Cycle AdjustmentStarted by blustar , 01 Feb 2024 |

|

|

||

TTHQ Directory →

Fearless Forecasters →

Higher Prices Expected into Next WeekStarted by blustar , 19 Jan 2024 |

|

|